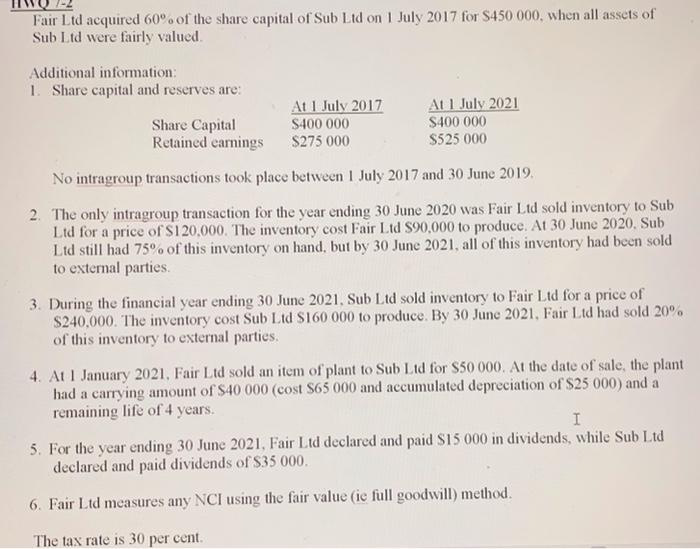

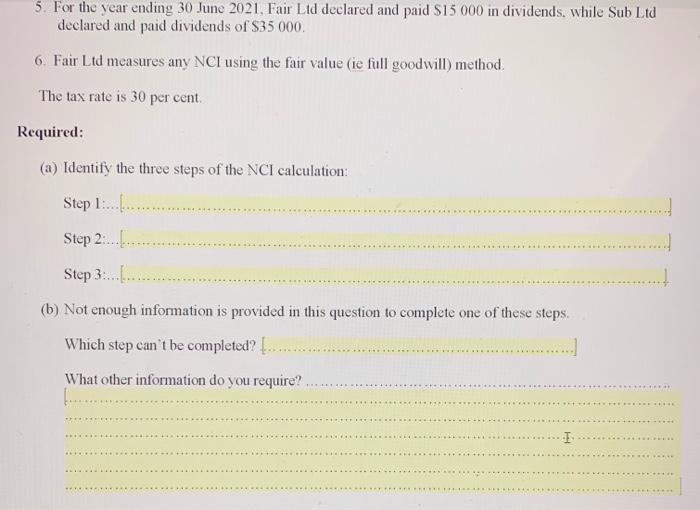

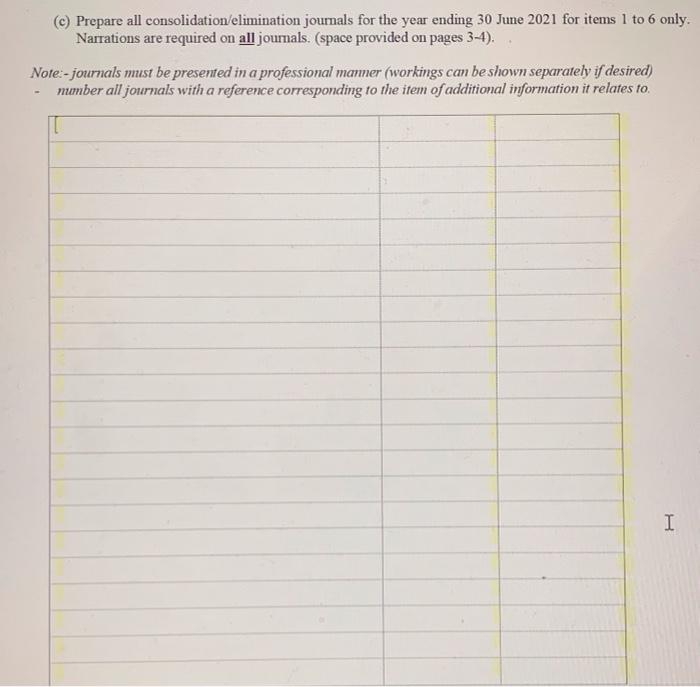

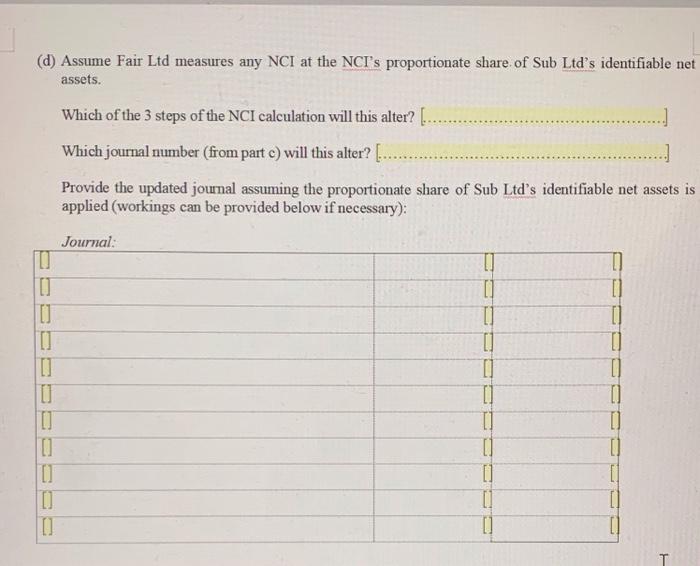

Fair Ltd acquired 60% of the share capital of Sub Lid on 1 July 2017 for $450 000, when all assets of Sub Ltd were fairly valued Additional information: 1 Share capital and reserves are: At 1 July 2017 At 1 July 2021 Share Capital S400 000 $400 000 Retained earnings $275 000 $525 000 No intragroup transactions took place between 1 July 2017 and 30 June 2019. 2. The only intragroup transaction for the year ending 30 June 2020 was Fair Lid sold inventory to Sub Lid for a price of $120,000. The inventory cost Fair Ltd S90,000 to produce. At 30 June 2020. Sub Ltd still had 75% of this inventory on hand, but by 30 June 2021, all of this inventory had been sold to external parties. 3. During the financial year ending 30 June 2021. Sub Lid sold inventory to Fair Ltd for a price of $240,000. The inventory cost Sub Ltd S160 000 to produce. By 30 June 2021. Fair Ltd had sold 20% of this inventory to external parties. 4. At January 2021. Fair Ltd sold an item of plant to Sub Lid for $50 000. At the date of sale, the plant had a carrying amount of $40 000 (cost S65 000 and accumulated depreciation of $25 000) and a remaining life of 4 years. I 5. For the year ending 30 June 2021, Fair Ltd declared and paid S15 000 in dividends, while Sub Ltd declared and paid dividends of S35 000. 6. Fair Ltd measures any NCI using the fair value (ie full goodwill) method. The tax rate is 30 per cent. 5. For the year ending 30 June 2021, Fair Ltd declared and paid $15 000 in dividends. while Sub Ltd declared and paid dividends of $35 000. 6. Fair Ltd measures any NCI using the fair value (ie full goodwill) method The tax rate is 30 per cent. Required: (a) Identify the three steps of the NCI calculation: Step 1: ............. Step 2............. Step 3........ .... (b) Not enough information is provided in this question to complete one of these steps. Which step can't be completed? [... What other information do you require? for... I (c) Prepare all consolidation elimination journals for the year ending 30 June 2021 for items 1 to 6 only. Narrations are required on all journals. (space provided on pages 3-4). Note-journals must be presented in a professional manner (workings can be shown separately if desired) number all journals with a reference corresponding to the item of additional information it relates to. I (d) Assume Fair Ltd measures any NCI at the NCI's proportionate share of Sub Ltd's identifiable net assets. Which of the 3 steps of the NCI calculation will this alter? [..... .. Which journal number (from part e) will this alter? [.............. Provide the updated journal assuming the proportionate share of Sub Ltd's identifiable net assets is applied (workings can be provided below if necessary): Journal: TI TO [] [] [] [] [] [ [] [] [] LI [] I [ ] [] [] D [ T Fair Ltd acquired 60% of the share capital of Sub Lid on 1 July 2017 for $450 000, when all assets of Sub Ltd were fairly valued Additional information: 1 Share capital and reserves are: At 1 July 2017 At 1 July 2021 Share Capital S400 000 $400 000 Retained earnings $275 000 $525 000 No intragroup transactions took place between 1 July 2017 and 30 June 2019. 2. The only intragroup transaction for the year ending 30 June 2020 was Fair Lid sold inventory to Sub Lid for a price of $120,000. The inventory cost Fair Ltd S90,000 to produce. At 30 June 2020. Sub Ltd still had 75% of this inventory on hand, but by 30 June 2021, all of this inventory had been sold to external parties. 3. During the financial year ending 30 June 2021. Sub Lid sold inventory to Fair Ltd for a price of $240,000. The inventory cost Sub Ltd S160 000 to produce. By 30 June 2021. Fair Ltd had sold 20% of this inventory to external parties. 4. At January 2021. Fair Ltd sold an item of plant to Sub Lid for $50 000. At the date of sale, the plant had a carrying amount of $40 000 (cost S65 000 and accumulated depreciation of $25 000) and a remaining life of 4 years. I 5. For the year ending 30 June 2021, Fair Ltd declared and paid S15 000 in dividends, while Sub Ltd declared and paid dividends of S35 000. 6. Fair Ltd measures any NCI using the fair value (ie full goodwill) method. The tax rate is 30 per cent. 5. For the year ending 30 June 2021, Fair Ltd declared and paid $15 000 in dividends. while Sub Ltd declared and paid dividends of $35 000. 6. Fair Ltd measures any NCI using the fair value (ie full goodwill) method The tax rate is 30 per cent. Required: (a) Identify the three steps of the NCI calculation: Step 1: ............. Step 2............. Step 3........ .... (b) Not enough information is provided in this question to complete one of these steps. Which step can't be completed? [... What other information do you require? for... I (c) Prepare all consolidation elimination journals for the year ending 30 June 2021 for items 1 to 6 only. Narrations are required on all journals. (space provided on pages 3-4). Note-journals must be presented in a professional manner (workings can be shown separately if desired) number all journals with a reference corresponding to the item of additional information it relates to. I (d) Assume Fair Ltd measures any NCI at the NCI's proportionate share of Sub Ltd's identifiable net assets. Which of the 3 steps of the NCI calculation will this alter? [..... .. Which journal number (from part e) will this alter? [.............. Provide the updated journal assuming the proportionate share of Sub Ltd's identifiable net assets is applied (workings can be provided below if necessary): Journal: TI TO [] [] [] [] [] [ [] [] [] LI [] I [ ] [] [] D [ T