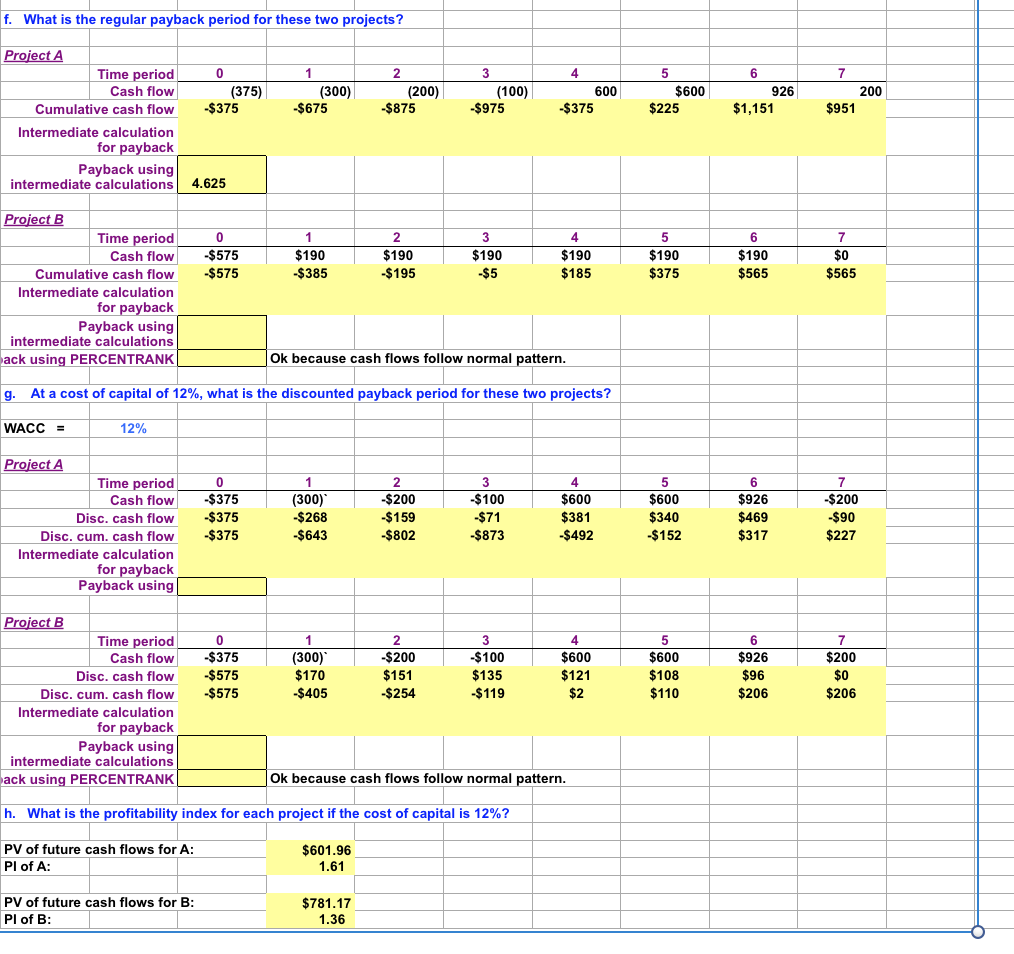

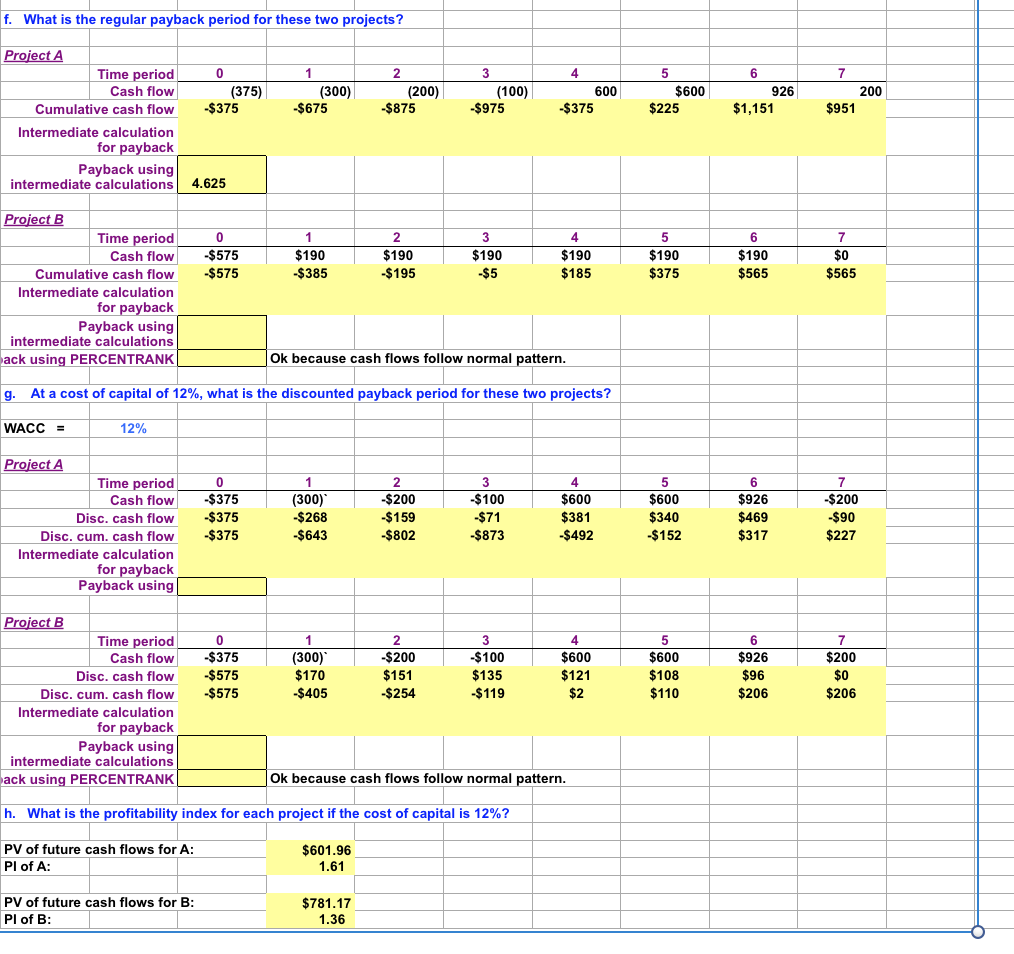

f. What is the regular payback period for these two projects? 0 (375) -$375 1 (300) $675 2 (200) -$875 3 (100) $975 600 -$375 5 $600 $225 926 $1,151 200 $951 Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 4.625 0 $575 2 $190 -$195 3 $190 $190 5 $190 $375 $190 $185 SO $190 $565 -$575 -$385 -$5 $565 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 6 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using 0 -$375 -$375 -$375 (300) -$268 $643 -$200 -$159 -$802 $100 -$71 -$873 $600 $381 -$492 5 $600 $340 -$152 $926 $469 $317 -$200 -$90 $227 2 $200 0 -$375 -$575 $575 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK (300) $170 -$405 -$200 $151 -$254 $100 $135 $ 119 $600 $121 $2 $600 $108 $110 6 $926 $96 $206 $0 $206 Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: Pl of A: $601.96 1.61 PV of future cash flows for B: Pl of B: $781.17 1.36 f. What is the regular payback period for these two projects? 0 (375) -$375 1 (300) $675 2 (200) -$875 3 (100) $975 600 -$375 5 $600 $225 926 $1,151 200 $951 Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 4.625 0 $575 2 $190 -$195 3 $190 $190 5 $190 $375 $190 $185 SO $190 $565 -$575 -$385 -$5 $565 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 6 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using 0 -$375 -$375 -$375 (300) -$268 $643 -$200 -$159 -$802 $100 -$71 -$873 $600 $381 -$492 5 $600 $340 -$152 $926 $469 $317 -$200 -$90 $227 2 $200 0 -$375 -$575 $575 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK (300) $170 -$405 -$200 $151 -$254 $100 $135 $ 119 $600 $121 $2 $600 $108 $110 6 $926 $96 $206 $0 $206 Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: Pl of A: $601.96 1.61 PV of future cash flows for B: Pl of B: $781.17 1.36