Answered step by step

Verified Expert Solution

Question

1 Approved Answer

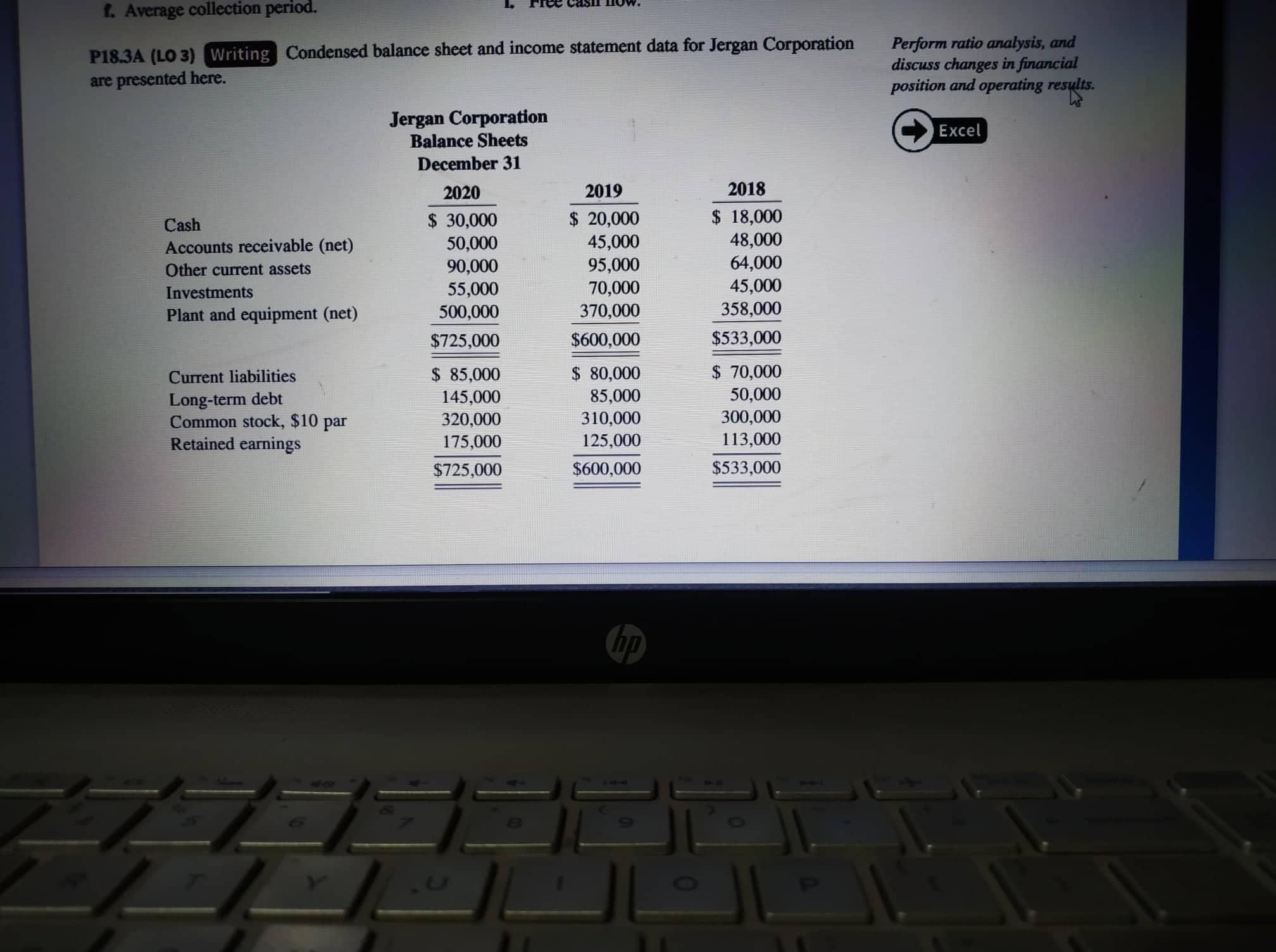

f. Average collection period. P18.3A (LO 3) Writing Condensed balance sheet and income statement data for Jergan Corporation are presented here. Jergan Corporation Balance

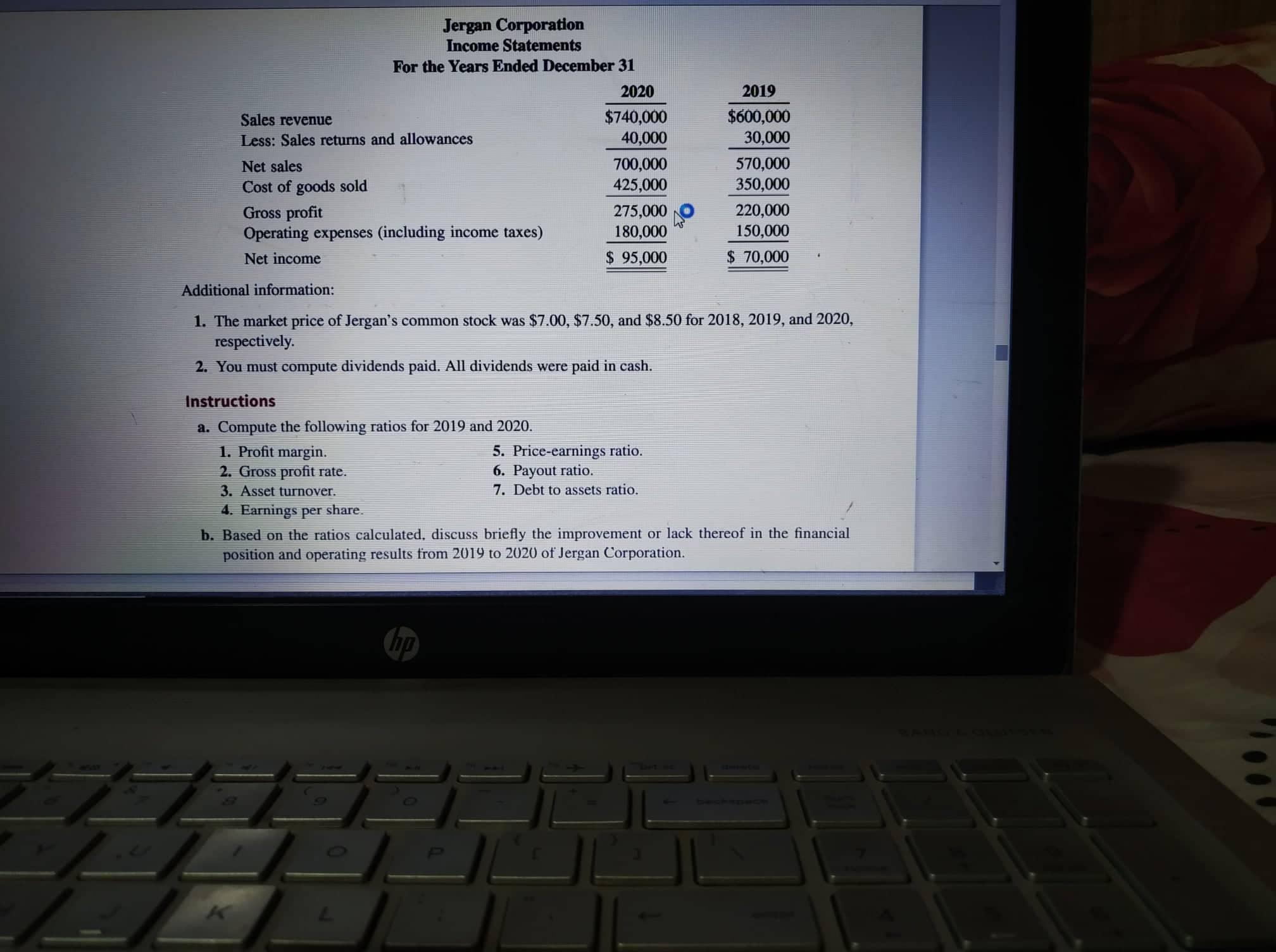

f. Average collection period. P18.3A (LO 3) Writing Condensed balance sheet and income statement data for Jergan Corporation are presented here. Jergan Corporation Balance Sheets December 31 2020 2019 2018 Cash $ 30,000 $ 20,000 $ 18,000 Accounts receivable (net) 50,000 45,000 48,000 Other current assets 90,000 95,000 64,000 Investments 55,000 70,000 45,000 Plant and equipment (net) 500,000 370,000 358,000 $725,000 $600,000 $533,000 Current liabilities $ 85,000 $ 80,000 $ 70,000 Long-term debt 145,000 85,000 50,000 320,000 310,000 300,000 Common stock, $10 par Retained earnings 175,000 125,000 113,000 $725,000 $600,000 $533,000 H 3 hp JI Perform ratio analysis, and discuss changes in financial position and operating results. Excel Jergan Corporation Income Statements For the Years Ended December 31 2020 2019 $600,000 Sales revenue $740,000 Less: Sales returns and allowances 40,000 30,000 Net sales 700,000 570,000 Cost of goods sold 425,000 350,000 Gross profit 275,000 220,000 Operating expenses (including income taxes) 180,000 150,000 Net income $ 95,000 $ 70,000 Additional information: 1. The market price of Jergan's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 2. You must compute dividends paid. All dividends were paid in cash. Instructions a. Compute the following ratios for 2019 and 2020. 1. Profit margin. 5. Price-earnings ratio. 2. Gross profit rate. 6. Payout ratio. 3. Asset turnover. 7. Debt to assets ratio. 4. Earnings per share. b. Based on the ratios calculated, discuss briefly the improvement or lack thereof in the financial position and operating results from 2019 to 2020 of Jergan Corporation. hp 2

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Computation of following Ratios of Sergen Corporation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started