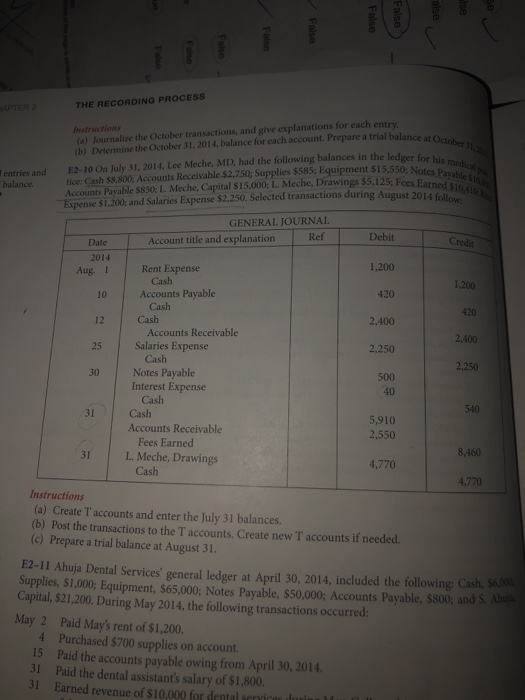

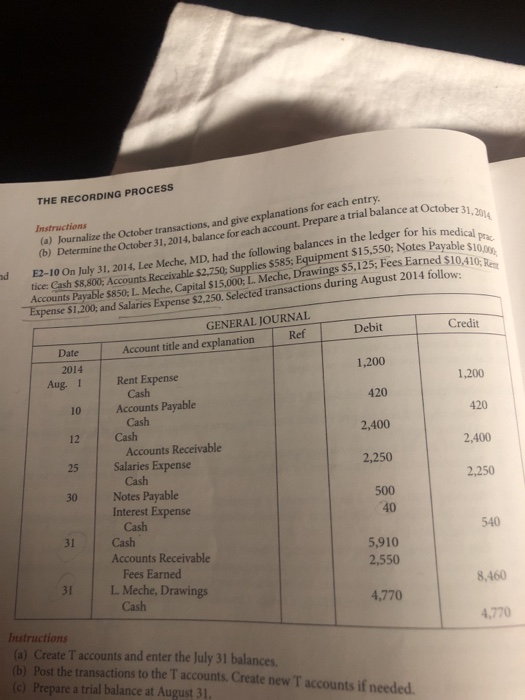

False False alse se False HAPTER 2 THE RECORDING PROCESS ce at October 31 (a) Journaline the October transactions, and give explanations for each entry. b) Determine the October 31, 2014, balance for each account. Prepare a trial balance E2-10 On July 31, 2014. Lee Meche, MD, had the following balances in the ledger tice Cash $8,800; Accounts Receivable $2,750; Supplies $585; Equipment $15.550: Note Accounts Payable $850; L. Meche, Capital $15,000; L. Meche, Drawings $5,125: Fees Bar Expense S1.200; and Salaries Expense $2.250. Selected transactions during August 2014 balance. Notes Payables Farned 510 A 2014 follow: GENERAL JOURNAL Account title and explanation Ref Debit Credit Date 2014 Aug. 1 1,200 1.200 420 420 2,400 2,400 2,250 Rent Expense Cash Accounts Payable Cash Cash Accounts Receivable Salaries Expense Cash Notes Payable Interest Expense Cash Cash Accounts Receivable Fees Earned L. Meche, Drawings Cash 2,250 500 40 540 5,910 2,550 31 8,460 4,770 4,770 Instructions (a) Create T accounts and enter the July 31 balances. (b) Post the transactions to the T accounts. Create new Taccounts if needed. (c) Prepare a trial balance at August 31. E2-11 Ahuja Dental Services' general ledger at April 30, 2014, included the following: Cash. So Supplies, $1,000; Equipment, $65,000; Notes Payable, $50,000; Accounts Payable, $800; and . Capital, $21,200. During May 2014, the following transactions occurred: May 2 Paid May's rent of $1,200. 4 Purchased $700 supplies on account. 15 Paid the accounts payable owing from April 30, 2014 31 Paid the dental assistant's salary of $1,800. 31 Earned revenue of $10.000 for dental services during THE RECORDING PROCESS dober 31,2014 medical prac Instructions (a) Journalize the October transactions, and give explanations for each entry. (b) Determine the October 31, 2014. balance for each account. Prepare a tha balance at October MD, had the follo 5585: Equipmees5,125; Fees Earne isable $2,750; SuppMeche, Drawingsring August 201 Payable $10.00 ned $10,410; E2-10 On July 31, 2014. Lee Meche, MD had the following balances in the ledger for his media tice Cash $8.800 Accounts Receivable $2.750: Supplies $585: Equipment $15,550; Notes Payable Accounts Payable $850; L Meche, Capital $15,000; L. Meche, Drawings $5,125; Fees Earned $10 4 Expense $1.200; and Salaries Expense $2.250, Selected transactions during August 2014 follow: Credit Debit GENERAL JOURNAL Account title and explanation Ref 1,200 Date 2014 Aug. 1 1,200 420 420 2,400 2,400 2,250 2,250 Rent Expense Cash Accounts Payable Cash Cash Accounts Receivable Salaries Expense Cash Notes Payable Interest Expense Cash Cash Accounts Receivable Fees Earned L. Meche, Drawings Cash 500 40 540 5,910 2,550 8,460 4,770 4,770 Instructions (a) Create T accounts and enter the July 31 balances. (b) Post the transactions to the accounts. Create new T accounts if needed (c) Prepare a trial balance at August 31