Answered step by step

Verified Expert Solution

Question

1 Approved Answer

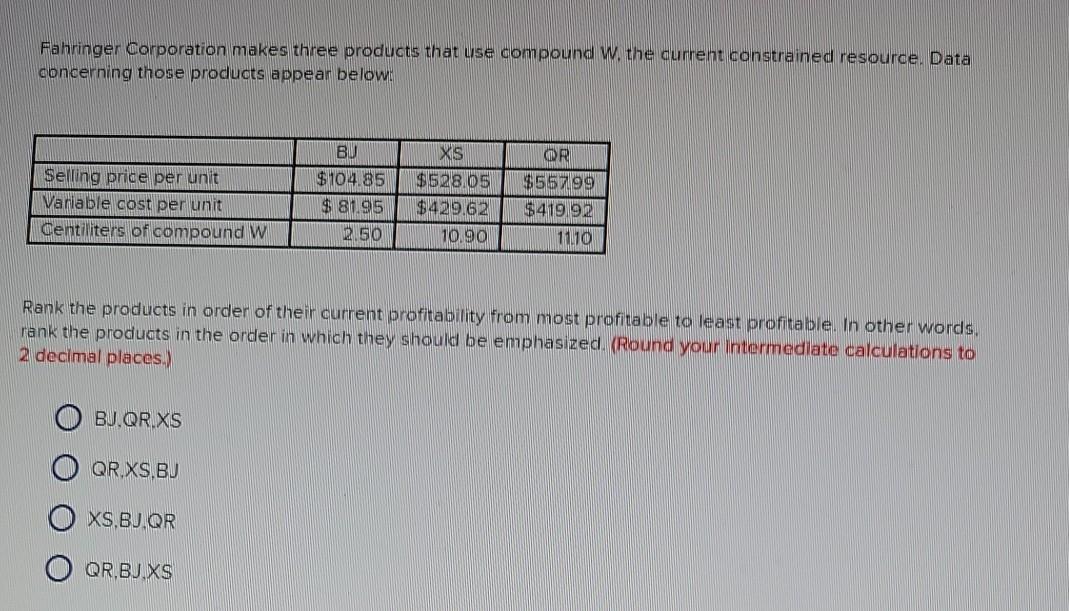

Fahringer Corporation makes three products that use compound W. the current constrained resource Data concerning those products appear below: OR Selling price per unit Variable

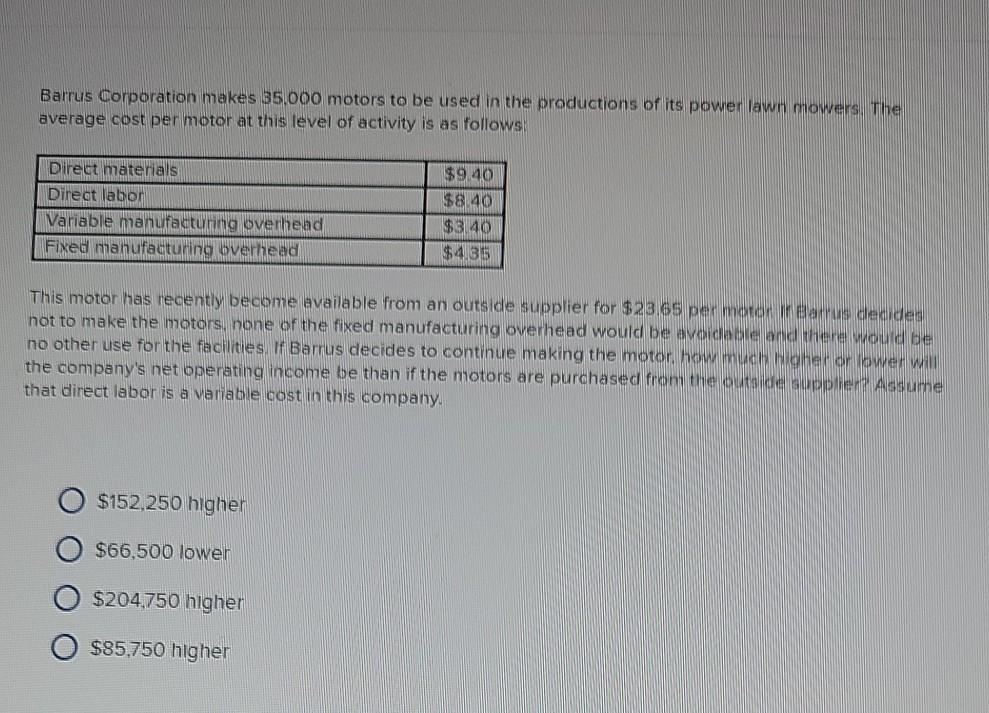

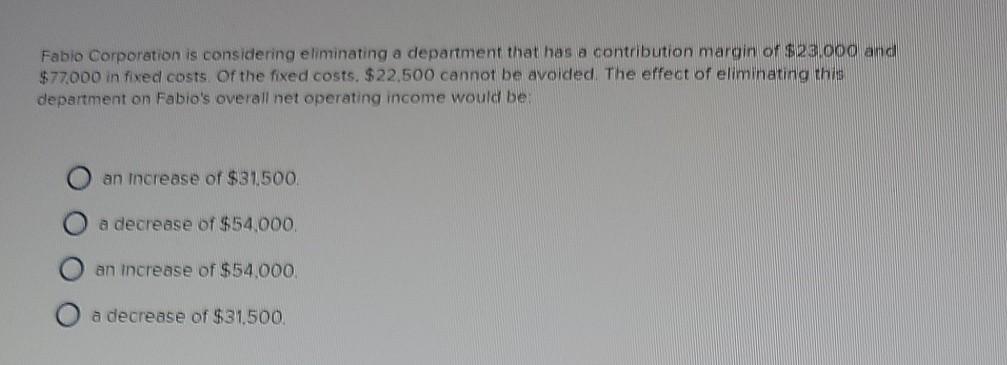

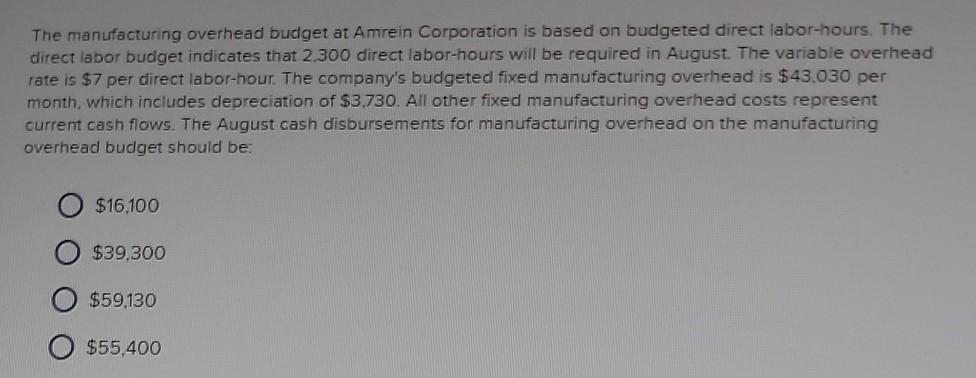

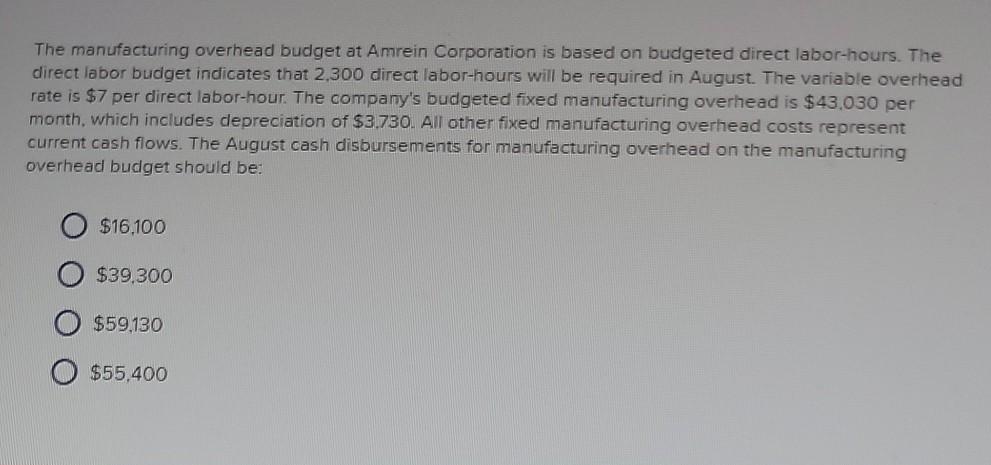

Fahringer Corporation makes three products that use compound W. the current constrained resource Data concerning those products appear below: OR Selling price per unit Variable cost per unit Centiliters of compound W BU $104.85 $8.95 XS $528.05 $429.62 10.90 $557199 $41992 11.10 2.50 Rank the products in order of their current profitability from most profitable to least profitable. In other words, rank the products in the order in which they should be emphasized. (Round your intermediate calculations to 2 decimal places.) BU.QR.XS QR.XS,BJ XS.B.QR QR.BU.XS Barrus Corporation makes 35.000 motors to be used in the productions of its power lawn mowers The average cost per motor at this level of activity is as follows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead $9.40 $8.40 $3140 $435 This motor has recently become available from an outside supplier for $23.65 per motor in Barrus decides not to make the motors none of the fixed manufacturing overhead would be avoidable and there would be no other use for the facilities y Barrus decides to continue making the motor how much bigher or lower will the company's net operating income be than if the motors are purchased from the outside supplier? Assume that direct labor is a variable cost in this company. $152,250 higher $66,500 lower $204,750 higher $85,750 higher Fabio Corporation is considering eliminating a department that has a contribution margin of $23.000 and $77.000 in fixed costs of the fixed costs. $22.500 cannot be avoided. The effect of eliminating the department on Fabio's overall net operating income would be: an increase of $31.500 a decrease of $54.000 an increase of $54.000 a decrease of $31.500 The manufacturing overhead budget at Amrein Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 2.300 direct labor-hours will be required in August. The variable overhead rate is $7 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $43.030 per month, which includes depreciation of $3.730. All other fixed manufacturing overhead costs represent current cash flows. The August cash disbursements for manufacturing overhead on the manufacturing overhead budget should be: $16.100 $39.300 $59,130 $55,400 The manufacturing overhead budget at Amrein Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 2,300 direct labor-hours will be required in August. The variable overhead rate is $7 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $43.030 per month, which includes depreciation of $3.730. All other fixed manufacturing overhead costs represent current cash flows. The August cash disbursements for manufacturing overhead on the manufacturing overhead budget should be: $16.100 $39,300 $59,130 $55,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started