Question

f) Consider a $10,000 payment received every 5 years for 50 years. What is the present worth if the annual (effective) rate is 5%?

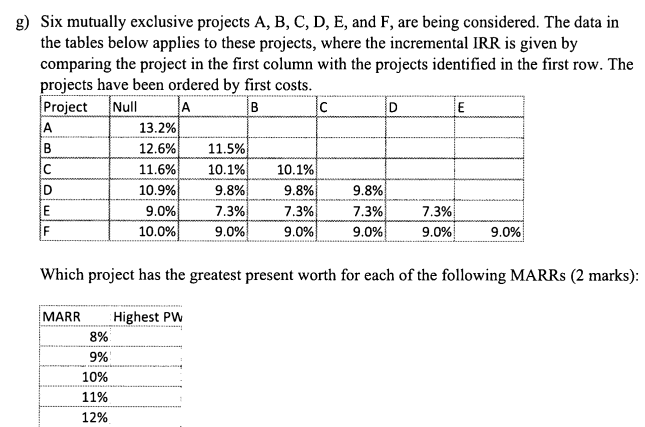

f) Consider a $10,000 payment received every 5 years for 50 years. What is the present worth if the annual (effective) rate is 5%? (2 marks) g) Six mutually exclusive projects A, B, C, D, E, and F, are being considered. The data in the tables below applies to these projects, where the incremental IRR is given by comparing the project in the first column with the projects identified in the first row. The projects have been ordered by first costs. Project Null A B C D E A 13.2% B 12.6% 11.5% C 11.6% 10.1% 10.1% D 10.9% 9.8% 9.8% 9.8% E 9.0% 7.3% 7.3% 7.3% 7.3% F 10.0% 9.0% 9.0% 9.0% 9.0% 9.0% Which project has the greatest present worth for each of the following MARRs (2 marks): MARR Highest PW 8% 9% 10% 11% 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introductory Statistics

Authors: Prem S. Mann

8th Edition

9781118473986, 470904100, 1118473981, 978-0470904107

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App