Answered step by step

Verified Expert Solution

Question

1 Approved Answer

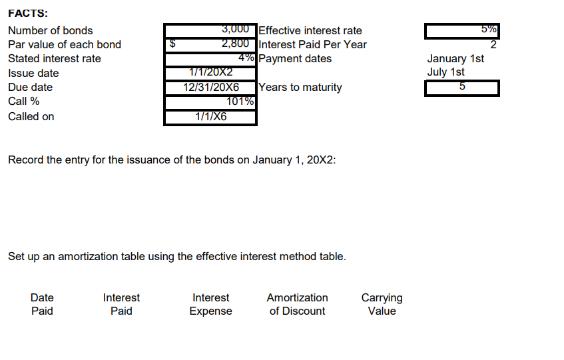

FACTS: Number of bonds Par value of each bond Stated interest rate Issue date Due date Call % Called on 3,000 Effective interest rate

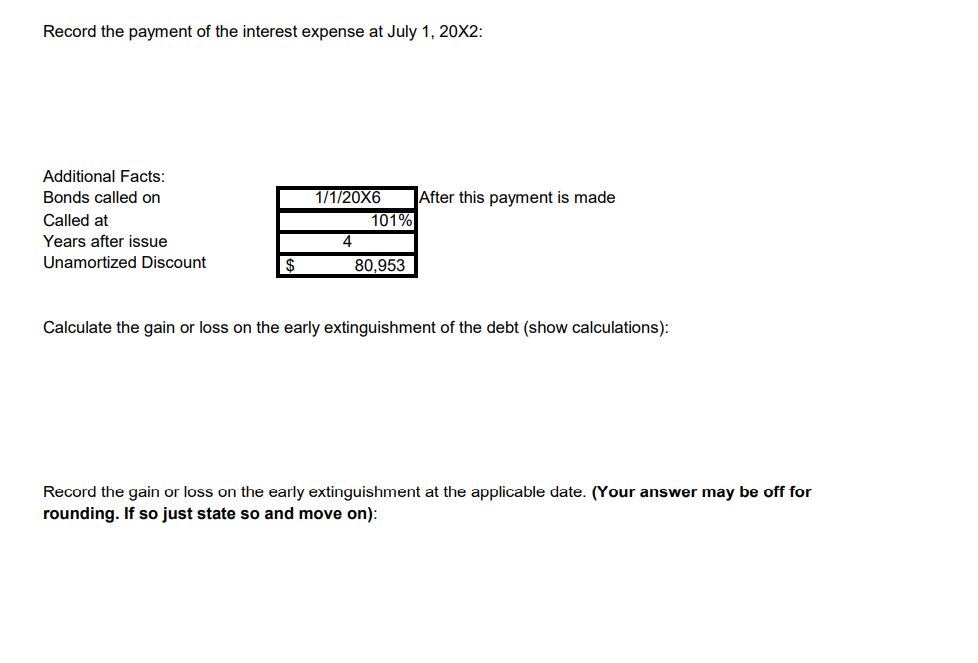

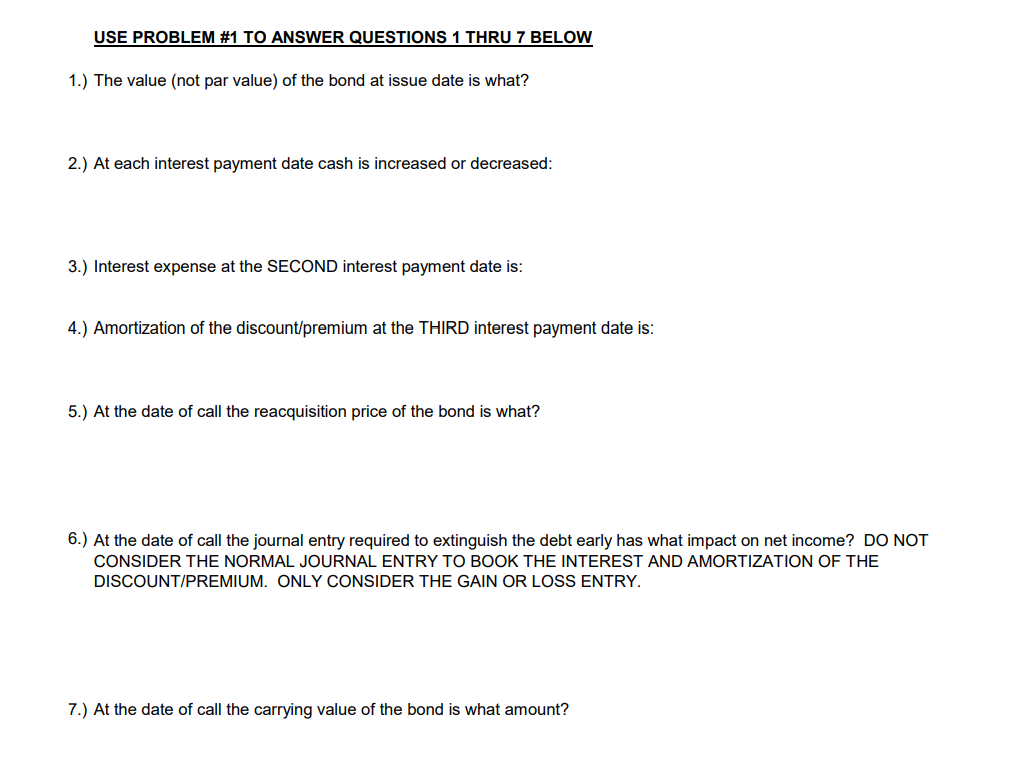

FACTS: Number of bonds Par value of each bond Stated interest rate Issue date Due date Call % Called on 3,000 Effective interest rate 2,800 Interest Paid Per Year 4% Payment dates Date Paid 1/1/20X2 12/31/20X6 Years to maturity Interest Paid 1/1/X6 Record the entry for the issuance of the bonds on January 1, 20X2: 101% Set up an amortization table using the effective interest method table. Interest Expense Amortization of Discount Carrying Value January 1st July 1st 5 Record the payment of the interest expense at July 1, 20X2: Additional Facts: Bonds called on Called at Years after issue Unamortized Discount $ 1/1/20X6 4 101% 80,953 After this payment is made Calculate the gain or loss on the early extinguishment of the debt (show calculations): Record the gain or loss on the early extinguishment at the applicable date. (Your answer may be off for rounding. If so just state so and move on): USE PROBLEM #1 TO ANSWER QUESTIONS 1 THRU 7 BELOW 1.) The value (not par value) of the bond at issue date is what? 2.) At each interest payment date cash is increased or decreased: 3.) Interest expense at the SECOND interest payment date is: 4.) Amortization of the discount/premium at the THIRD interest payment date is: 5.) At the date of call the reacquisition price of the bond is what? 6.) At the date of call the journal entry required to extinguish the debt early has what impact on net income? DO NOT CONSIDER THE NORMAL JOURNAL ENTRY TO BOOK THE INTEREST AND AMORTIZATION OF THE DISCOUNT/PREMIUM. ONLY CONSIDER THE GAIN OR LOSS ENTRY. 7.) At the date of call the carrying value of the bond is what amount?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

FACTS Number of bonds 3000 Effective interest rate 5 Par value of each bond 1000 Stated interest rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started