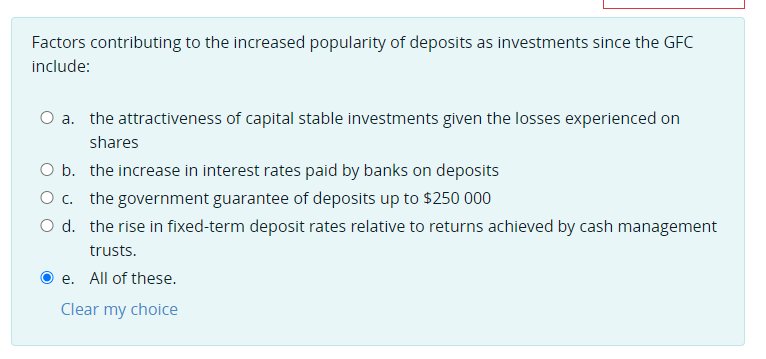

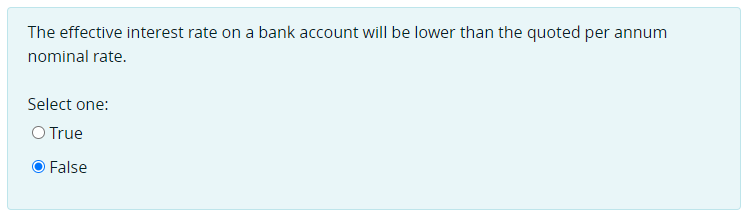

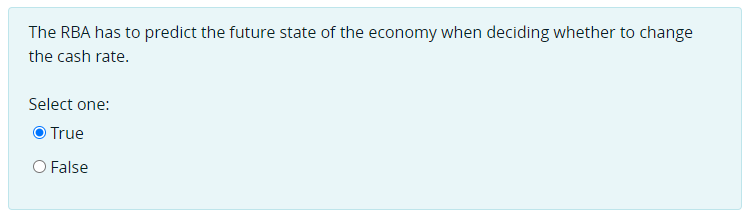

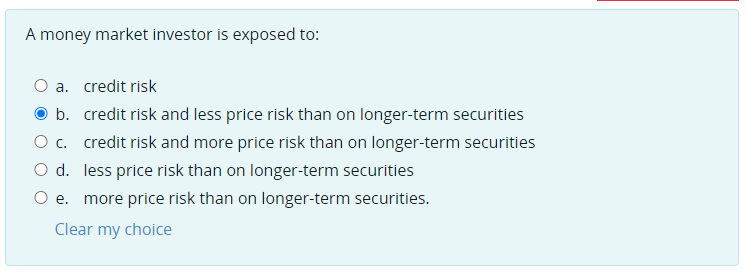

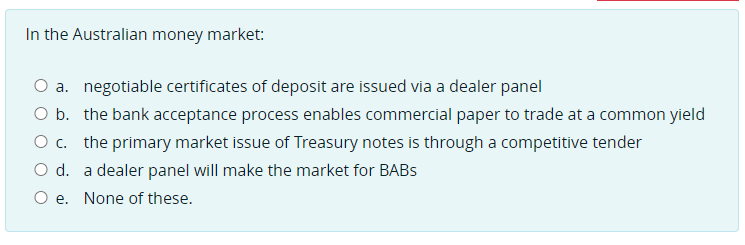

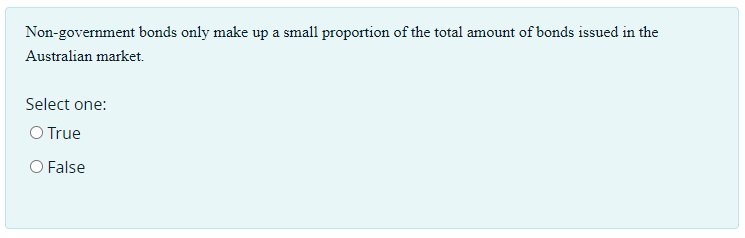

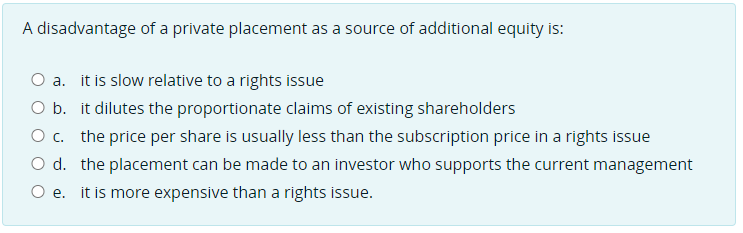

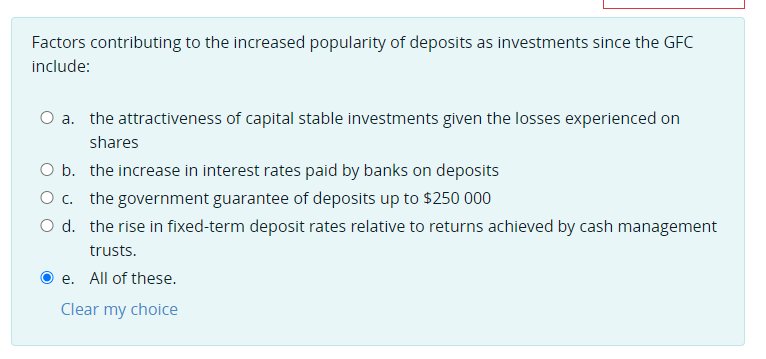

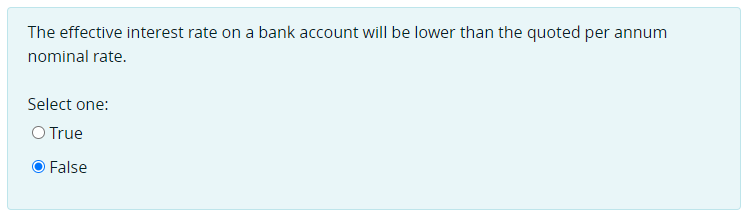

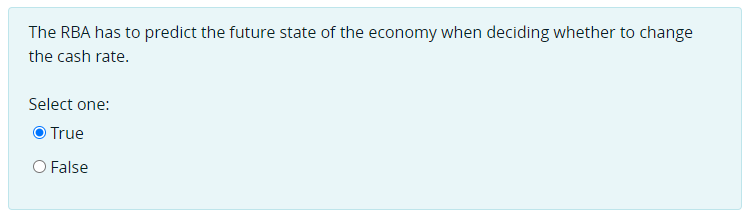

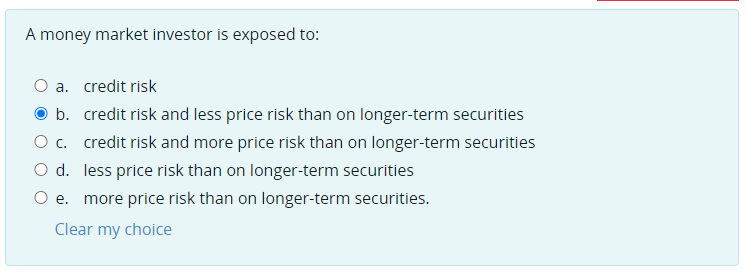

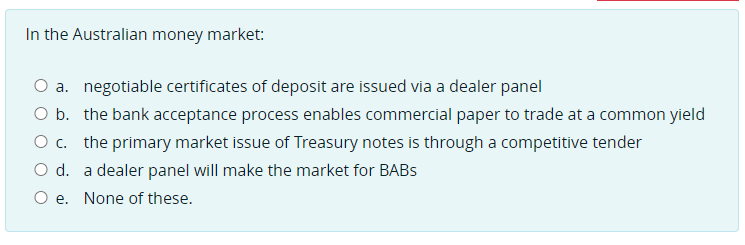

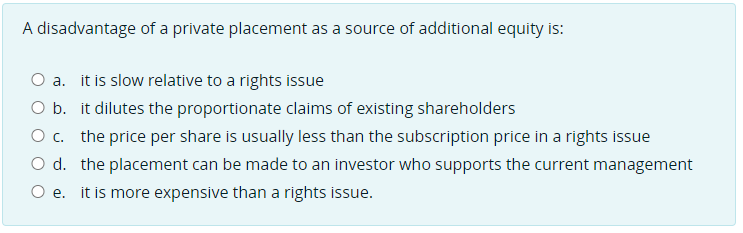

Factors contributing to the increased popularity of deposits as investments since the GFC include: a. the attractiveness of capital stable investments given the losses experienced on shares b. the increase in interest rates paid by banks on deposits c. the government guarantee of deposits up to $250000 d. the rise in fixed-term deposit rates relative to returns achieved by cash management trusts. e. All of these. Clear my choice The effective interest rate on a bank account will be lower than the quoted per annum nominal rate. Select one: True False The RBA has to predict the future state of the economy when deciding whether to change the cash rate. Select one: True False A money market investor is exposed to: a. credit risk b. credit risk and less price risk than on longer-term securities c. credit risk and more price risk than on longer-term securities d. less price risk than on Ionger-term securities e. more price risk than on longer-term securities. Clear my choice In the Australian money market: a. negotiable certificates of deposit are issued via a dealer panel b. the bank acceptance process enables commercial paper to trade at a common yield c. the primary market issue of Treasury notes is through a competitive tender d. a dealer panel will make the market for BABs e. None of these. Non-government bonds only make up a small proportion of the total amount of bonds issued in the Australian market. Select one: True False A disadvantage of a private placement as a source of additional equity is: a. it is slow relative to a rights issue b. it dilutes the proportionate claims of existing shareholders c. the price per share is usually less than the subscription price in a rights issue d. the placement can be made to an investor who supports the current management e. it is more expensive than a rights issue. Commodity currency is priced in the terms currency. Select one: True False An Australian company wishes to buy USD. Given the AUD is quoted as the commodity currency, the company will be looking to transact at the lowest bid quote available Select one: True False A long futures position means that a trader holds more contracts that have a longer period to their settlement date than contracts with a shorter period to settlement. Select one: True False Through the processes of novation and margin payments, the clearinghouse: a. becomes counterparty to each futures transaction b. seeks to protect traders from default risk c. will close out the position of defaulting traders d. guarantees the performance of futures contracts. e. All of these are correct. Trading in BAB futures reveals implicit forward interest rates. Select one: True False