Answered step by step

Verified Expert Solution

Question

1 Approved Answer

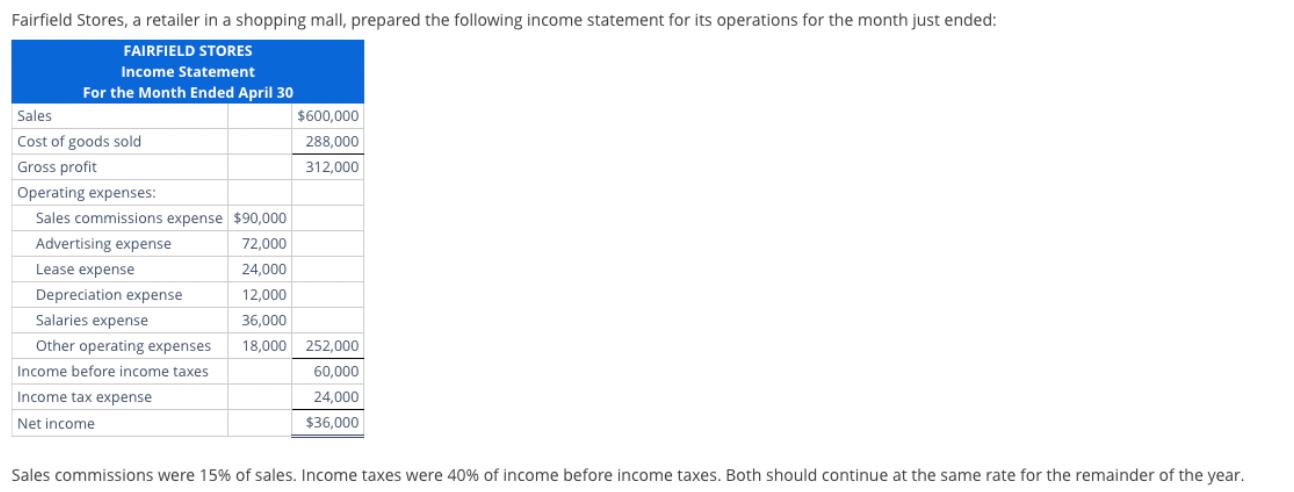

Fairfield Stores, a retailer in a shopping mall, prepared the following income statement for its operations for the month just ended: FAIRFIELD STORES Income

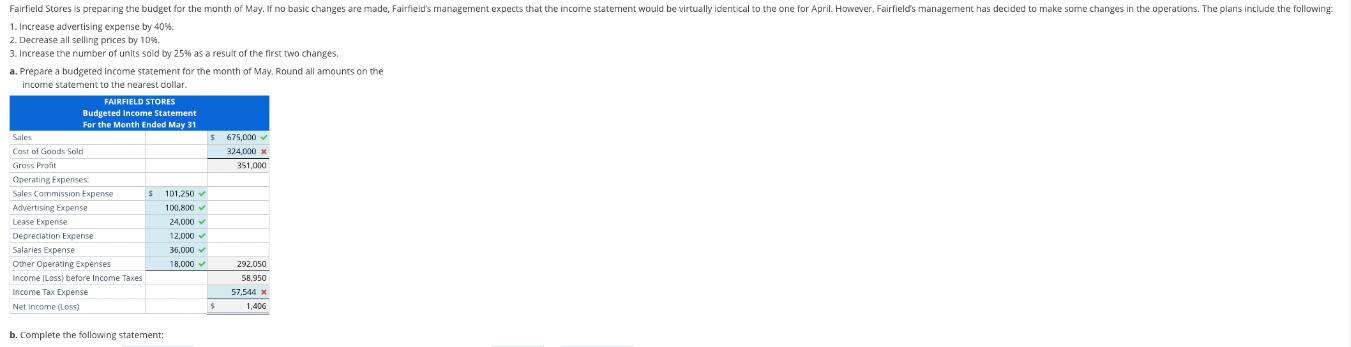

Fairfield Stores, a retailer in a shopping mall, prepared the following income statement for its operations for the month just ended: FAIRFIELD STORES Income Statement For the Month Ended April 30 Sales $600,000 Cost of goods sold 288,000 Gross profit 312,000 Operating expenses: Sales commissions expense $90,000 Advertising expense 72,000 Lease expense 24,000 Depreciation expense 12,000 Salaries expense 36,000 Other operating expenses 18,000 252,000 60,000 Income before income taxes Income tax expense Net income 24,000 $36,000 Sales commissions were 15% of sales. Income taxes were 40% of income before income taxes. Both should continue at the same rate for the remainder of the year. Fairfield Stores is preparing the budget for the month of May. If no basic changes are made, Fairfield's management expects that the income statement would be virtually identical to the one for April. However, Fairfield's management has decided to make some changes in the operations. The plans include the following: 1. Increase advertising expense by 40%, 2. Decrease all selling prices by 10%. 3. Increase the number of units sold by 25% as a result of the first two changes. a. Prepare a budgeted income statement for the month of May, Round all amounts on the income statement to the nearest dollar. Sales Cost of Goods Sold FAIRFIELD STORES Budgeted Income Statement For the Month Ended May 31 $675,000 324,000 x Gross Profit 351,000 Operating Expenses Sales Commission Expense $ Advertising Expense Lease Expense 101,250 100,800 24,000 Depreciation Expense 12,000 Salaries Expense 36,000 Other Operating Expenses 18,000 292,050 Income (Loss) before Income Taxes 58,950 Income Tax Expense Net Income (Loss) b. Complete the following statement: 57,544 x 1,406

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started