Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Facebook will pay a dividend of $3.05 next year. The company has stated that it will maintain a constant growth rate of 5 percent a

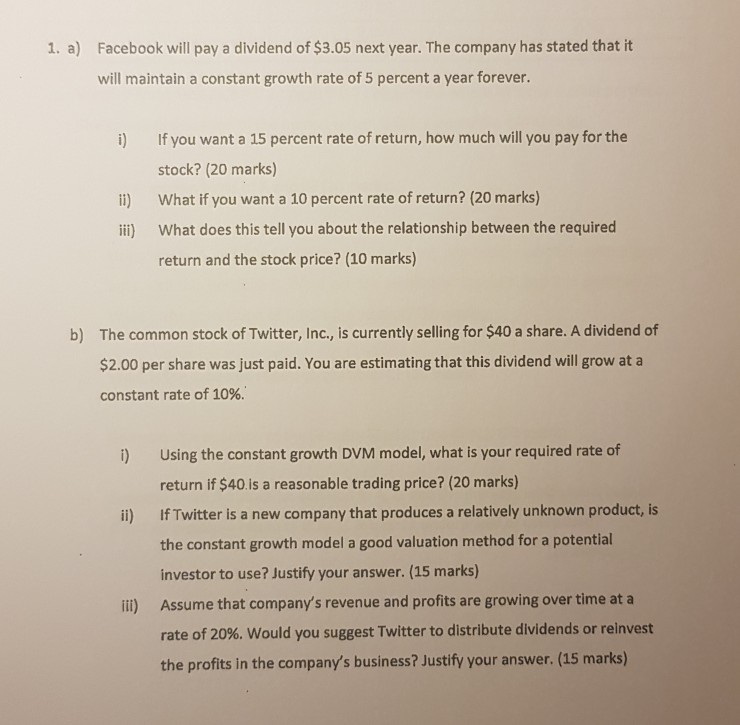

Facebook will pay a dividend of $3.05 next year. The company has stated that it will maintain a constant growth rate of 5 percent a year forever. 1. a) i) If you want a 15 percent rate of return, how much will you pay for the stock? (20 marks) li) What if you want a 10 percent rate of return? (20 marks) ii) What does this tell you about the relationship between the required return and the stock price? (10 marks) The common stock of Twitter, Inc., is currently selling for $40 a share. A dividend of $2.00 per share was just paid. You are estimating that this dividend will grow at a constant rate of 10%. b) i) Using the constant growth DVM model, what is your required rate of return if $40 is a reasonable trading price? (20 marks) If Twitter is a new company that produces a relatively unknown product, s i) the constant growth model a good valuation method for a potential investor to use? Justify your answer. (15 marks) I) Assume that company's revenue and profits are growing over time at a rate of 20%, would you suggest Twitter to distribute dividends or reinvest the profits in the company's business? Justify your answer. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started