Answered step by step

Verified Expert Solution

Question

1 Approved Answer

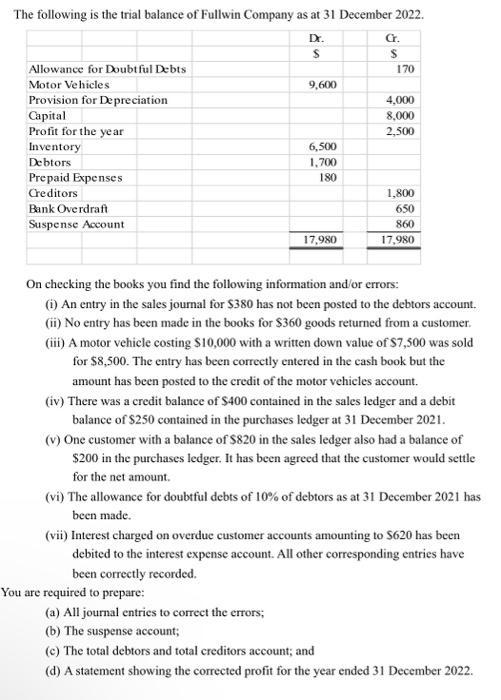

The following is the trial balance of Fullwin Company as at 31 December 2022. Dr. $ Allowance for Doubtful Debts Motor Vehicles Provision for

The following is the trial balance of Fullwin Company as at 31 December 2022. Dr. $ Allowance for Doubtful Debts Motor Vehicles Provision for Depreciation Capital Profit for the year Inventory Debtors Prepaid Expenses Creditors Bank Overdraft Suspense Account 9,600 6,500 1,700 180 17,980 You are required to prepare: Cr. S 170 4,000 8,000 2,500 1,800 650 860 17,980 On checking the books you find the following information and/or errors: (i) An entry in the sales journal for $380 has not been posted to the debtors account. (ii) No entry has been made in the books for $360 goods returned from a customer. (iii) A motor vehicle costing $10,000 with a written down value of $7,500 was sold for $8,500. The entry has been correctly entered in the cash book but the amount has been posted to the credit of the motor vehicles account. (iv) There was a credit balance of $400 contained in the sales ledger and a debit balance of $250 contained in the purchases ledger at 31 December 2021. (v) One customer with a balance of $820 in the sales ledger also had a balance of $200 in the purchases ledger. It has been agreed that the customer would settle for the net amount. (vi) The allowance for doubtful debts of 10% of debtors as at 31 December 2021 has been made. (vii) Interest charged on overdue customer accounts amounting to $620 has been debited to the interest expense account. All other corresponding entries have been correctly recorded. (a) All journal entries to correct the errors; (b) The suspense account; (c) The total debtors and total creditors account; and (d) A statement showing the corrected profit for the year ended 31 December 2022.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a All journal entries to correct the errors Sales journal entry Debit Accounts Receivable 380 Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started