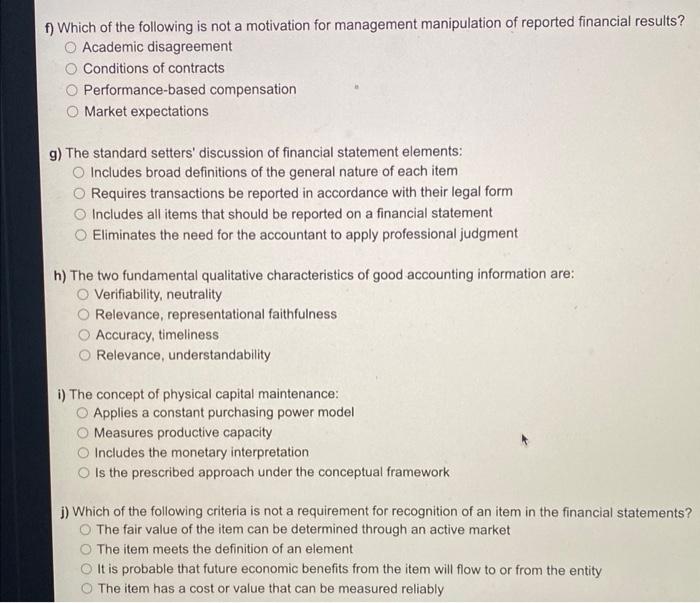

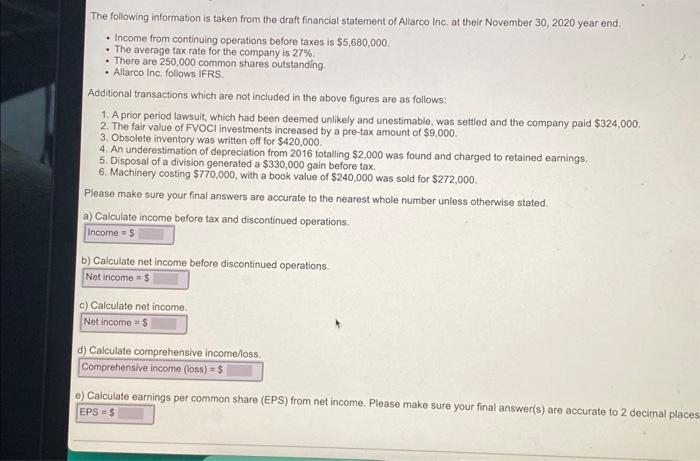

f) Which of the following is not a motivation for management manipulation of reported financial results? Academic disagreement Conditions of contracts Performance-based compensation Market expectations g) The standard setters' discussion of financial statement elements: Includes broad definitions of the general nature of each item Requires transactions be reported in accordance with their legal form Includes all items that should be reported on a financial statement Eliminates the need for the accountant to apply professional judgment h) The two fundamental qualitative characteristics of good accounting information are: Verifiability, neutrality Relevance, representational faithfulness Accuracy, timeliness Relevance, understandability i) The concept of physical capital maintenance: Applies a constant purchasing power model Measures productive capacity Includes the monetary interpretation Is the prescribed approach under the conceptual framework j) Which of the following criteria is not a requirement for recognition of an item in the financial statements? The fair value of the item can be determined through an active market The item meets the definition of an element It is probable that future economic benefits from the item will flow to or from the entity The item has a cost or value that can be measured reliably The following information is taken from the draft financial statement of Allarco Inc. at their November 30,2020 year end. - Income from continuing operations before taxes is $5,680,000. - The average tax rate for the company is 27%. - There are 250,000 common shares outstanding. - Allarco Inc, follows IFRS. Additional transactions which are not included in the above figures are as follows: 1. A prior period lawsuit, which had been deemed unlikely and unestimable, was settled and the company paid $324,000. 2. The fair value of FVOCl investments increased by a pre-tax amount of $9,000. 3. Obsolete inventory was written off for $420,000. 4. An underestimation of depreciation from 2016 totalling $2,000 was found and charged to retained earnings. 5. Disposal of a division generated a $330,000 gain before tax. 6. Machinery costing $770,000, with a book value of $240,000 was sold for $272,000. Please make sure your final answers are accurate to the nearest whole number unless otherwise stated. a) Calculate income before tax and discontinued operations. b) Calculate net income before discontinued operations. c) Calculate net income. d) Calculate comprehensive incomefoss. e) Calculate earnings per common share (EPS) from net income. Please make sure your final answer(s) are accurate to 2 decimal place