Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fabulous Berhad is a company with an issued and paid-up capital of 100,000 ordinary shares of RM1 each and 20,000 10% debentures of RM1

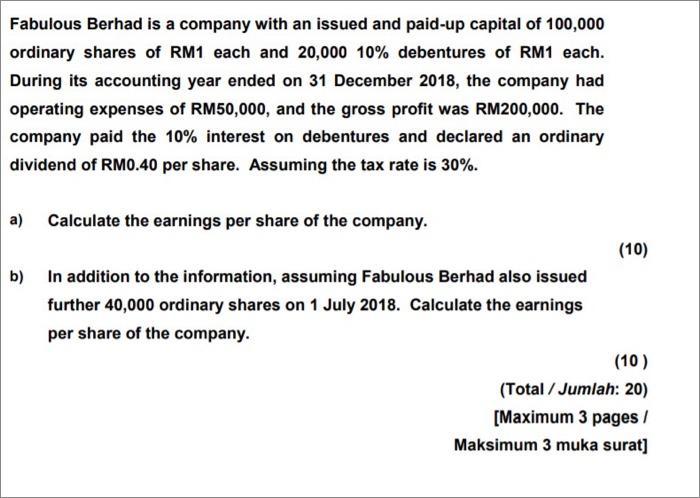

Fabulous Berhad is a company with an issued and paid-up capital of 100,000 ordinary shares of RM1 each and 20,000 10% debentures of RM1 each. During its accounting year ended on 31 December 2018, the company had operating expenses of RM50,000, and the gross profit was RM200,000. The company paid the 10% interest on debentures and declared an ordinary dividend of RMO.40 per share. Assuming the tax rate is 30%. a) Calculate the earnings per share of the company. (10) b) In addition to the information, assuming Fabulous Berhad also issued further 40,000 ordinary shares on 1 July 2018. Calculate the earnings per share of the company. (10 ) (Total / Jumlah: 20) [Maximum 3 pages / Maksimum 3 muka surat]

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Required a Earnings per share Earnings available to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started