Answered step by step

Verified Expert Solution

Question

1 Approved Answer

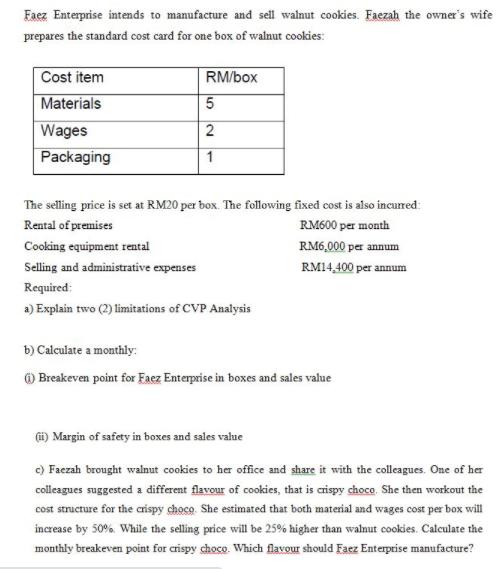

Eaez Enterprise intends to manufacture and sell walnut cookies. Faezah the owner's wife prepares the standard cost card for one box of walnut cookies:

Eaez Enterprise intends to manufacture and sell walnut cookies. Faezah the owner's wife prepares the standard cost card for one box of walnut cookies: Cost item Materials RM/box Wages Packaging 1 The selling price is set at RM20 per box. The following fixed cost is also incurred: Rental of premises RM600 per month Cooking equipment rental RM6,000 per annum Selling and administrative expenses RM14,400 per annum Required: a) Explain two (2) limitations of CVP Analysis b) Calculate a monthly: O Breakeven point for Faez Enterprise in boxes and sales value G) Margin of safety in boxes and sales value c) Faczah brought walnut cookies to her office and share it with the colleagues. One of her colleagues suggested a different flavour of cookies, that is crispy choco. She then workout the cost structure for the arispy choco She estimated that both material and wages cost per box will increase by 50%. While the selling price will be 25% higher than walnut cookies. Calculate the monthly breakeven point for crispy choco. Which flavour should Faez Enterprise manufacture?

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Limitations of Cost Volume Profit Analysis are 1 CVP analysis assures that all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started