Answered step by step

Verified Expert Solution

Question

1 Approved Answer

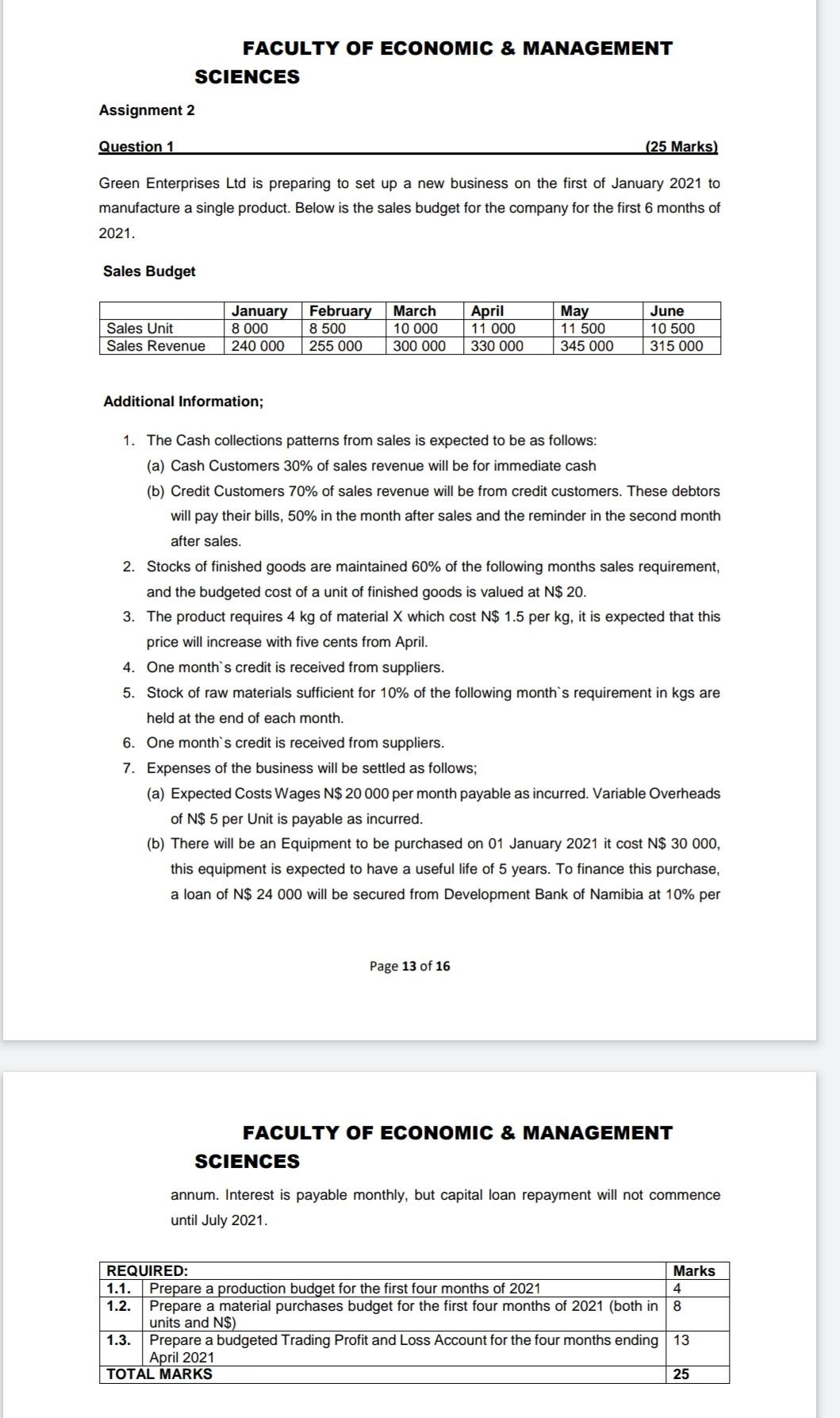

FACULTY OF ECONOMIC & MANAGEMENT SCIENCES Assignment 2 Question 1 (25 Marks Green Enterprises Ltd is preparing to set up a new business on the

FACULTY OF ECONOMIC & MANAGEMENT SCIENCES Assignment 2 Question 1 (25 Marks Green Enterprises Ltd is preparing to set up a new business on the first of January 2021 to manufacture a single product. Below is the sales budget for the company for the first 6 months of 2021. Sales Budget Sales Unit Sales Revenue January 8 000 240 000 February 8 500 255 000 March 10 000 300 000 April 11 000 330 000 May 11 500 345 000 June 10 500 315 000 Additional Information; 1. The Cash collections patterns from sales is expected to be as follows: (a) Cash Customers 30% of sales revenue will be for immediate cash (b) Credit Customers 70% of sales revenue will be from credit customers. These debtors will pay their bills, 50% in the month after sales and the reminder in the second month after sales. 2. Stocks of finished goods are maintained 60% of the following months sales requirement, and the budgeted cost of a unit of finished goods is valued at N$ 20. 3. The product requires 4 kg of material X which cost N$ 1.5 per kg, it is expected that this price will increase with five cents from April. 4. One month's credit is received from suppliers. 5. Stock of raw materials sufficient for 10% of the llowing month's requirement in kgs are held at the end of each month. 6. One month's credit is received from suppliers. 7. Expenses of the business will be settled as follows; (a) Expected Costs Wages N$ 20 000 per month payable as incurred. Variable Overheads of N$ 5 per Unit is payable as incurred. (b) There will be an Equipment to be purchased on 01 January 2021 it cost N$ 30 000, this equipment is expected to have a useful life of 5 years. To finance this purchase, a loan of N$ 24 000 will be secured from Development Bank of Namibia at 10% per Page 13 of 16 FACULTY OF ECONOMIC & MANAGEMENT SCIENCES annum. Interest is payable monthly, but capital loan repayment will not commence until July 2021. REQUIRED: Marks 1.1. Prepare a production budget for the first four months of 2021 4 1.2. Prepare a material purchases budget for the first four months of 2021 (both in 8 units and N$) 1.3. Prepare a budgeted Trading Profit and Loss Account for the four months ending 13 April 2021 TOTAL MARKS 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started