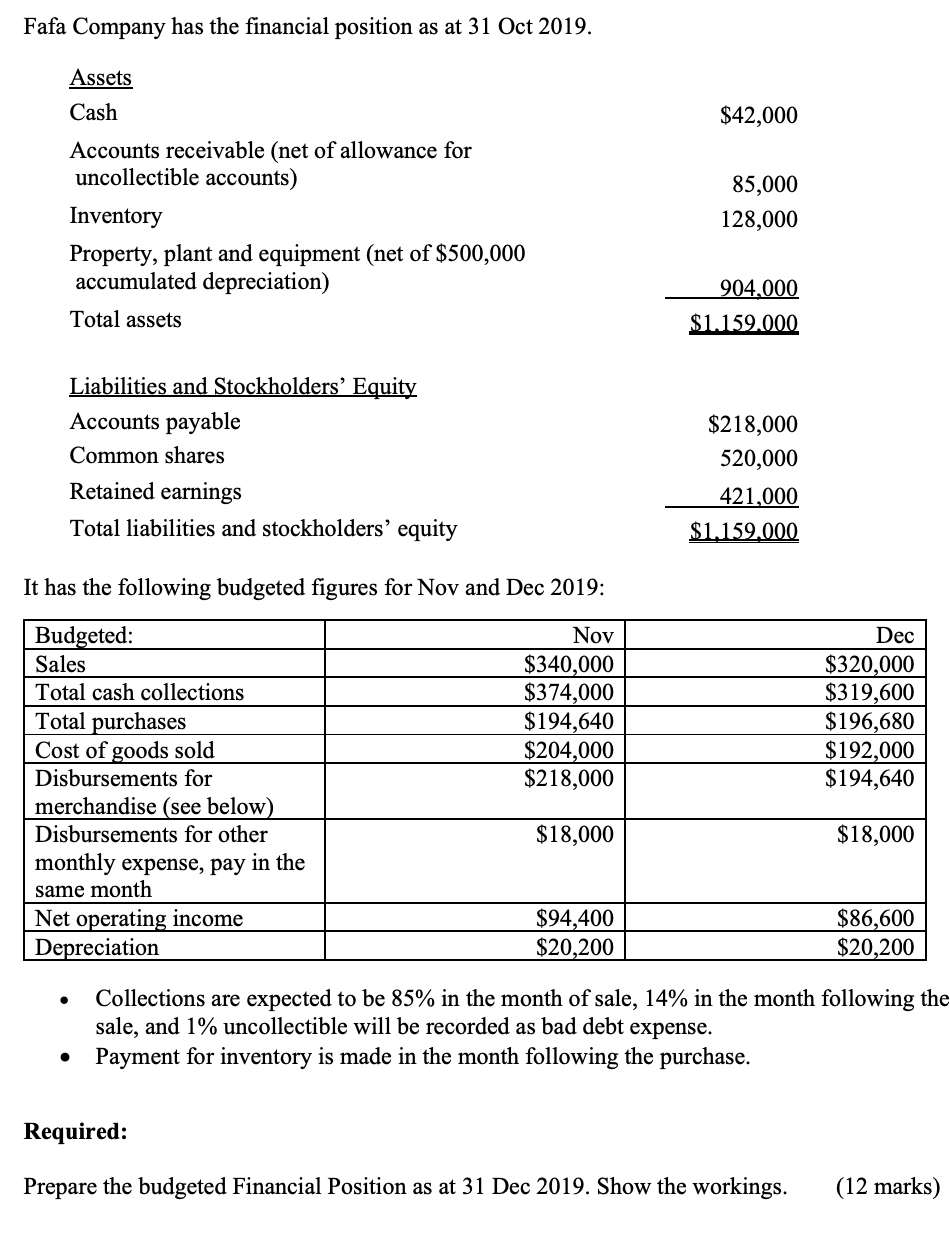

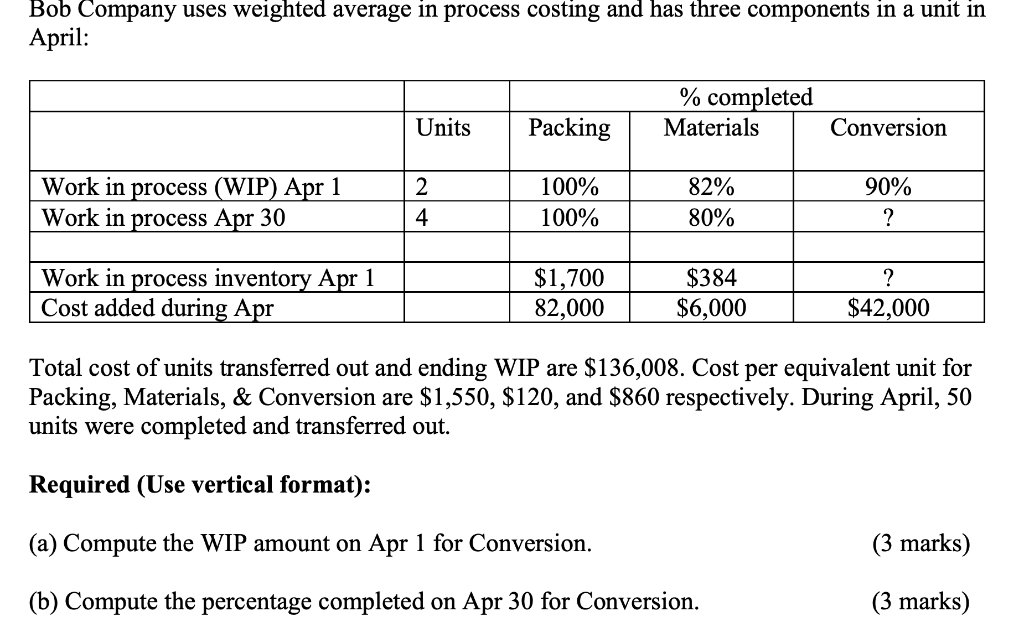

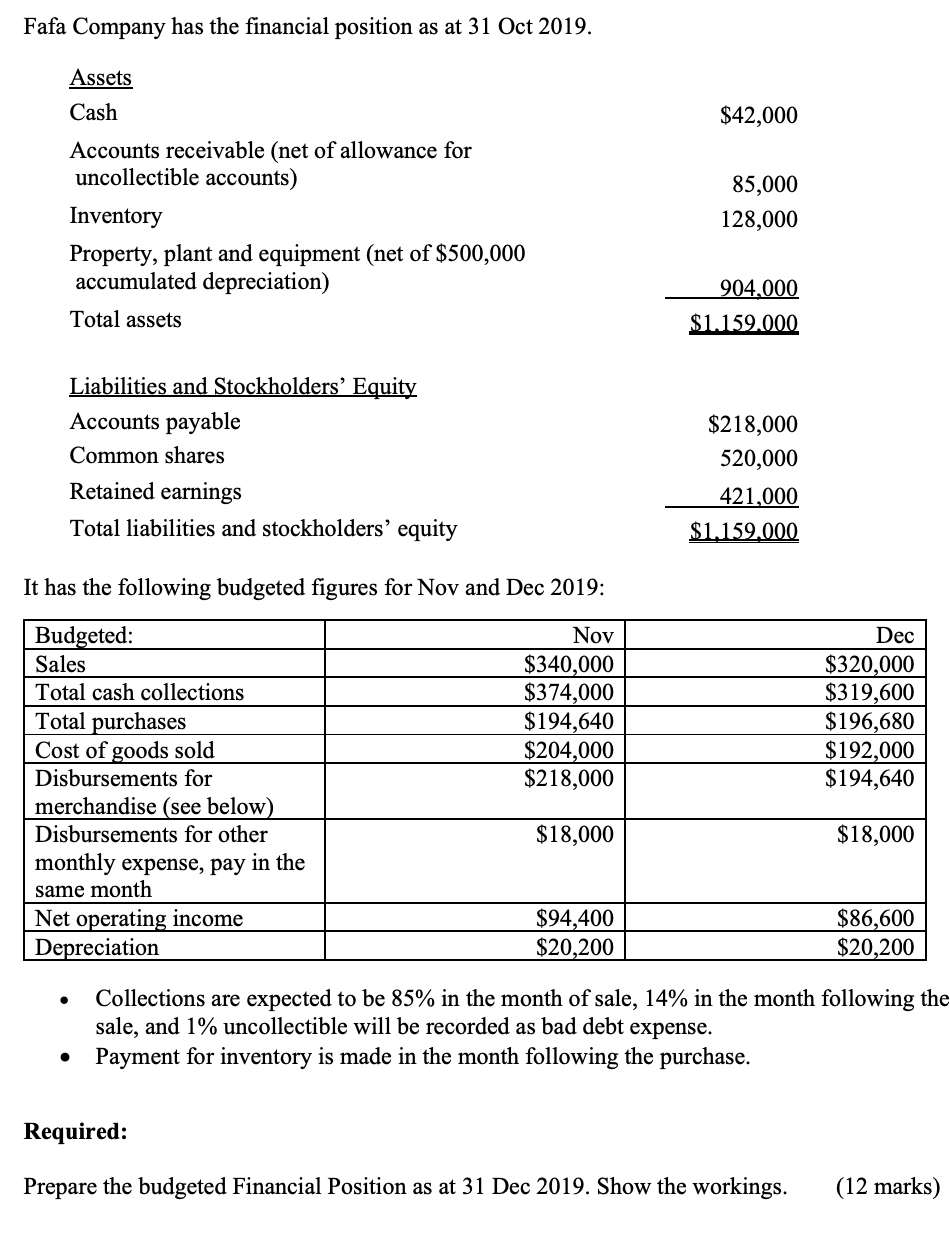

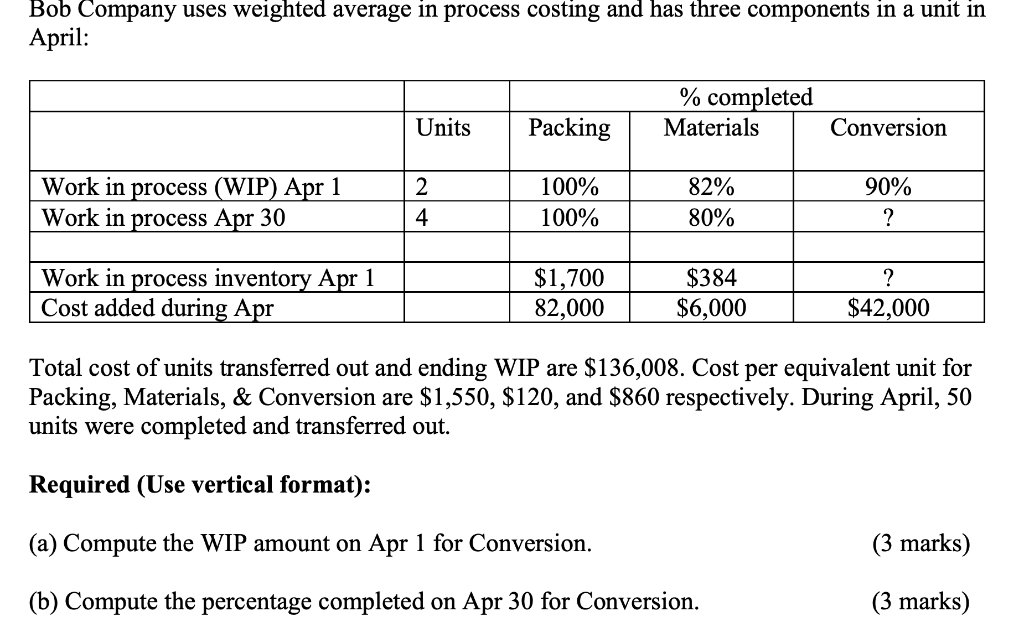

Fafa Company has the financial position as at 31 Oct 2019. $42,000 Assets Cash Accounts receivable (net of allowance for uncollectible accounts) Inventory Property, plant and equipment (net of $500,000 accumulated depreciation) Total assets 85,000 128,000 904,000 $1.159.000 Liabilities and Stockholders' Equity Accounts payable Common shares Retained earnings Total liabilities and stockholders' equity $218,000 520,000 421,000 $1.159.000 It has the following budgeted figures for Nov and Dec 2019: Budgeted: Sales Nov $340,000 $374,000 $194,640 $204,000 $218,000 Dec $320,000 $319,600 $196,680 $192,000 $194,640 Total cash collections Total purchases Cost of goods sold Disbursements for merchandise (see below) Disbursements for other monthly expense, pay in the same month Net operating income Depreciation $18,000 $18,000 $94,400 $20,200 $86,600 $20,200 Collections are expected to be 85% in the month of sale, 14% in the month following the sale, and 1% uncollectible will be recorded as bad debt expense. Payment for inventory is made in the month following the purchase. Required: Prepare the budgeted Financial Position as at 31 Dec 2019. Show the workings. (12 marks) Bob Company uses weighted average in process costing and has three components in a unit in April: % completed Materials Units Packing Conversion 2 Work in process (WIP) Apr 1 Work in process Apr 30 100% 100% 82% 80% 90% ? A Work in process inventory Apr 1 Cost added during Apr $1,700 82,000 $384 $6,000 $42,000 Total cost of units transferred out and ending WIP are $136,008. Cost per equivalent unit for Packing, Materials, & Conversion are $1,550, $120, and $860 respectively. During April, 50 units were completed and transferred out. Required (Use vertical format): (a) Compute the WIP amount on Apr 1 for Conversion. (3 marks) (b) Compute the percentage completed on Apr 30 for Conversion. (3 marks) Fafa Company has the financial position as at 31 Oct 2019. $42,000 Assets Cash Accounts receivable (net of allowance for uncollectible accounts) Inventory Property, plant and equipment (net of $500,000 accumulated depreciation) Total assets 85,000 128,000 904,000 $1.159.000 Liabilities and Stockholders' Equity Accounts payable Common shares Retained earnings Total liabilities and stockholders' equity $218,000 520,000 421,000 $1.159.000 It has the following budgeted figures for Nov and Dec 2019: Budgeted: Sales Nov $340,000 $374,000 $194,640 $204,000 $218,000 Dec $320,000 $319,600 $196,680 $192,000 $194,640 Total cash collections Total purchases Cost of goods sold Disbursements for merchandise (see below) Disbursements for other monthly expense, pay in the same month Net operating income Depreciation $18,000 $18,000 $94,400 $20,200 $86,600 $20,200 Collections are expected to be 85% in the month of sale, 14% in the month following the sale, and 1% uncollectible will be recorded as bad debt expense. Payment for inventory is made in the month following the purchase. Required: Prepare the budgeted Financial Position as at 31 Dec 2019. Show the workings. (12 marks) Bob Company uses weighted average in process costing and has three components in a unit in April: % completed Materials Units Packing Conversion 2 Work in process (WIP) Apr 1 Work in process Apr 30 100% 100% 82% 80% 90% ? A Work in process inventory Apr 1 Cost added during Apr $1,700 82,000 $384 $6,000 $42,000 Total cost of units transferred out and ending WIP are $136,008. Cost per equivalent unit for Packing, Materials, & Conversion are $1,550, $120, and $860 respectively. During April, 50 units were completed and transferred out. Required (Use vertical format): (a) Compute the WIP amount on Apr 1 for Conversion. (3 marks) (b) Compute the percentage completed on Apr 30 for Conversion