Question

fair value of $157,000 . This is in full settlement of the loan obligation. Assuming that Waterway Bank treats Pharoah's shares as FV-Nl investments, prepare

fair value of

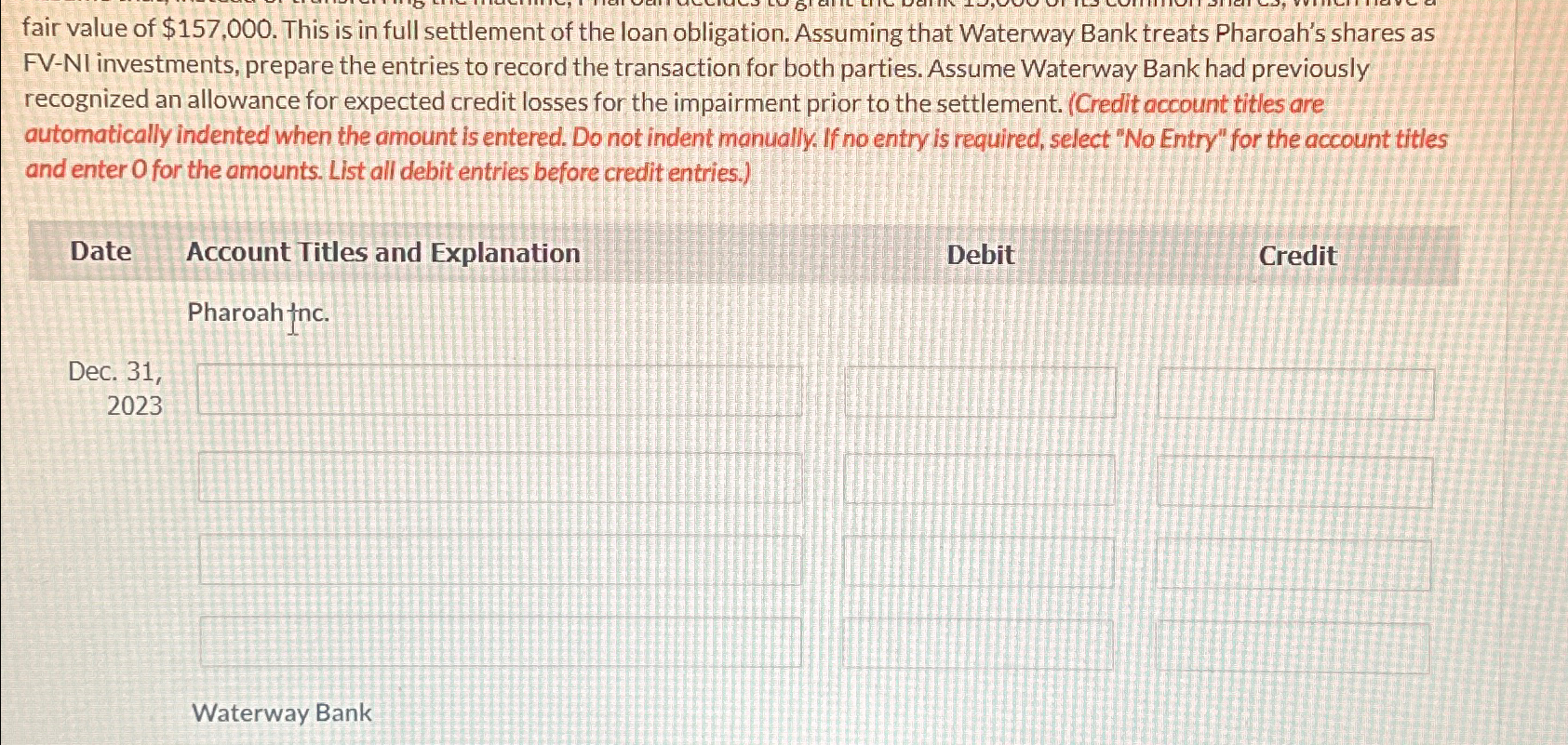

$157,000. This is in full settlement of the loan obligation. Assuming that Waterway Bank treats Pharoah's shares as FV-Nl investments, prepare the entries to record the transaction for both parties. Assume Waterway Bank had previously recognized an allowance for expected credit losses for the impairment prior to the settlement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)\ Date Account Titles and Explanation\ Debit\ Credit\ Pharoahtnc.\ Dec. 31,\ 2023\ Waterway Bank

fair value of $157,000. This is in full settlement of the loan obligation. Assuming that Waterway Bank treats Pharoah's shares as FV-NI investments, prepare the entries to record the transaction for both parties. Assume Waterway Bank had previously recognized an allowance for expected credit losses for the impairment prior to the settlement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Dec. 31, 2023 Account Titles and Explanation Pharoah tnc. Debit Credit Waterway Bank

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started