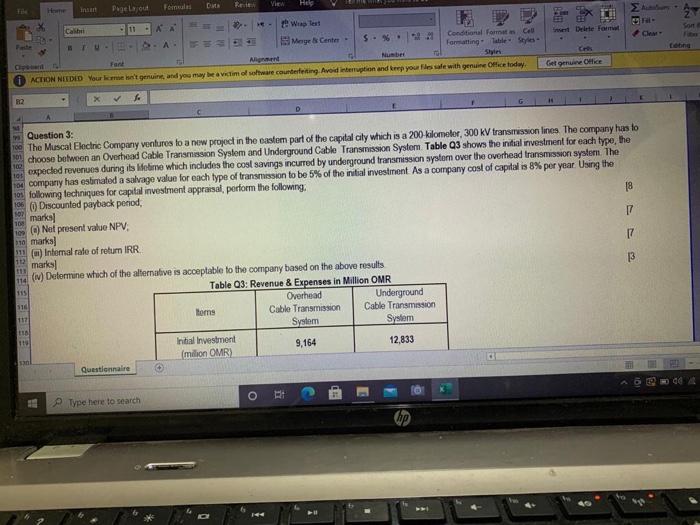

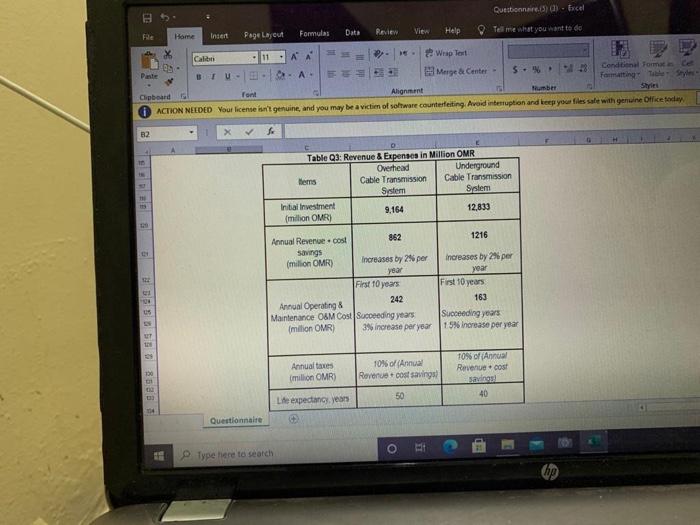

F WE Dente forma H insan Page Layout Foil DATA Hes Cashi 11 Wapter Mage Center - $. % Conditional Format Formatting Totale Number A CT Fan Shin ACTION NEEDID Your me he's genuine, and you may be avetimo software counterfering. Avoid interruption and rep you safe with genuine Office today Geluwe Otice X 100 107 100 Question 3 100 The Muscal Electric Company ventures to a new project in the eastem part of the capital city which is a 200 kilometer, 300 kV transmission lines. The company has to choose between an Overhead Cable Transmission System and Underground Cable Transmission System Table 03 shows the initial investment for each type, the 198 expected revenues during its time which includes the cost savings incurred by underground transmission system over the overhead transmission system. The To company has estimated a salvage value for each type of transmission to be 5% of the initial investment. As a company cost of capital is 8% per year. Using the 101 following techniques for capital investment appraisal, perform the following 106 Discounted payback period, 18 marks 1. Nel present value NPV, 17 180 marks] 111 () Intemal rate of retur IRR 17 marks 11 (1) Determine which of the alternative is acceptable to the company based on the above results 3 Table 03: Revenue & Expenses in Million OMR Overhead Underground Horns Cable Transmission Cable Transmission System System 110 Initial Investment 9,164 12,833 milion OMR) Questionnaire 12 115 117 10 an o RE Type here to search Questione di scel Review View File Page Layout Formulas Home Data Help Insert Tell me what you want to do Caliti -11 -A Wrap let A: Merge & Center 5. Conditional Forma Chipboard Font Alignment ACTION NEEDED Your license kan't genuine, and you may be a victim of software counterfeiting. Avand interruption and keep you files sale with genuine Office today B2 X Table 03: Revenue & Expenses in Million OMR Overhead Underground Hems Cable Transmission Cable Transmission Sistem Sistem Initial Investment 9,164 12,833 million OMRI 862 1216 2 Annual Revenue cos! Savings (milion OMR) Increases by 2 per 1 First 10 years 242 Annual Operating & Maintenance O&M Cost Succeeding years milion OMR) 3% increase per your increases by 2 per year First 10 years 163 Succeeding years 15% Increase per year to Annual taxes million OMR) 10% of (Annual Revenue + cost saving 100 10% of Annual Revenue cost savings 40 50 Life expectancy years 4 Questionnaire o Type here to search F WE Dente forma H insan Page Layout Foil DATA Hes Cashi 11 Wapter Mage Center - $. % Conditional Format Formatting Totale Number A CT Fan Shin ACTION NEEDID Your me he's genuine, and you may be avetimo software counterfering. Avoid interruption and rep you safe with genuine Office today Geluwe Otice X 100 107 100 Question 3 100 The Muscal Electric Company ventures to a new project in the eastem part of the capital city which is a 200 kilometer, 300 kV transmission lines. The company has to choose between an Overhead Cable Transmission System and Underground Cable Transmission System Table 03 shows the initial investment for each type, the 198 expected revenues during its time which includes the cost savings incurred by underground transmission system over the overhead transmission system. The To company has estimated a salvage value for each type of transmission to be 5% of the initial investment. As a company cost of capital is 8% per year. Using the 101 following techniques for capital investment appraisal, perform the following 106 Discounted payback period, 18 marks 1. Nel present value NPV, 17 180 marks] 111 () Intemal rate of retur IRR 17 marks 11 (1) Determine which of the alternative is acceptable to the company based on the above results 3 Table 03: Revenue & Expenses in Million OMR Overhead Underground Horns Cable Transmission Cable Transmission System System 110 Initial Investment 9,164 12,833 milion OMR) Questionnaire 12 115 117 10 an o RE Type here to search Questione di scel Review View File Page Layout Formulas Home Data Help Insert Tell me what you want to do Caliti -11 -A Wrap let A: Merge & Center 5. Conditional Forma Chipboard Font Alignment ACTION NEEDED Your license kan't genuine, and you may be a victim of software counterfeiting. Avand interruption and keep you files sale with genuine Office today B2 X Table 03: Revenue & Expenses in Million OMR Overhead Underground Hems Cable Transmission Cable Transmission Sistem Sistem Initial Investment 9,164 12,833 million OMRI 862 1216 2 Annual Revenue cos! Savings (milion OMR) Increases by 2 per 1 First 10 years 242 Annual Operating & Maintenance O&M Cost Succeeding years milion OMR) 3% increase per your increases by 2 per year First 10 years 163 Succeeding years 15% Increase per year to Annual taxes million OMR) 10% of (Annual Revenue + cost saving 100 10% of Annual Revenue cost savings 40 50 Life expectancy years 4 Questionnaire o Type here to search