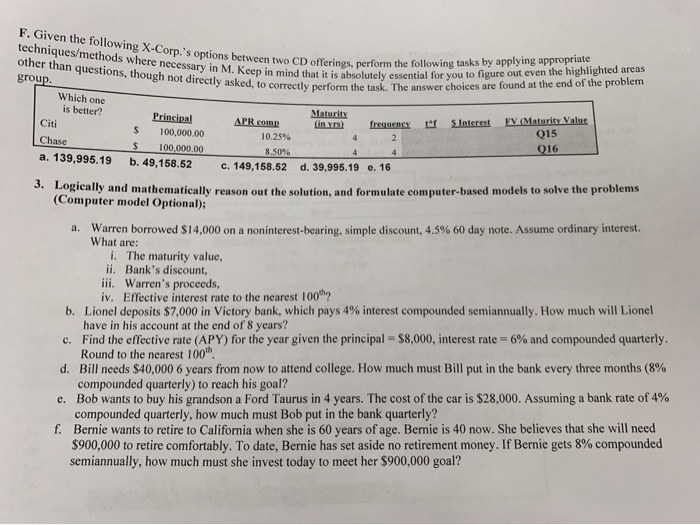

F. Given the following X-Corp.'s options between two techniques/methods where necessary in M. Keep in mind other than questions, though not directly asked, to correctly perform the tas etween two CD offerings, perform the following tasks by applying appropriate weep in mind that it is absolutely essential for you to figure out even the highlighted areas group. cuy perform the task. The answer choices are found at the end of the problem Which one is better? Maturity Principal APR.com Citi (in vrs) frequency Interest FV (Maturity Value S 100,000.00 015 10.25% 4 2 Chase $ 100,000.00 8.50% a. 139,995.19 b. 49,158.52 C. 149,158.52 d. 39,995.19 e. 16 3. Logically and . Logically and mathematically reason out the solution, and formulate computer-based models to solve the problems (Computer model Optional); 016 a. Warren borrowed $14,000 on a noninterest-bearing, simple discount, 4.5% 60 day note. Assume ordinary interest. What are: i. The maturity value, ii. Bank's discount, iii. Warren's proceeds, iv. Effective interest rate to the nearest 100? b. Lionel deposits $7,000 in Victory bank, which pays 4% interest compounded semiannually. How much will Lionel have in his account at the end of 8 years? c. Find the effective rate (APY) for the year given the principal - $8,000, interest rate=6% and compounded quarterly. Round to the nearest 100 d. Bill needs $40,000 6 years from now to attend college. How much must Bill put in the bank every three months (8% compounded quarterly) to reach his goal? e. Bob wants to buy his grandson a Ford Taurus in 4 years. The cost of the car is $28,000. Assuming a bank rate of 4% compounded quarterly, how much must Bob put in the bank quarterly? f. Bernie wants to retire to California when she is 60 years of age. Bernie is 40 now. She believes that she will need $900,000 to retire comfortably. To date, Bernie has set aside no retirement money. If Bernie gets 8% compounded semiannually, how much must she invest today to meet her $900,000 goal? F. Given the following X-Corp.'s options between two techniques/methods where necessary in M. Keep in mind other than questions, though not directly asked, to correctly perform the tas etween two CD offerings, perform the following tasks by applying appropriate weep in mind that it is absolutely essential for you to figure out even the highlighted areas group. cuy perform the task. The answer choices are found at the end of the problem Which one is better? Maturity Principal APR.com Citi (in vrs) frequency Interest FV (Maturity Value S 100,000.00 015 10.25% 4 2 Chase $ 100,000.00 8.50% a. 139,995.19 b. 49,158.52 C. 149,158.52 d. 39,995.19 e. 16 3. Logically and . Logically and mathematically reason out the solution, and formulate computer-based models to solve the problems (Computer model Optional); 016 a. Warren borrowed $14,000 on a noninterest-bearing, simple discount, 4.5% 60 day note. Assume ordinary interest. What are: i. The maturity value, ii. Bank's discount, iii. Warren's proceeds, iv. Effective interest rate to the nearest 100? b. Lionel deposits $7,000 in Victory bank, which pays 4% interest compounded semiannually. How much will Lionel have in his account at the end of 8 years? c. Find the effective rate (APY) for the year given the principal - $8,000, interest rate=6% and compounded quarterly. Round to the nearest 100 d. Bill needs $40,000 6 years from now to attend college. How much must Bill put in the bank every three months (8% compounded quarterly) to reach his goal? e. Bob wants to buy his grandson a Ford Taurus in 4 years. The cost of the car is $28,000. Assuming a bank rate of 4% compounded quarterly, how much must Bob put in the bank quarterly? f. Bernie wants to retire to California when she is 60 years of age. Bernie is 40 now. She believes that she will need $900,000 to retire comfortably. To date, Bernie has set aside no retirement money. If Bernie gets 8% compounded semiannually, how much must she invest today to meet her $900,000 goal