Answered step by step

Verified Expert Solution

Question

1 Approved Answer

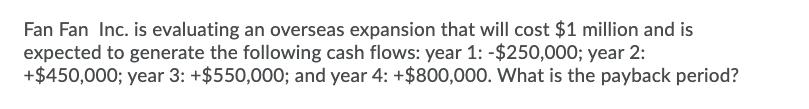

Fan Fan Inc. is evaluating an overseas expansion that will cost $1 million and is expected to generate the following cash flows: year 1:

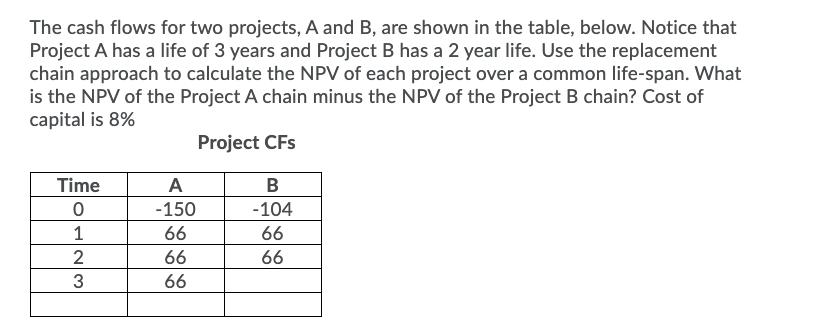

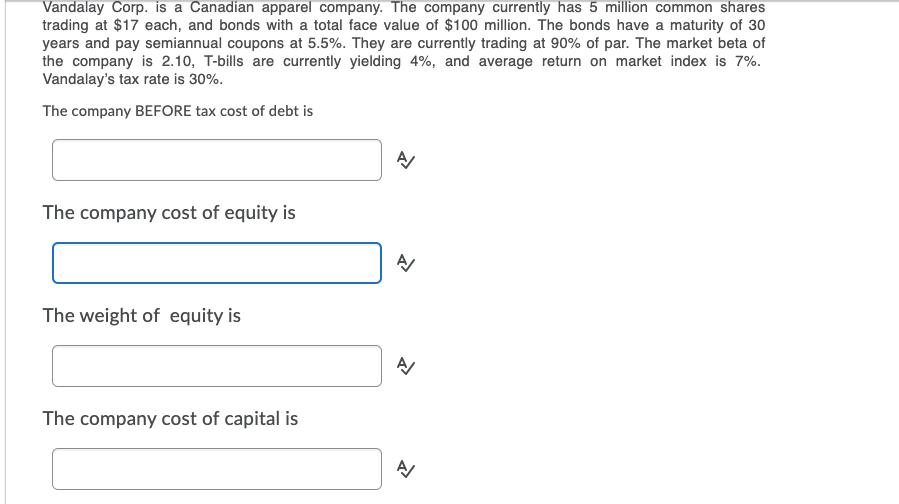

Fan Fan Inc. is evaluating an overseas expansion that will cost $1 million and is expected to generate the following cash flows: year 1: -$250,000; year 2: +$450,000; year 3: +$550,000; and year 4: +$800,000. What is the payback period? The cash flows for two projects, A and B, are shown in the table, below. Notice that Project A has a life of 3 years and Project B has a 2 year life. Use the replacement chain approach to calculate the NPV of each project over a common life-span. What is the NPV of the Project A chain minus the NPV of the Project B chain? Cost of capital is 8% Project CFs Time A B 0 -150 -104 1 66 66 2 66 66 3 66 Vandalay Corp. is a Canadian apparel company. The company currently has 5 million common shares trading at $17 each, and bonds with a total face value of $100 million. The bonds have a maturity of 30 years and pay semiannual coupons at 5.5%. They are currently trading at 90% of par. The market beta of the company is 2.10, T-bills are currently yielding 4%, and average return on market index is 7%. Vandalay's tax rate is 30%. The company BEFORE tax cost of debt is The company cost of equity is The weight of equity is The company cost of capital is A/ A A/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the payback period for the overseas expansion by Fan Fan Inc we need to determine the point in time when the cumulative cash inflows equa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started