Answered step by step

Verified Expert Solution

Question

1 Approved Answer

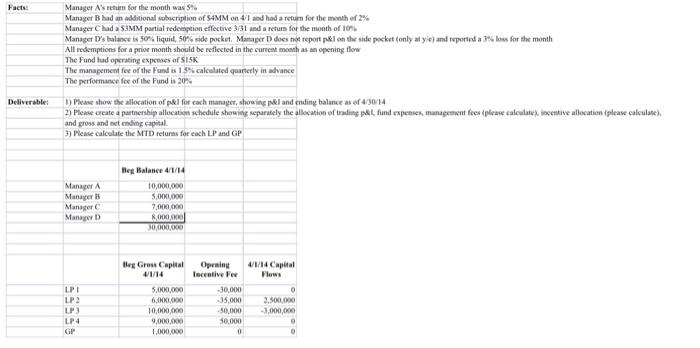

Facts: Deliverable: Manager A's return for the month was 5% Manager B had an additional subscription of $4MM on 4/1 and had a return for

Facts: Deliverable: Manager A's return for the month was 5% Manager B had an additional subscription of $4MM on 4/1 and had a return for the month of 2% Manager C had a $3MM partial redemption effective 3/31 and a return for the month of 10% Manager D's balance is 50% liquid, 50% side pocket. Manager D does not report p&l on the side pocket (only at y/e) and reported a 3% loss for the month All redemptions for a prior month should be reflected in the current month as an opening flow The Fund had operating expenses of $15K The management fee of the Fund is 1.5% calculated quarterly in advance The performance fee of the Fund is 20% 1) Please show the allocation of p&l for each manager, showing p&l and ending balance as of 4/30/14 2) Please create a partnership allocation schedule showing separately the allocation of trading p&l, fund expenses, management fees (please calculate), incentive allocation (please calculate), and gross and net ending capital. 3) Please calculate the MTD returns for each LP and GP Manager A Manager B Manager C Manager D LP 1 LP 2 LP 3 LP 4 GP Beg Balance 4/1/14 10,000,000 5,000,000 7,000,000 8,000,000 30,000,000 Beg Gross Capital 4/1/14 5,000,000 6,000,000 10,000,000 9,000,000 1,000,000 Opening Incentive Fee -30,000 -35,000 -50,000 50,000 0 4/1/14 Capital Flows 0 2,500,000 -3,000,000 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started