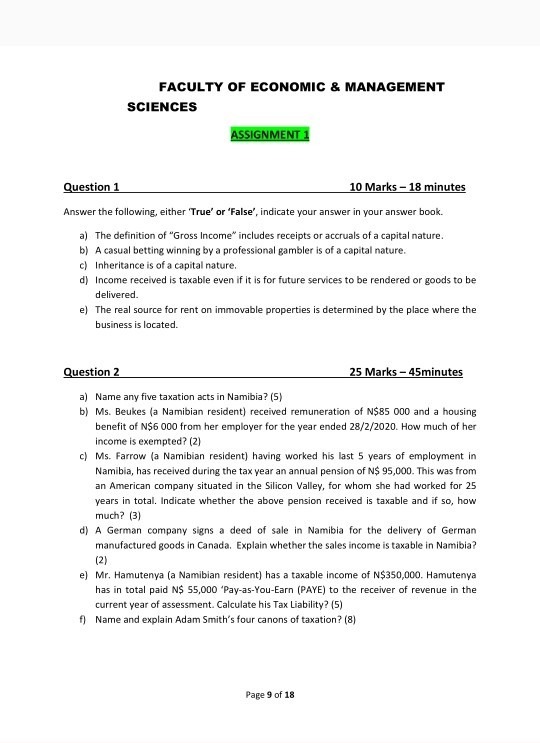

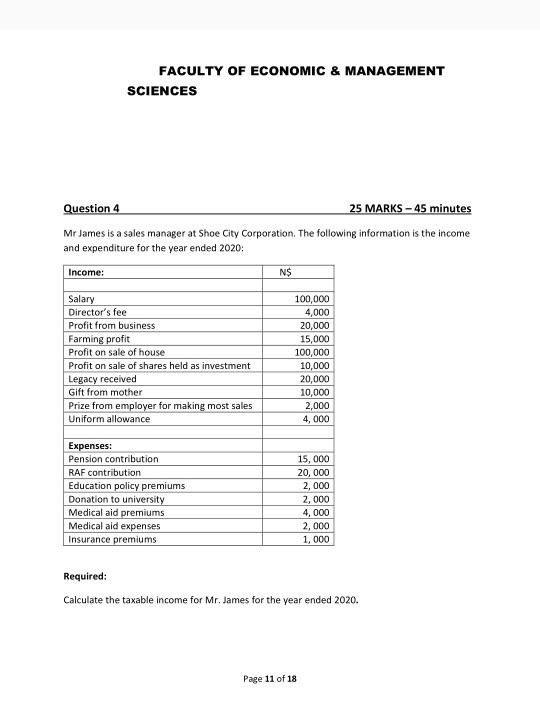

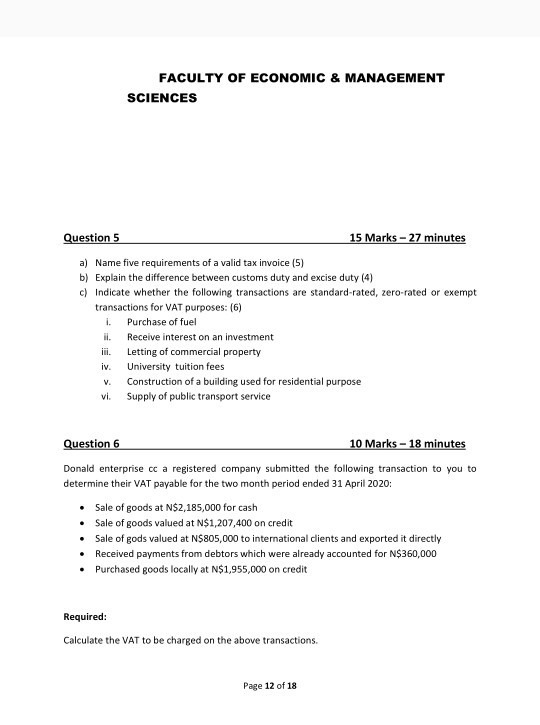

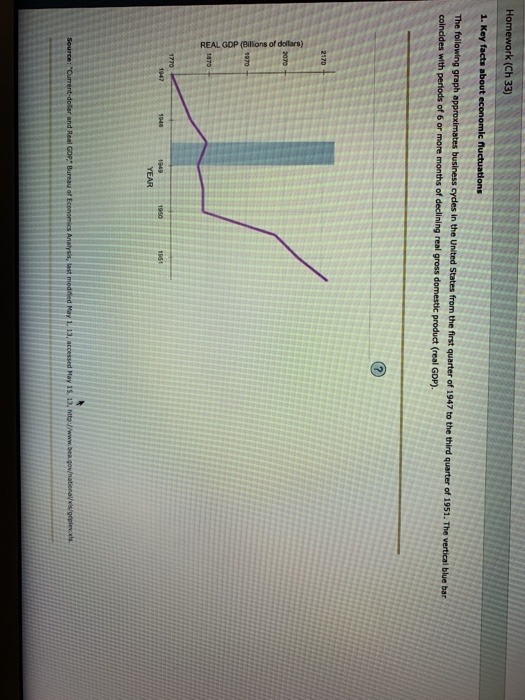

FACULTY OF ECONOMIC & MANAGEMENT SCIENCES ASSIGNMENT 1 Question 1 10 Marks - 18 minutes Answer the following, either 'True' or 'False', indicate your answer in your answer book. a) The definition of "Gross Income" includes receipts or accruals of a capital nature. b) A casual betting winning by a professional gambler is of a capital nature. c) Inheritance is of a capital nature. d) Income received is taxable even if it is for future services to be rendered or goods to be delivered. e) The real source for rent on immovable properties is determined by the place where the business is located. Question 2 25 Marks - 45minutes a) Name any five taxation acts in Namibia? (5) b) Ms. Beukes (a Namibian resident) received remuneration of N$85 000 and a housing benefit of N$6 000 from her employer for the year ended 28/2/2020. How much of her income is exempted? (2) c) Ms. Farrow (a Namibian resident) having worked his last 5 years of employment in Namibia, has received during the tax year an annual pension of N$ 95,000. This was from an American company situated in the Silicon Valley, for whom she had worked for 25 years in total. Indicate whether the above pension received is taxable and if so, how much? (3) d) A German company signs a deed of sale in Namibia for the delivery of German manufactured goods in Canada. Explain whether the sales income is taxable in Namibia? (2) e) Mr. Hamutenya (a Namibian resident) has a taxable income of N$350,000. Hamutenya has in total paid N$ 55,000 'Pay-as-You-Earn (PAYE) to the receiver of revenue in the current year of assessment. Calculate his Tax Liability? (5) () Name and explain Adam Smith's four canons of taxation? (8) Page 9 of 18FACULTY OF ECONOMIC & MANAGEMENT SCIENCES Question 4 25 MARKS - 45 minutes Mr James is a sales manager at Shoe City Corporation. The following information is the income and expenditure for the year ended 2020: Income: NS Salary 100,000 Director's fee 4,000 Profit from business 20,000 Farming profit 15,000 Profit on sale of house 100,000 Profit on sale of shares held as investment 10,000 Legacy received 20,000 Gift from mother 10,000 Prize from employer for making most sales 2,000 Uniform allowance 4, 000 Expenses: Pension contribution 15, 000 RAF contribution 20, 000 Education policy premiums 2, 000 Donation to university 2, 000 Medical aid premiums 4, 000 Medical aid expenses 2, 000 Insurance premiums 1, 000 Required: Calculate the taxable income for Mr. James for the year ended 2020. Page 11 of 18FACULTY OF ECONOMIC & MANAGEMENT SCIENCES Question 5 15 Marks - 27 minutes a) Name five requirements of a valid tax invoice (5) b) Explain the difference between customs duty and excise duty (4) c) Indicate whether the following transactions are standard-rated, zero-rated or exempt transactions for VAT purposes: (6) 1. Purchase of fuel Receive interest on an investment Fi. Letting of commercial property iv. University tuition fees V. Construction of a building used for residential purpose vi. Supply of public transport service Question 6 10 Marks - 18 minutes Donald enterprise cc a registered company submitted the following transaction to you to determine their VAT payable for the two month period ended 31 April 2020: Sale of goods at N$2,185,000 for cash Sale of goods valued at N$1,207,400 on credit Sale of gods valued at N$805,000 to international clients and exported it directly Received payments from debtors which were already accounted for N$360,000 Purchased goods locally at N$1,955,090 on credit Required: Calculate the VAT to be charged on the above transactions. Page 12 of 187. Recently there has been a trend towards bilateral trade agreements. What are the costs and benefits of this approach for the countries involved or the global economy? 8. What were the most important drivers of the Asian Financial crisis? Pick a country and discuss some of the drivers? What were the costs of some of the policy responses? What factors increase a country's exposure to crisis? 9. What are some of the political implications of the response to the Global financial crisis (of 2008)? Feel free to mention global implications of the crisis or its aftershocks or local policy dilemmas.Homework (Ch 33) 1. Key facts about economic fluctuations The following graph approximates business cycles in the United States from the first quarter of 1947 to the third quarter of 1951. The vertical blue bar coincides with periods of 6 or more months of declining real gross domestic product (real GDP). 2170 REAL GDP (Billions of dollars) 1770 YEAR Source: "Current-dolls esued May 15. 13, http:/www.bea gowationalx z/gepie