Answered step by step

Verified Expert Solution

Question

1 Approved Answer

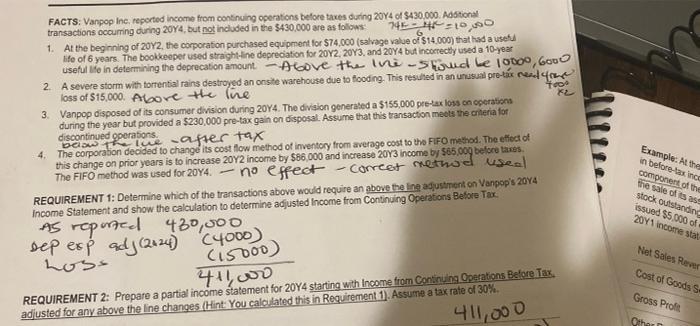

FACTS: Vanpop Inc. reported income from continuing operations before taxes during 20Y4 of $430,000. Additional 742-4=10,000 transactions occurring during 2014, but not included in

FACTS: Vanpop Inc. reported income from continuing operations before taxes during 20Y4 of $430,000. Additional 742-4=10,000 transactions occurring during 2014, but not included in the $430,000 are as follows: 1. At the beginning of 20Y2, the corporation purchased equipment for $74,000 (salvage value of $14,000) that had a useful life of 6 years. The bookkeeper used straight-line depreciation for 2012, 2013, and 20Y4 but incorrectly used a 10-year useful life in determining the deprecation amount. -Above the live-shoud be 10000, 6000 4000 2. A severe storm with torrential rains destroyed an onsite warehouse due to flooding. This resulted in an unusual pre-tax ned loss of $15,000. Above the line 3. Vanpop disposed of its consumer division during 20Y4. The division generated a $155,000 pre-tax loss on operations during the year but provided a $230,000 pre-tax gain on disposal. Assume that this transaction meets the criteria for discontinued operations. below the live after tax 4. The corporation decided to change its cost flow method of inventory from average cost to the FIFO method. The effect of this change on prior years is to increase 20Y2 income by $86,000 and increase 2013 income by $65,000 before taxes. The FIFO method was used for 2014. no effect - correct method used REQUIREMENT 1: Determine which of the transactions above would require an above the line adjustment on Vanpop's 2014 Income Statement and show the calculation to determine adjusted Income from Continuing Operations Before Tax. As repurteel sep esp adj (2424) (4000) 430,000 Lobs (15000) 411,000 REQUIREMENT 2: Prepare a partial income statement for 20Y4 starting with Income from Continuing Operations Before Tax, adjusted for any above the line changes (Hint: You calculated this in Requirement 1). Assume a tax rate of 30%. 411,000 Example: At the in before-tax inco component of the the sale of its ass stock outstanding issued $5,000 of 20Y1 income stat Net Sales Rever Cost of Goods Se Gross Profit Other p

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Determine which of the transactions above would require an above the line adjustment on Vanpops 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started