Answered step by step

Verified Expert Solution

Question

1 Approved Answer

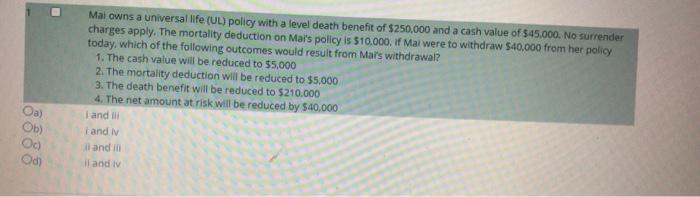

?? Oa) Ob) Oc) Odj Mai owns a universal life (UL) policy with a level death benefit of $250,000 and a cash value of $45,000.

??

??

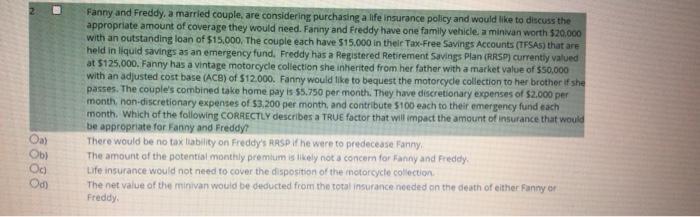

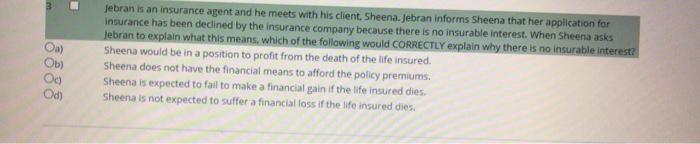

Oa) Ob) Oc) Odj Mai owns a universal life (UL) policy with a level death benefit of $250,000 and a cash value of $45,000. No surrender charges apply. The mortality deduction on Mai's policy is $10.000. if Mai were to withdraw $40,000 from her policy today, which of the following outcomes would result from Mars withdrawal? 1. The cash value will be reduced to $5,000 2. The mortality deduction will be reduced to $5,000 3. The death benefit will be reduced to $210.000 4. The net amount at risk will be reduced by $40,000 I and li and iv il and ill il and iv Oa) Obl Og Od Fanny and Freddy, a married couple, are considering purchasing a life insurance policy and would like to discuss the appropriate amount of coverage they would need. Fanny and Freddy have one family vehicle, a minivan worth $20.000 with an outstanding loan of $15,000. The couple each have $15.000 in their Tax-Free Savings Accounts (TFSAS) that are held in liquid savings as an emergency fund. Freddy has a Registered Retirement Savings Plan (RRSP) currently valued at $125,000. Fanny has a vintage motorcycle collection she inherited from her father with a market value of $50,000 with an adjusted cost base (ACB) of $12.000. Fanny would like to bequest the motorcycle collection to her brother if she passes. The couple's combined take home pay is $5.750 per month. They have discretionary expenses of $2.000 per month, non-discretionary expenses of $3,200 per month, and contribute $100 each to their emergency fund each month. Which of the following CORRECTLY describes a TRUE factor that will impact the amount of insurance that would be appropriate for Fanny and Freddy? There would be no tax liability on Freddy's RRSP if he were to predecease Fanny. The amount of the potential monthly premium is likely not a concern for Fanny and Freddy. Life insurance would not need to cover the disposition of the motorcycle collection. The net value of the minivan would be deducted from the total insurance needed on the death of either Fanny or Freddy. 18888 Oa) Ob) B Jebran is an insurance agent and he meets with his client. Sheena. Jebran informs Sheena that her application for insurance has been declined by the insurance company because there is no insurable interest. When Sheena asks jebran to explain what this means, which of the following would CORRECTLY explain why there is no insurable interest? Sheena would be in a position to profit from the death of the life insured. Sheena does not have the financial means to afford the policy premiums. Sheena is expected to fail to make a financial gain if the life insured dies. Sheena is not expected to suffer a financial loss if the life insured dies.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 a i and iii i The cash value of the policy will reduce by 40000 due to withdrawal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started