Answered step by step

Verified Expert Solution

Question

1 Approved Answer

F. Task(s) Question 1 (a) Caring Sdn Bhd (CSB), a Malaysian tax resident company, is principally engaged in the business of manufacturing and sale

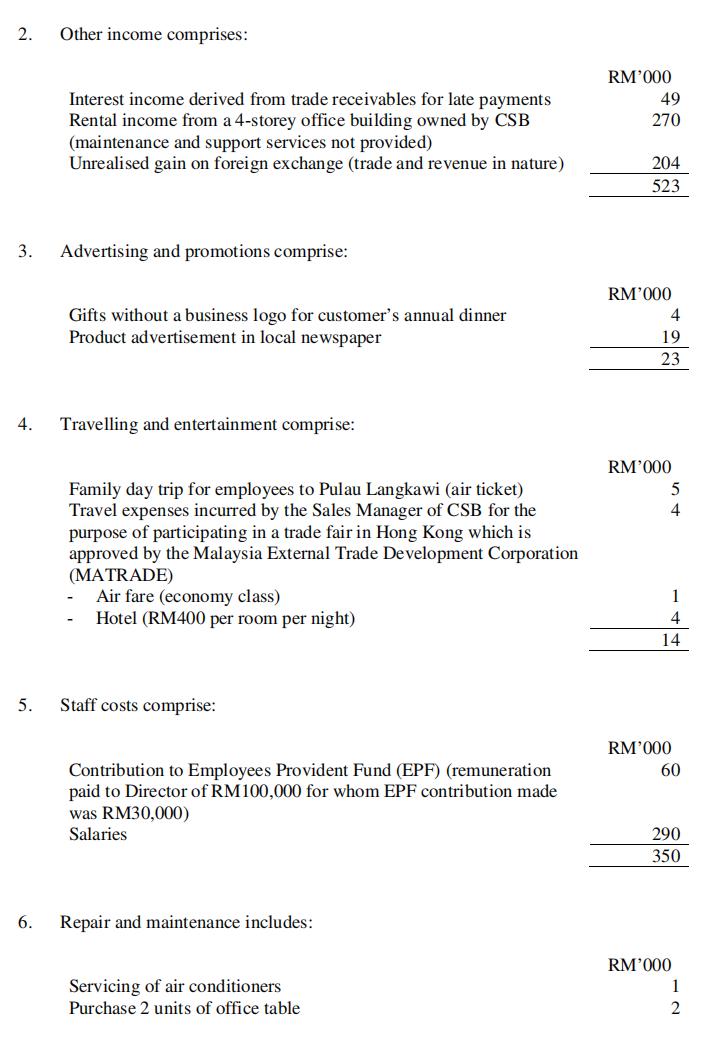

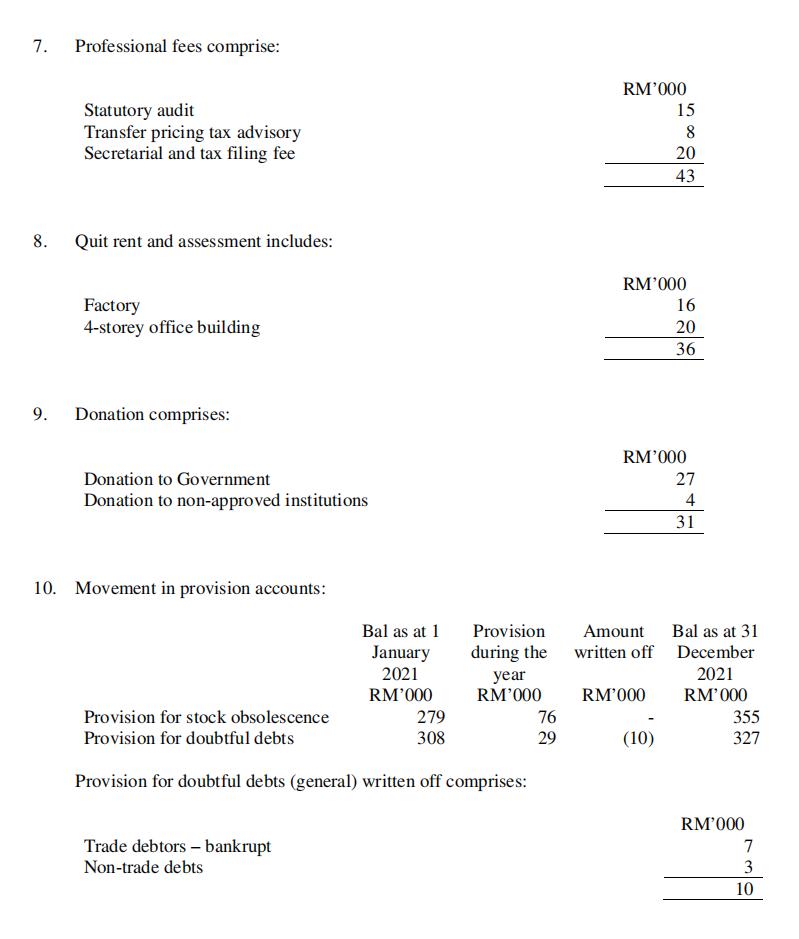

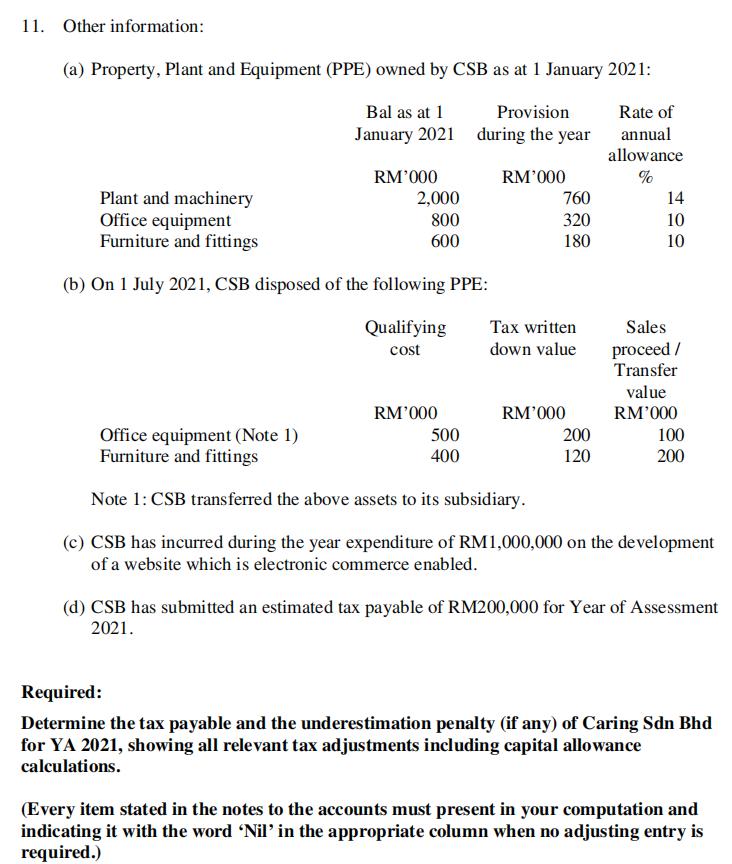

F. Task(s) Question 1 (a) Caring Sdn Bhd (CSB), a Malaysian tax resident company, is principally engaged in the business of manufacturing and sale of vitamins and supplements. CSB prepares its accounts to December 31 annually and has an ordinary paid-up share capital of RM3,500,000. CSB's Statement of Comprehensive Income for the year ended 31 December 2021 is as follows:- Sales Less: Cost of goods manufactured Gross profit Add: Other income Less: Administrative expenses Advertisement and promotions Travelling and entertainment Staff costs Repair and maintenance Professional fees Quit rent and assessment Donation Loss on disposal of plant and equipment Depreciation Profit before taxation Notes: 1. Cost of goods manufactured includes:- Note 1 2 3 4 5 6 7 8 9 Provision for stock obsolescence Provision for doubtful debts (general) Certification for recognized systems and standards (issued by a certification body determined by the Minister of Finance on 25 January 2022) RM'000 23 14 350 15 43 36 31 15 184 RM'000 RM'000 76 29 40 3,895 (1,322) 2,573 523 (711) 2,385 2. Other income comprises: Interest income derived from trade receivables for late payments Rental income from a 4-storey office building owned by CSB (maintenance and support services not provided) Unrealised gain on foreign exchange (trade and revenue in nature) RM'000 49 270 204 523 3. Advertising and promotions comprise: Gifts without a business logo for customer's annual dinner Product advertisement in local newspaper 4. Travelling and entertainment comprise: Family day trip for employees to Pulau Langkawi (air ticket) Travel expenses incurred by the Sales Manager of CSB for the purpose of participating in a trade fair in Hong Kong which is approved by the Malaysia External Trade Development Corporation (MATRADE) Air fare (economy class) Hotel (RM400 per room per night) 5. Staff costs comprise: Contribution to Employees Provident Fund (EPF) (remuneration paid to Director of RM100,000 for whom EPF contribution made was RM30,000) Salaries 6. Repair and maintenance includes: Servicing of air conditioners Purchase 2 units of office table RM'000 4 19 23 RM'000 5 4 1 4 14 RM'000 60 290 350 RM'000 1 2 7. 8. 9. Professional fees comprise: Statutory audit Transfer pricing tax advisory Secretarial and tax filing fee Quit rent and assessment includes: Factory 4-storey office building Donation comprises: Donation to Government Donation to non-approved institutions 10. Movement in provision accounts: Bal as at 1 January 2021 RM'000 Trade debtors - bankrupt Non-trade debts year RM'000 Provision for stock obsolescence 279 Provision for doubtful debts 308 Provision for doubtful debts (general) written off comprises: RM'000 Provision Amount during the written off 76 29 15 RM'000 RM'000 8 (10) 20 43 RM'000 16 20 36 27 4 31 Bal as at 31 December 2021 RM'000 355 327 RM'000 7 3 10 11. Other information: (a) Property, Plant and Equipment (PPE) owned by CSB as at 1 January 2021: Bal as at 1 Rate of Provision during the year January 2021 annual allowance RM'000 % RM'000 Plant and machinery Office equipment Furniture and fittings (b) On 1 July 2021, CSB disposed of the following PPE: Qualifying cost 2,000 800 600 RM'000 500 400 760 320 180 Tax written down value RM'000 14 200 120 10 10 Sales proceed / Transfer Office equipment (Note 1) Furniture and fittings Note 1: CSB transferred the above assets to its subsidiary. (c) CSB has incurred during the year expenditure of RM1,000,000 on the development of a website which is electronic commerce enabled. value RM'000 100 200 (d) CSB has submitted an estimated tax payable of RM200,000 for Year of Assessment 2021. Required: Determine the tax payable and the underestimation penalty (if any) of Caring Sdn Bhd for YA 2021, showing all relevant tax adjustments including capital allowance calculations. (Every item stated in the notes to the accounts must present in your computation and indicating it with the word 'Nil' in the appropriate column when no adjusting entry is required.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started