Question

Facts: On January 1, 2022, Parent Co purchased 100% of the voting common shares of Sub Co. Parent Co uses the equity method to account

Facts: On January 1, 2022, Parent Co purchased 100% of the voting common shares of Sub Co. Parent Co uses the equity method to account for its investment in Sub Co. At the acquisition date, $810 of the purchase price was attributed to land that had a fair value in

excess of the carrying value on Sub Co's books. In addition, $270 of the purchase price was attributed to equipment that had a fair value in excess of the carrying value on Sub Co's books. At acquisition date, the equipment had a remaining useful life of 10 years.

It is assumed that the consideration paid by Parent to acquire Sub Co was equal to the fair value i.e., market value) of the business and that the fair value of the business exceeded the fair value of net assets acquired at the acquisition date by $540.

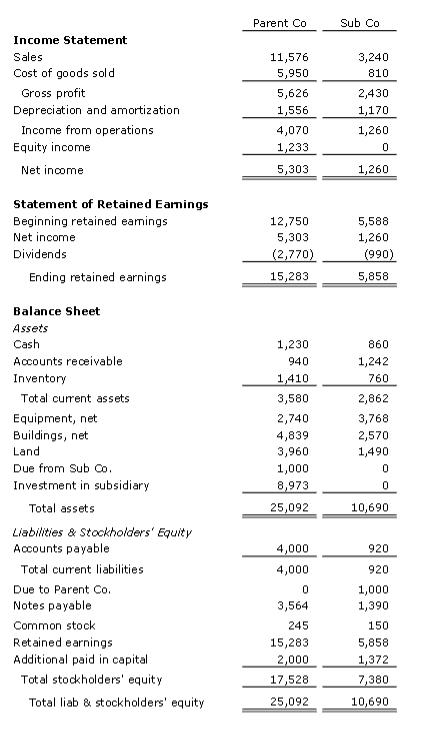

It is now December 31, 2022, and consolidated financial statements need to be prepared. As of year-end, Sub Co had borrowed $1,000 from Parent Co, without interest. Parent Co and Sub Co's financial statements at the end of the first year following the acquisition are detailed in the Excel file "Case 1 - Advanced accounting topics."

Required: Using the Excel file "Case 1 - Advanced accounting topics" and the worksheet

"Part I," prepare the eliminating/consolidating journal entries and the consolidated financial statements at

the end of the first year following the acquisition. Ignore tax effects for any adjustments to the income statement.

Income Statement Sales Cost of goods sold Gross profit Depreciation and amortization Income from operations Equity income Net income Statement of Retained Earnings Beginning retained eamings Net income Dividends Ending retained earnings Balance Sheet Assets Cash Accounts receivable. Inventory Total current assets Equipment, net Buildings, net Land Due from Sub Co. Investment in subsidiary Total assets Liabilities & Stockholders' Equity Accounts payable Total current liabilities Due to Parent Co. Notes payable Common stock Retained earnings Additional paid in capital. Total stockholders' equity Total liab & stockholders' equity Parent Co 11,576 5,950 5,626 1,556 4,070 1,233 5,303 12,750 5,303 (2,770) 15,283 1,230 940 1,410 3,580 2,740 4,839 3,960 1,000 8,973 25,092 4,000 4,000 0 3,564 245 15,283 2,000 17,528 25,092 Sub Co 3,240 810 2,430 1,170 1,260 0 1,260 5,588 1,260 (990) 5,858 860 1,242 760 2,862 3,768 2,570 1,490 0 0 10,690 920 920 1,000 1,390 150 5,858 1,372 7,380 10,690

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started