Answered step by step

Verified Expert Solution

Question

1 Approved Answer

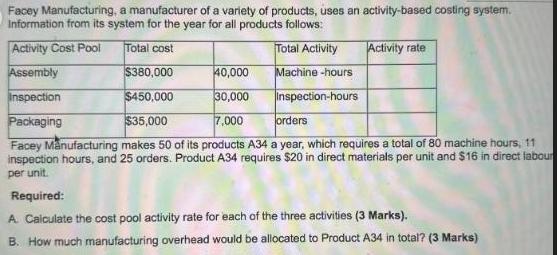

Facey Manufacturing, a manufacturer of a variety of products, uses an activity-based costing system. Information from its system for the year for all products

Facey Manufacturing, a manufacturer of a variety of products, uses an activity-based costing system. Information from its system for the year for all products follows: Total cost Activity Cost Pool Assembly 40,000 Inspection 30,000 Packaging $35,000 7,000 orders Facey Manufacturing makes 50 of its products A34 a year, which requires a total of 80 machine hours, 11 inspection hours, and 25 orders. Product A34 requires $20 in direct materials per unit and $16 in direct labour per unit. $380,000 $450,000 Total Activity Machine -hours Inspection-hours Activity rate Required: A. Calculate the cost pool activity rate for each of the three activities (3 Marks). B. How much manufacturing overhead would be allocated to Product A34 in total? (3 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To calculate the cost pool activity rate for each of the three activities we use the following for...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started