Answered step by step

Verified Expert Solution

Question

1 Approved Answer

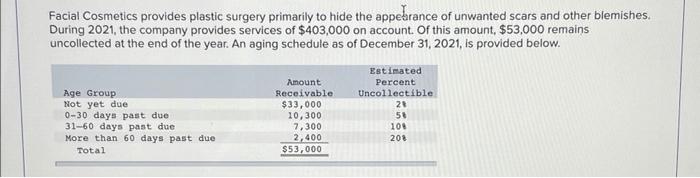

Facial Cosmetics provides plastic surgery primarily to hide the appearance of unwanted scars and other blemishes. During 2021, the company provides services of $403,000

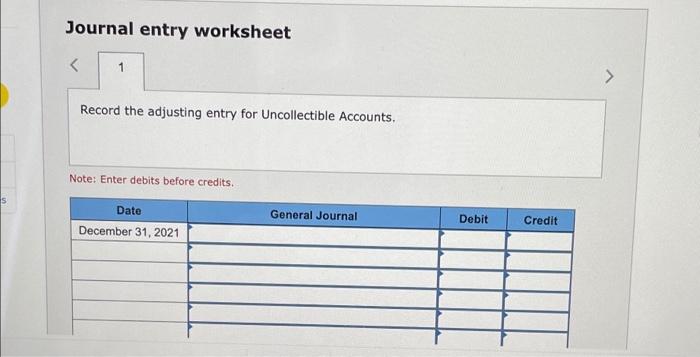

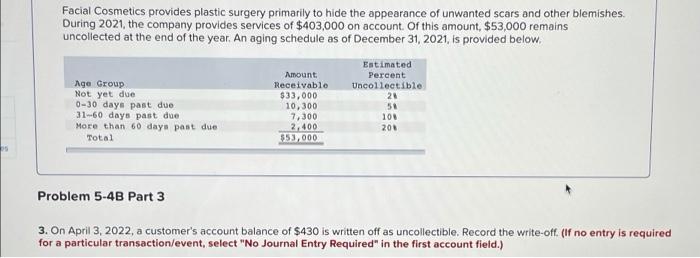

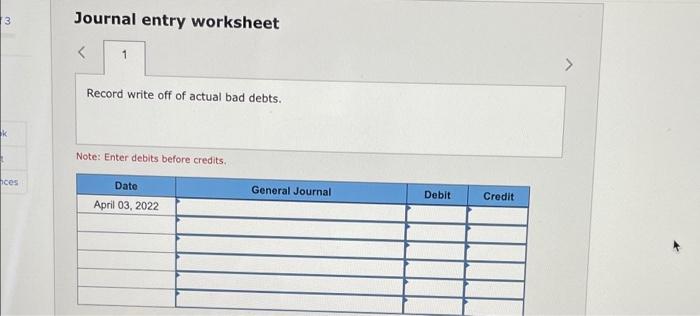

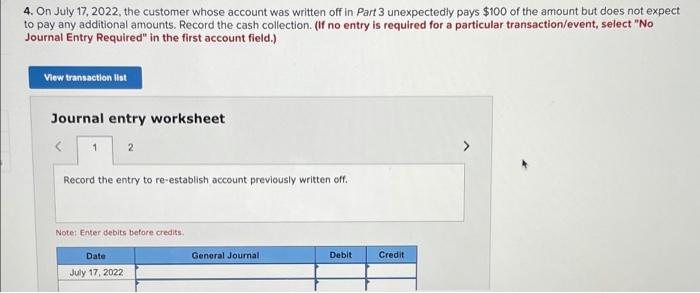

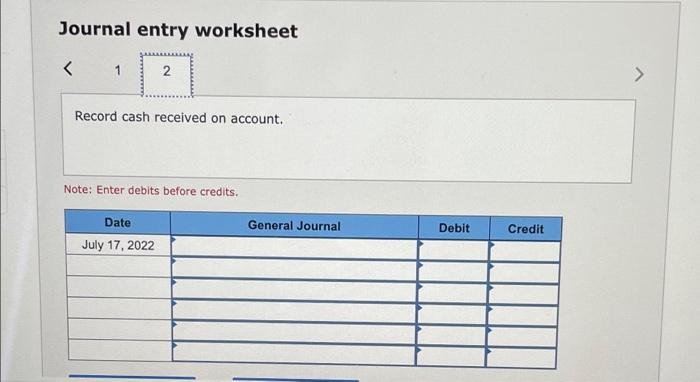

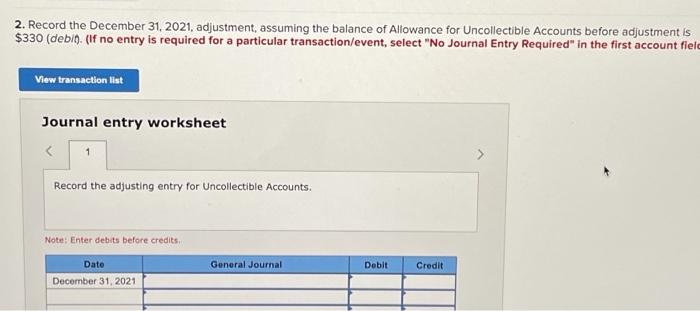

Facial Cosmetics provides plastic surgery primarily to hide the appearance of unwanted scars and other blemishes. During 2021, the company provides services of $403,000 on account. Of this amount, $53,000 remains uncollected at the end of the year. An aging schedule as of December 31, 2021, is provided below. Estimated Amount Percent Receivable $33,000 10,300 7,300 2,400 $53,000 Uncollectible. Age Group Not yet due 0-30 days past due 31-60 days past due More than 60 days past due 28 58 101 208 Total Journal entry worksheet 1 Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021 Facial Cosmetics provides plastic surgery primarily to hide the appearance of unwanted scars and other blemishes. During 2021, the company provides services of $403,000 on account. Of this amount, $53,000 remains uncollected at the end of the year. An aging schedule as of December 31, 2021, is provided below. Estimated Amount Percent Uncollectible 21 Age Group Not yet due 0-30 daya past due 31-60 days past due More than 60 daya past due Receivable $33,000 10,300 7,300 2,400 $53,000 10 20 Total Problem 5-4B Part 3 3. On April 3, 2022, a customer's account balance of $430 is written off as uncollectible. Record the write-off. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record write off of actual bad debts. Note: Enter debits before credits. ces Date General Journal Debit Credit April 03, 2022 4. On July 17, 2022, the customer whose account was written off in Part 3 unexpectedly pays $100 of the amount but does not expect to pay any additional amounts. Record the cash collection. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction lst Journal entry worksheet 1 2 Record the entry to re-establish account previously written off. Note: Enter debits before credits. Date General Joural Debit Credit July 17, 2022 Journal entry worksheet 1 Record cash received on account. Note: Enter debits before credits. Date General Journal Debit Credit July 17, 2022 2. Record the December 31, 2021, adjustment, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $330 (debin. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account fielc View transaction list Journal entry worksheet Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Amount Uncollectible Uncollectible Not yet due 33000 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started