Answered step by step

Verified Expert Solution

Question

1 Approved Answer

F675) Realizel sam= 18925,000 -1.425,000 realised On December 31, 2021, Anthony sold the inherited land from his uncle. The consideration was $950,000 installment note

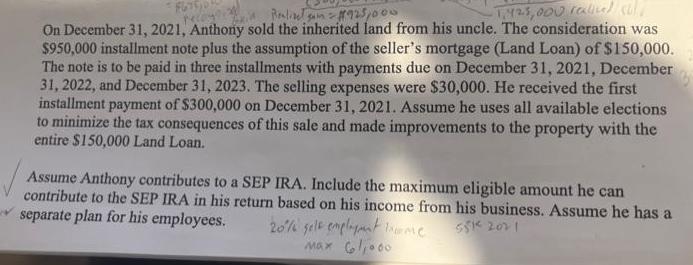

F675) Realizel sam= 18925,000 -1.425,000 realised On December 31, 2021, Anthony sold the inherited land from his uncle. The consideration was $950,000 installment note plus the assumption of the seller's mortgage (Land Loan) of $150,000. The note is to be paid in three installments with payments due on December 31, 2021, December 31, 2022, and December 31, 2023. The selling expenses were $30,000. He received the first installment payment of $300,000 on December 31, 2021. Assume he uses all available elections to minimize the tax consequences of this sale and made improvements to the property with the entire $150,000 Land Loan. Assume Anthony contributes to a SEP IRA. Include the maximum eligible amount he can contribute to the SEP IRA in his return based on his income from his business. Assume he has a separate plan for his employees. 20% self employment income 551 2021 Max 61,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started