Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Facebook has just hired some social media influencers to promote its new acquisition, Whats app, which they believe will boost their sales and earnings.

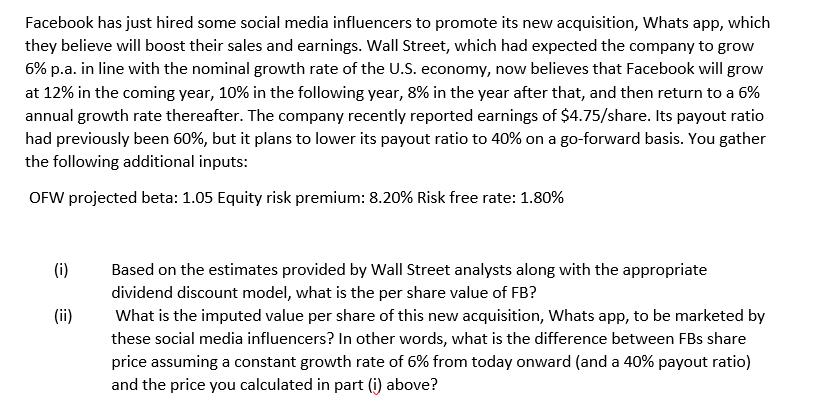

Facebook has just hired some social media influencers to promote its new acquisition, Whats app, which they believe will boost their sales and earnings. Wall Street, which had expected the company to grow 6% p.a. in line with the nominal growth rate of the U.S. economy, now believes that Facebook will grow at 12% in the coming year, 10% in the following year, 8% in the year after that, and then return to a 6% annual growth rate thereafter. The company recently reported earnings of $4.75/share. Its payout ratio had previously been 60%, but it plans to lower its payout ratio to 40% on a go-forward basis. You gather the following additional inputs: OFW projected beta: 1.05 Equity risk premium: 8.20% Risk free rate: 1.80% (i) (ii) Based on the estimates provided by Wall Street analysts along with the appropriate dividend discount model, what is the per share value of FB? What is the imputed value per share of this new acquisition, Whats app, to be marketed by these social media influencers? In other words, what is the difference between FBs share price assuming a constant growth rate of 6% from today onward (and a 40% payout ratio) and the price you calculated in part (i) above?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Share Price of Facebook Using the Dividend Discount Model DDM Calculate the Terminal Value TV Give...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started