Question

You are the CFO of ABC Manufacturing Company. Your Company is considering the purchase of a machine which will automate its production process. You have

You are the CFO of ABC Manufacturing Company. Your Company is considering the purchase of a machine which will automate its production process. You have been asked by the President to justify the purchase of the machine, and you have worked with the sales and manufacturing departments to develop projections relating to the purchase of the machine.

Here are the projections that your team has developed:

- The initial cost of the machine is $500,000

- The company uses straight line depreciation for a period of 5 years for machine of this type

- The company expects incremental operating income to be $125,000 per year and a tax rate of 25%

- The company’s weighted average cost of capital is 10.5%

- The company has traditionally used the simple payback method to evaluate project acceptance

After completing the NPV worksheet, you wish to use other measures of performance, including NPV, simple payback, discounted payback, internal; rate of return and the discounted benefit/cost ratio. You believe that an increase in the number of performance measures is valid and you wish to explain why other measures should be used to evaluate project performance.

Required:

Complete the NPV worksheet and make a recommendation about whether or not the project should be approved. Include an explanation of the pros and cons of each performance measure, and explain why some measures are better than others in evaluating project performance.

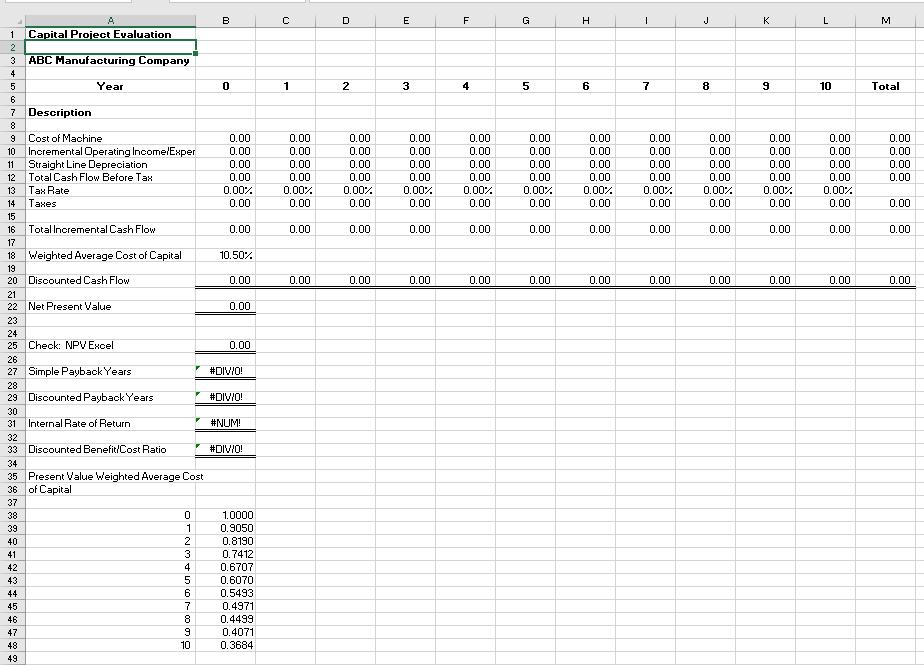

B D. E F G K Capital Project Evaluation 3 ABC Manufacturing Company 4 5 Year 1 2 3 4 5 6. 7 8 10 Total 6 7 Description 8 Cost of Machine 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Incremental Operating Income/Exper Straight Line Depreciation Total Cash Flow Before Tax 10 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 11 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 12 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Rate es 0.00% 0.00% 0.00 0.00% 0.00 13 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 14 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 15 16 Total Incremental Cash Flow 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 17 18 Weighted Average Cost of Capital 10.50% 19 20 Discounted Cash Flow 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 21 22 Net Present Value 0.00 23 24 25 Check: NPVExcel 0.00 26 27 Simple Payback Years #DIVIO! 28 29 Discounted Payback Years #DIVIO! 30 31 Internal Rate of Return #NUM! 32 33 Discounted Benefit/Cost Ratio #DIVIO! 34 35 Present Value Weighted Average Cost 36 of Capital 37 38 1.0000 39 1 0.9050 40 0.8190 41 3 0.7412 42 4 0.6707 5 0.6070 0.5493 0.4971 43 44 45 46 0.4499 47 0.4071 48 10 0.3684 49

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Following assumptions have been made in solving this question 1 Operat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started