FACTS: The Budvar Company sells parts to a foreign customer on December 1, Year 1, with payment of 20,000 crowns to be received on

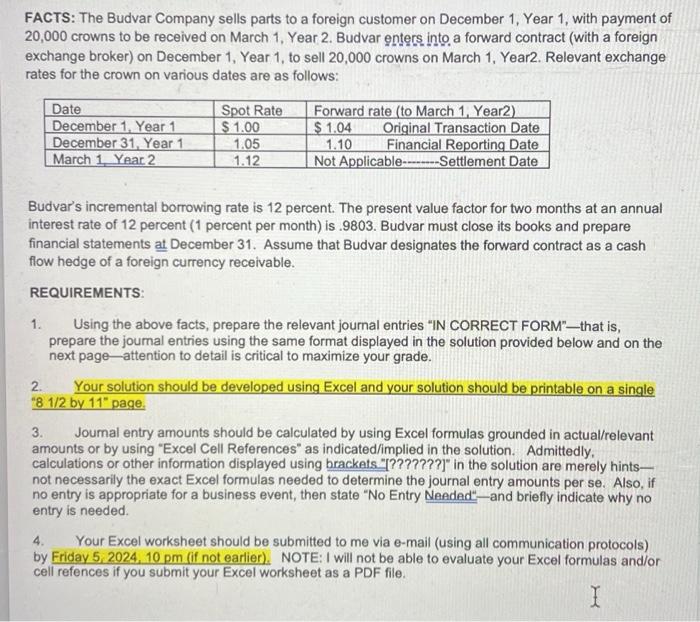

FACTS: The Budvar Company sells parts to a foreign customer on December 1, Year 1, with payment of 20,000 crowns to be received on March 1, Year 2. Budvar enters into a forward contract (with a foreign exchange broker) on December 1, Year 1, to sell 20,000 crowns on March 1, Year2. Relevant exchange rates for the crown on various dates are as follows: Date Spot Rate December 1, Year 1 December 31, Year 1 March 1 Year 2 $1.00 1.05 1.12 Forward rate (to March 1, Year2) $1.04 1.10 Original Transaction Date Financial Reporting Date Not Applicable-Settlement Date Budvar's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent (1 percent per month) is .9803. Budvar must close its books and prepare financial statements at December 31. Assume that Budvar designates the forward contract as a cash flow hedge of a foreign currency receivable. REQUIREMENTS: 1. 2. Using the above facts, prepare the relevant journal entries "IN CORRECT FORM"-that is, prepare the journal entries using the same format displayed in the solution provided below and on the next page attention to detail is critical to maximize your grade. Your solution should be developed using Excel and your solution should be printable on a single "8 1/2 by 11" page. 3. Journal entry amounts should be calculated by using Excel formulas grounded in actual/relevant amounts or by using "Excel Cell References" as indicated/implied in the solution. Admittedly. calculations or other information displayed using brackets "[???????]" in the solution are merely hints- not necessarily the exact Excel formulas needed to determine the journal entry amounts per se. Also, if no entry is appropriate for a business event, then state "No Entry Needed"-and briefly indicate why no entry is needed. 4. Your Excel worksheet should be submitted to me via e-mail (using all communication protocols) by Friday 5, 2024, 10 pm (if not earlier). NOTE: I will not be able to evaluate your Excel formulas and/or cell refences if you submit your Excel worksheet as a PDF file. I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you sent contains a question about accounting for a forward contract used as a cash flow hedge Based on the information providedhere are the relevant journal entries for Budvar Companyassumi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started