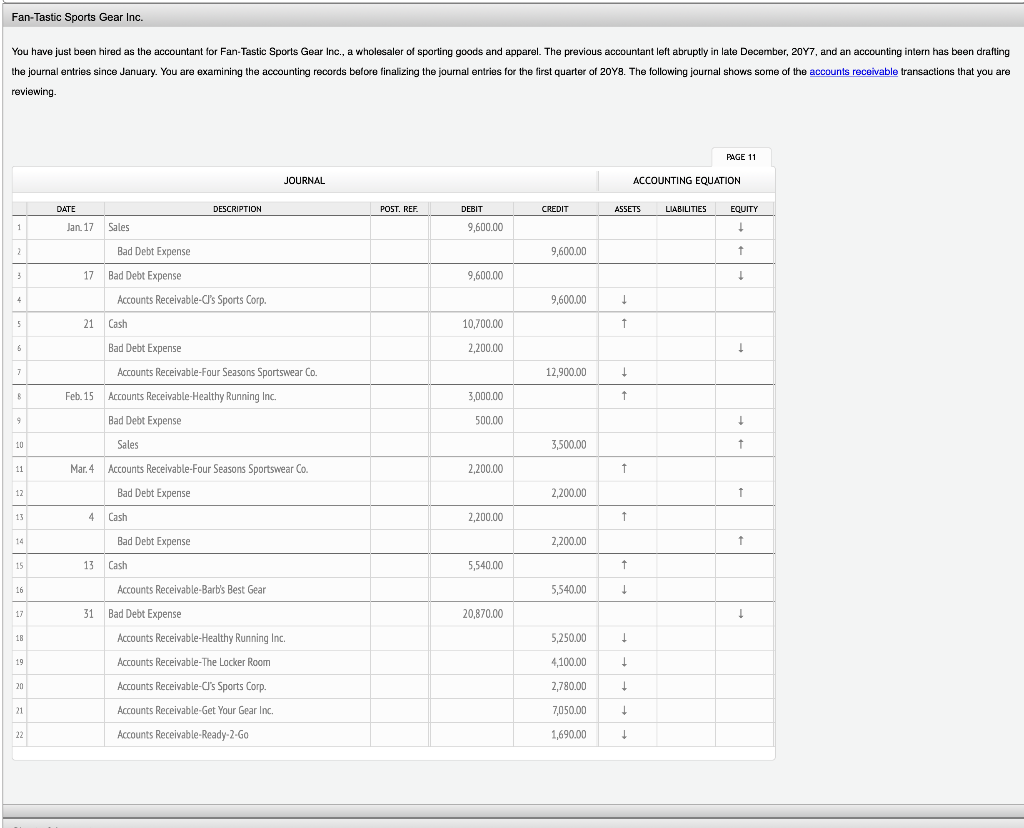

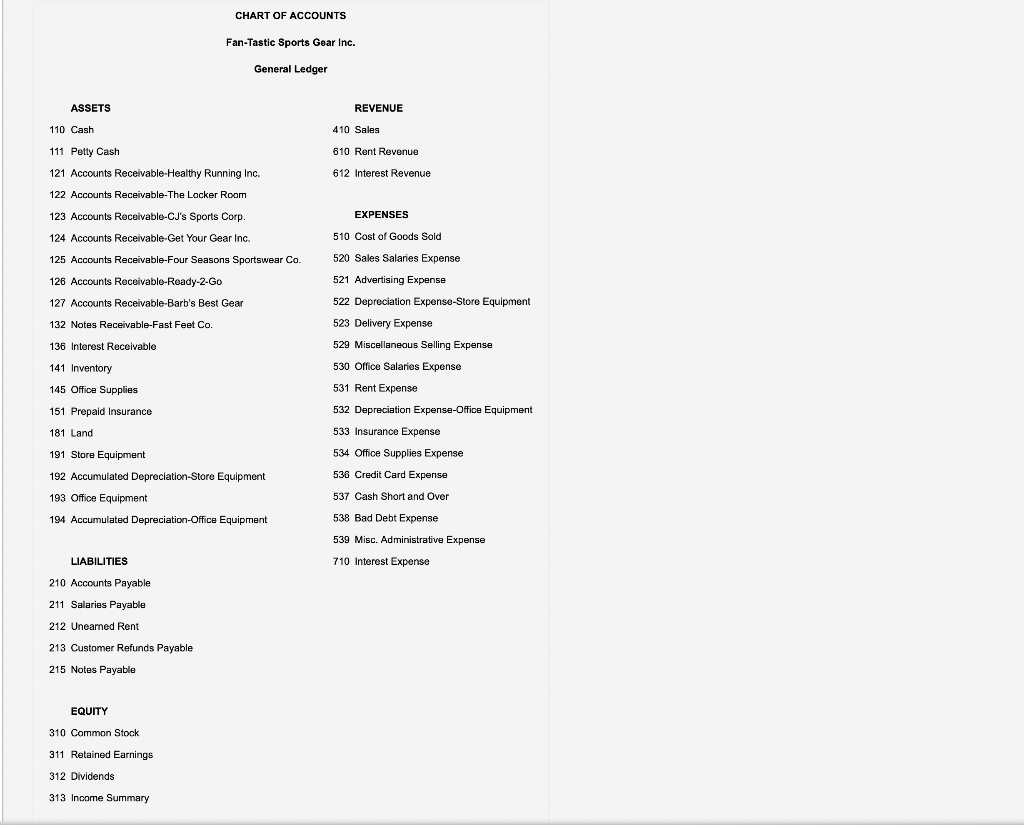

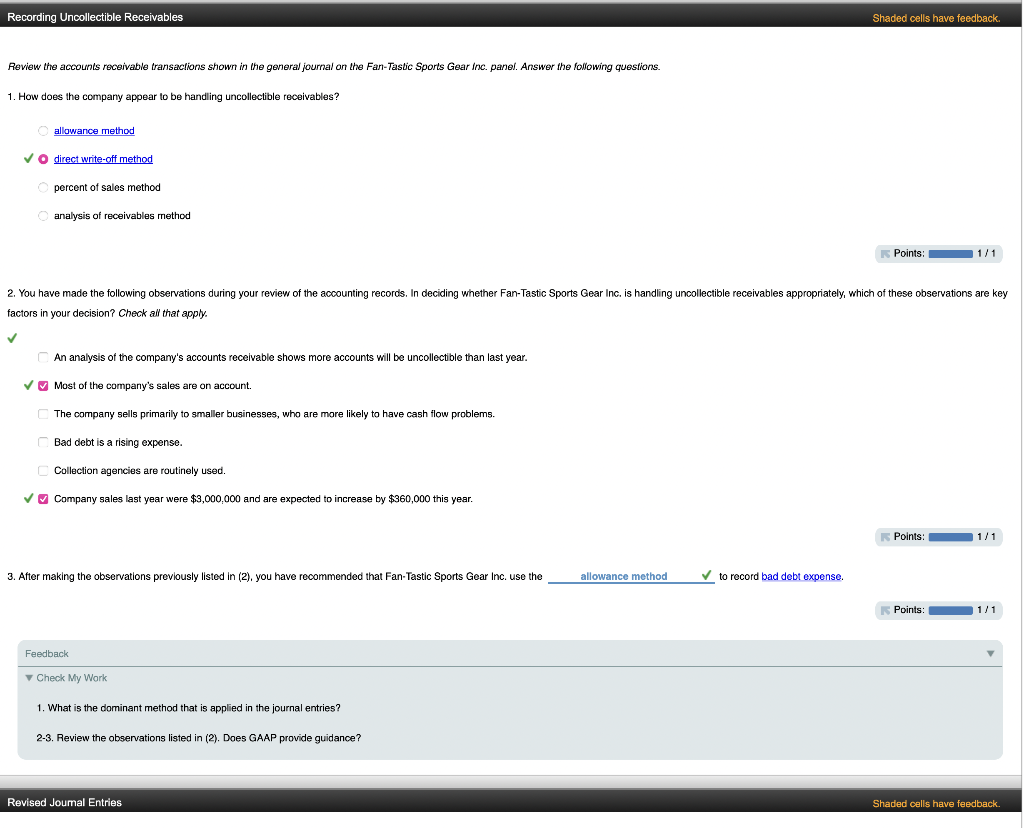

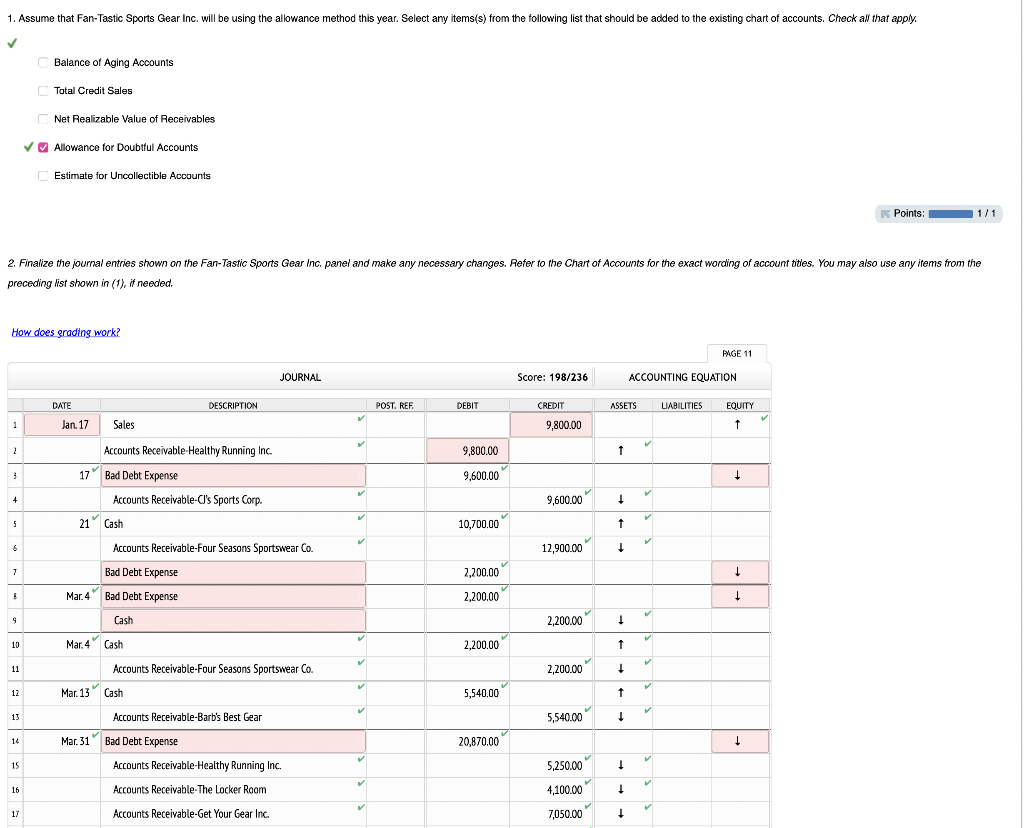

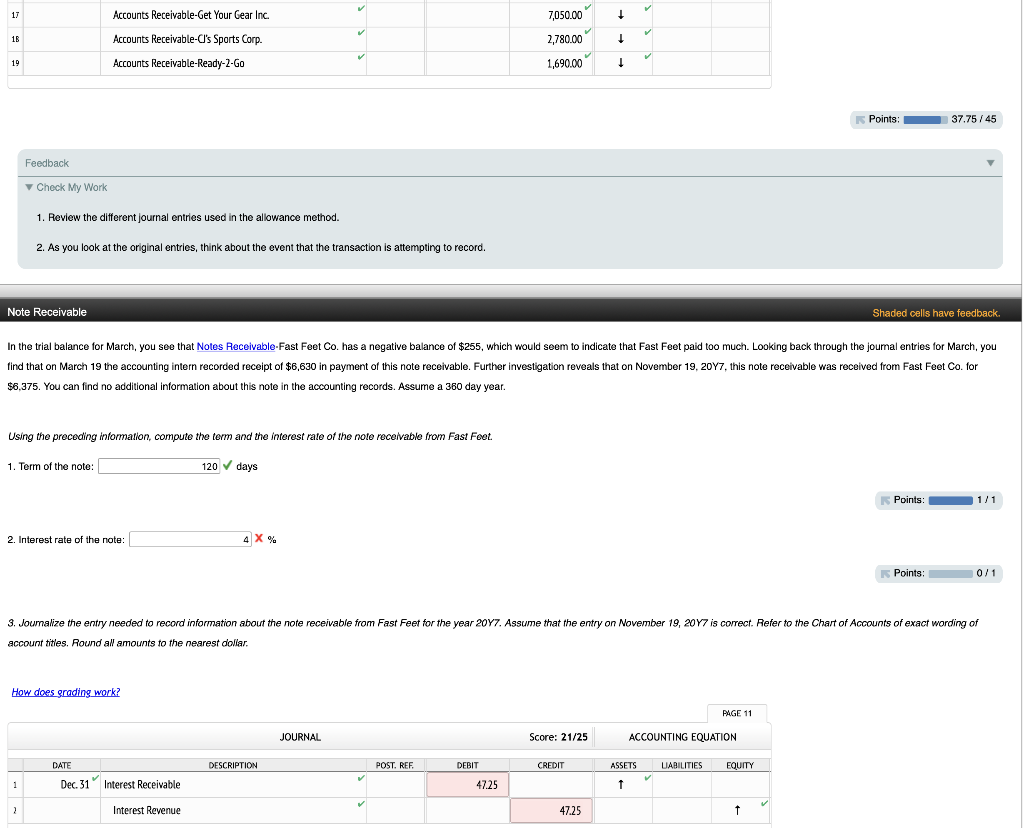

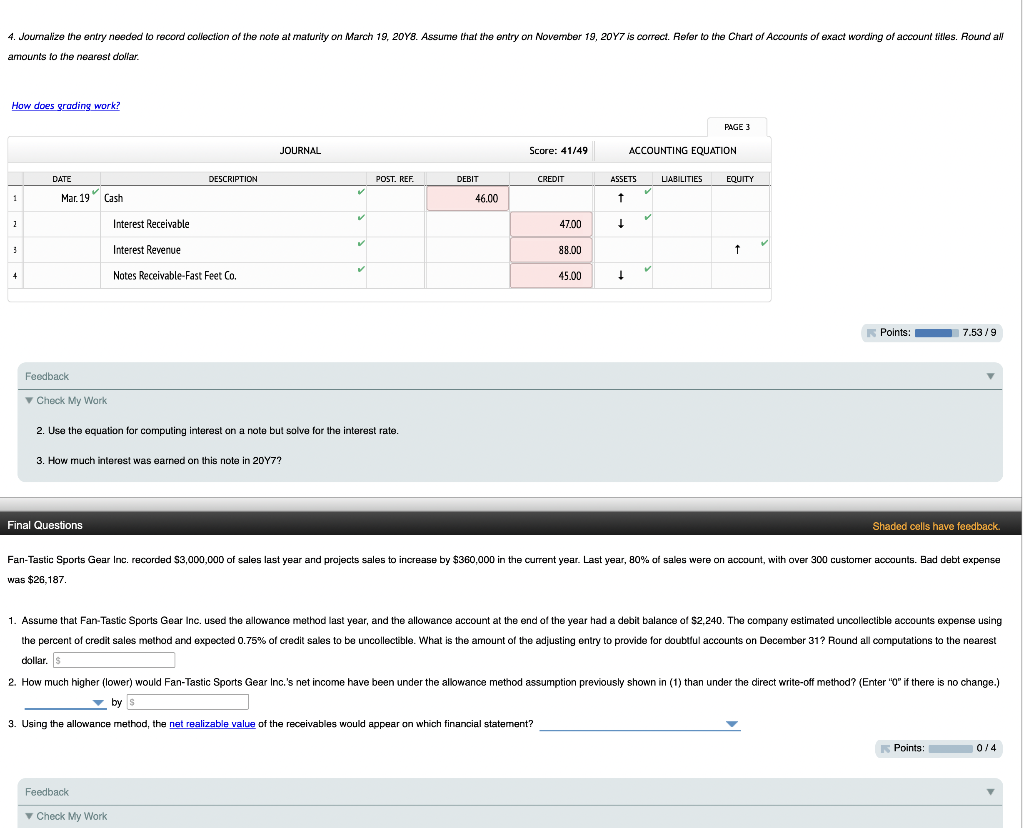

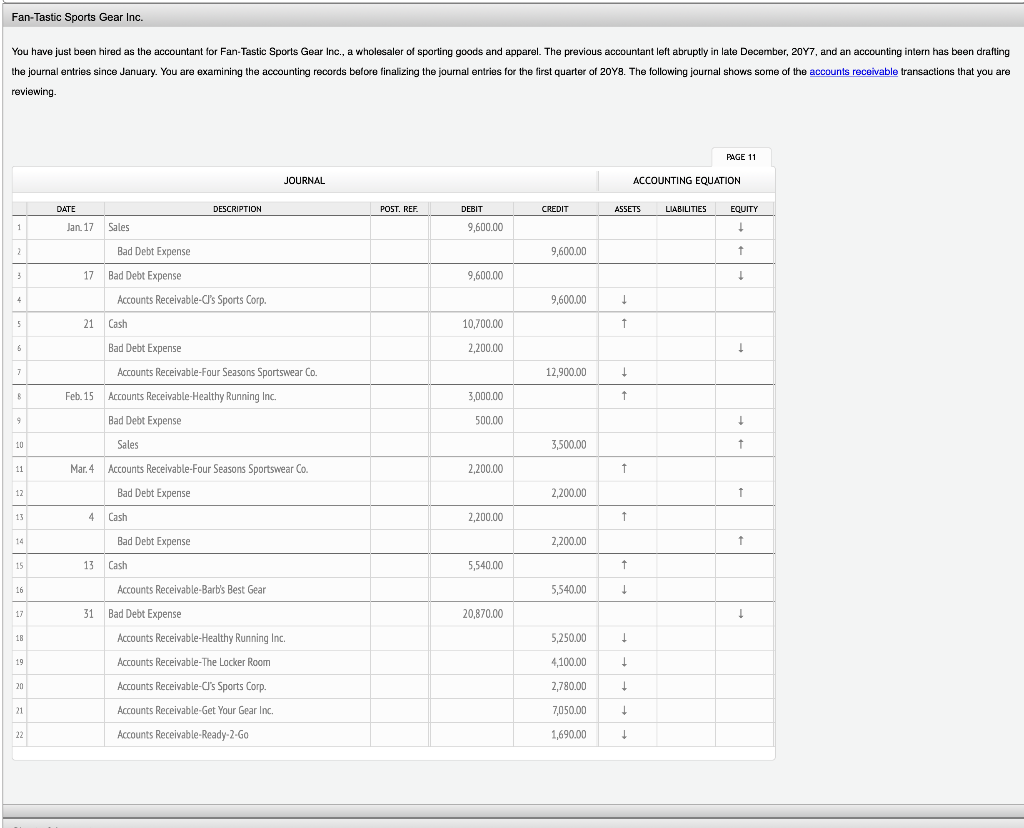

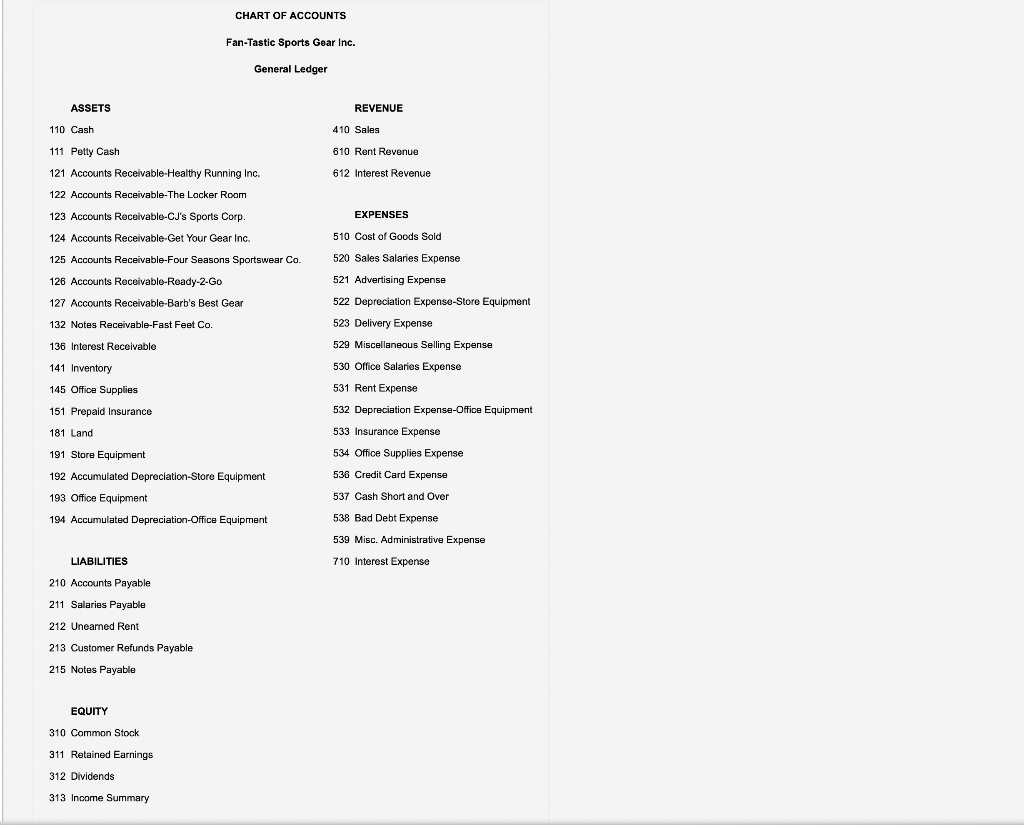

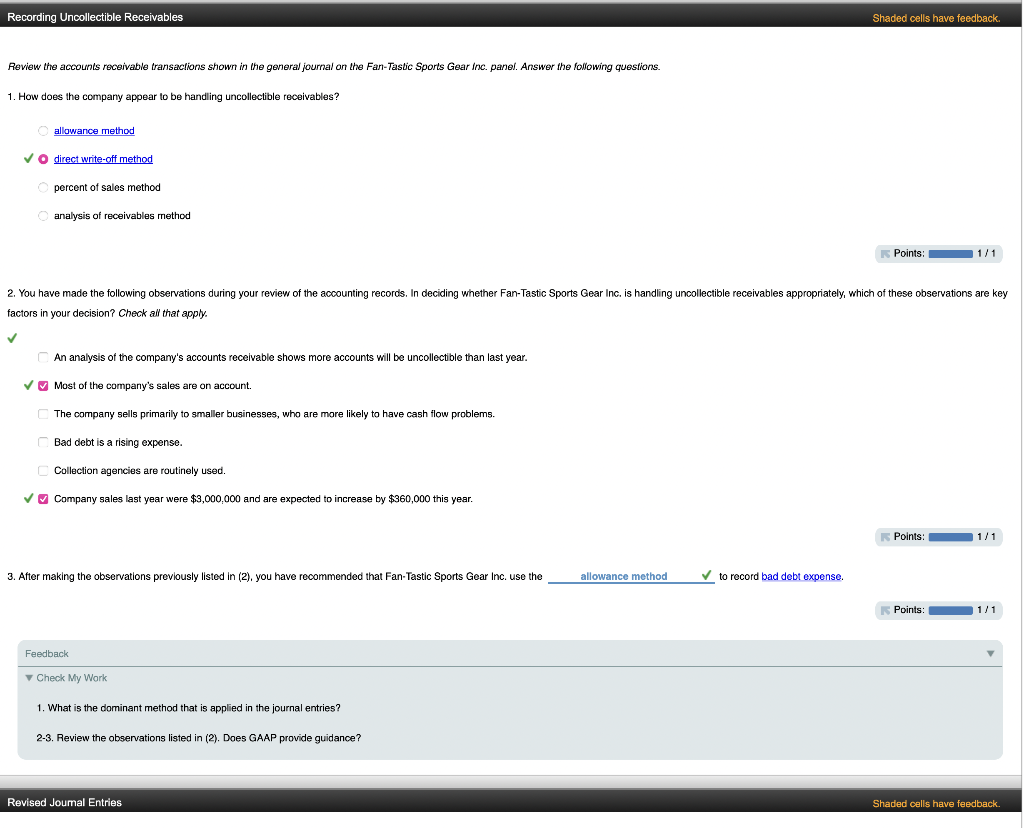

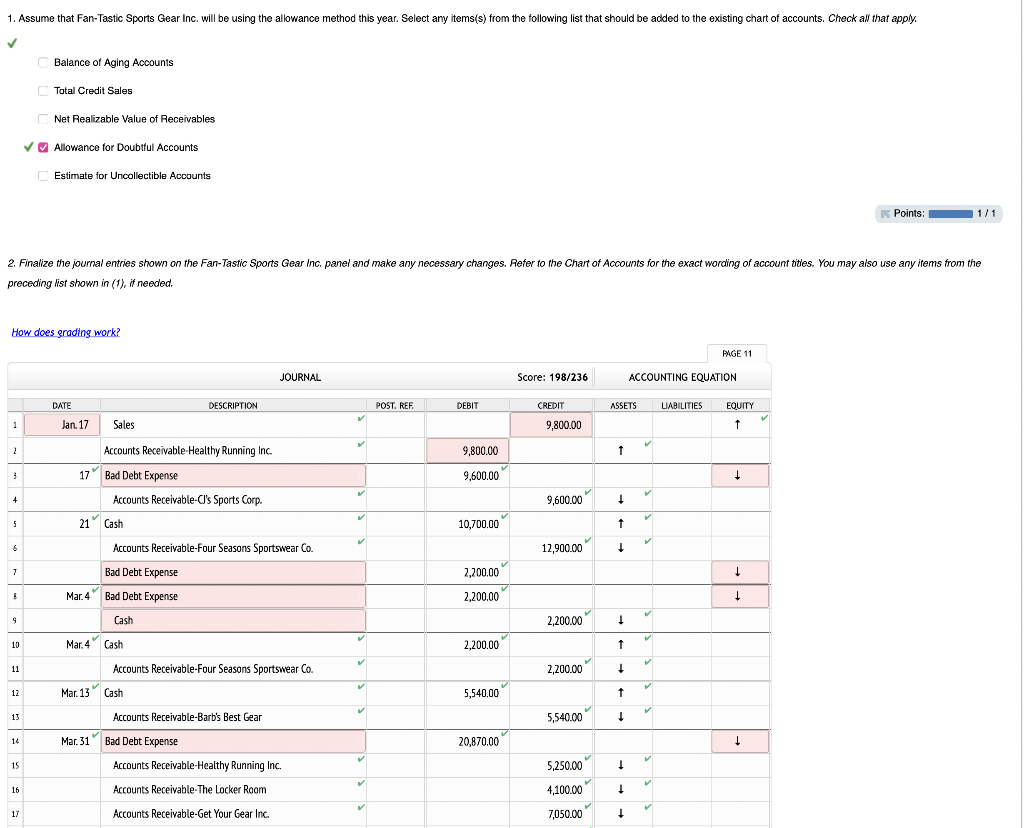

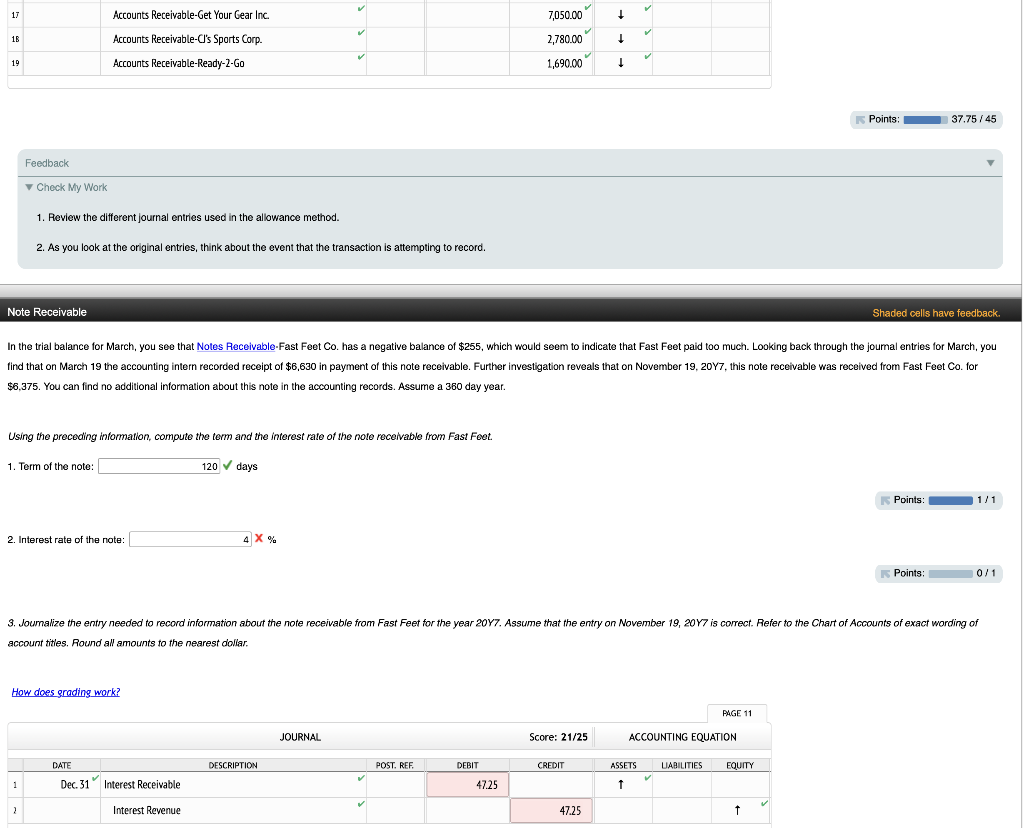

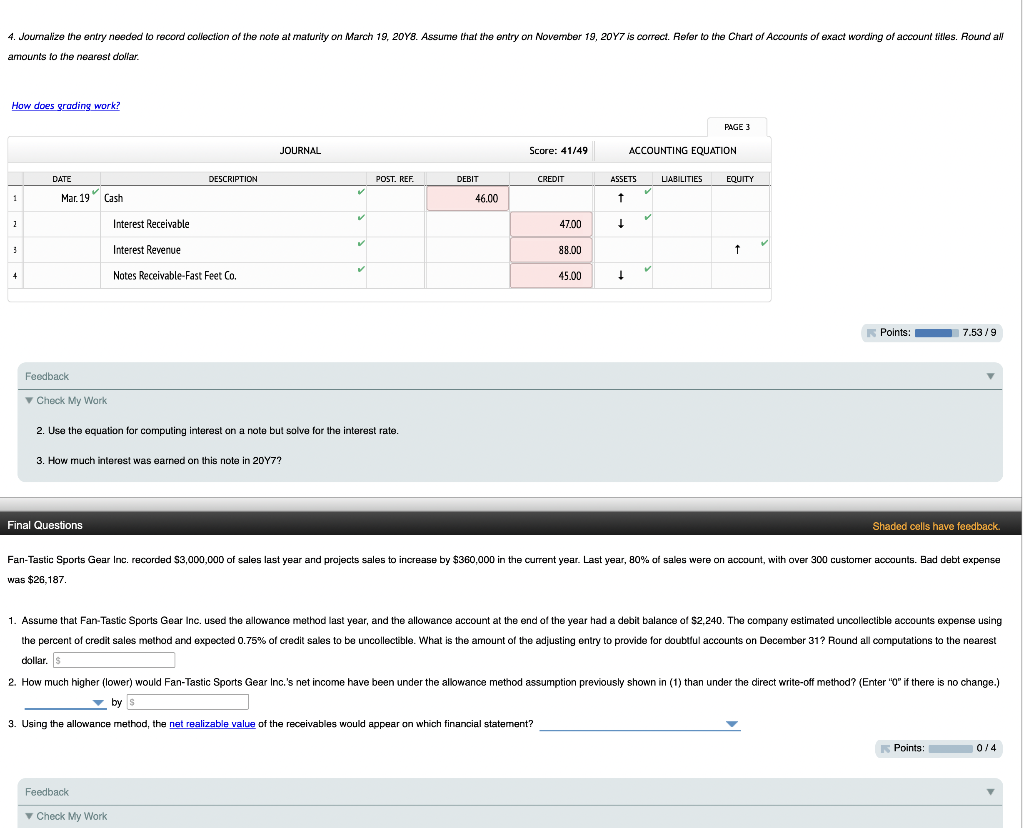

Fan-Tastic Sports Gear Inc. You have just been hired as the accountant for Fan-Tastic Sports Gear Inc., a wholesaler of sporting goods and apparel. The previous accountant left abruptly in late December, 20Y7, and an accounting intern has been drafting the journal entries since January. You are examining the accounting records before finalizing the journal entries for the first quarter of 20Y8. The following journal shows some of the accounts receivable transactions that you are reviewing. PAGE 11 JOURNAL ACCOUNTING EQUATION DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES DATE Jan 17 EQUITY 1 1 Sales 9,600.00 Bad Debt Expense 9,600.00 t 3 17 Bad Debt Expense 9,600.00 1 4 Accounts Receivable-C's Sports Corp. 9,600.00 1 5 21 Cash 10,700.00 1 Bad Debt Expense 2,200.00 7 Accounts Receivable-Four Seasons Sportswear Co. 12,900.00 + 6 Feb. 15 Accounts Receivable Healthy Running Inc. 3,000.00 1 9 500.00 + Bad Debt Expense Sales 10 3,500.00 1 11 Mar. 4 Accounts Receivable-Four Seasons Sportswear Co. 2,200.00 1 12 Bad Debt Expense 2,200.00 t 13 4 Cash 2,200.00 1 14 Bad Debt Expense 2,200.00 1 t 15 13 Cash 5,540.00 1 16 Accounts Receivable-Barb's Best Gear 5,540.00 + 17 20,870.00 + 31 Bad Debt Expense Accounts Receivable-Healthy Running Inc. 18 5,250.00 1 19 Accounts Receivable-The Locker Room 4,100.00 + 20 2,780.00 + 21 Accounts Receivable-C's Sports Corp. Accounts Receivable-Get Your Gear Inc. Accounts Receivable-Ready-2-GO 2 7,050.00 + 22 1,690.00 1 CHART OF ACCOUNTS Fan-Tastic Sports Gear Inc. General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Rent Revenue 612 Interest Revenue EXPENSES 510 Cost of Goods Sold 520 Sales Salaries Expense 121 Accounts Receivable-Healthy Running Inc. 122 Accounts Receivable-The Locker Room - 123 Accounts Receivable-CJ's Sports Corp. 124 Accounts Receivable-Get Your Gear Inc. 125 Accounts Receivable-Four Seasons Sportswear Co. 126 Accounts Receivable-Ready-2-Go 127 Accounts Receivable-Barb's Best Gear 132 Notes Receivable-Fast Feet Co. 136 Interest Receivable 141 Inventory 145 Office Supplies 521 Advertising Expense 522 Depreciation Expense-Store Equipment 523 Delivery Expense 529 Miscellaneous Selling Expense 530 Office Salaries Expense 531 Rent Expense 532 Depreciation Expense-Office Equipment 151 Prepaid Insurance 181 Land 533 Insurance Expense 191 Store Equipment 192 Accumulated Depreciation Store Equipment 193 Office Equipment 194 Accumulated Depreciation Office Equipment 534 Office Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Misc. Administrative Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 212 Unearned Rent 213 Customer Refunds Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 313 Income Summary Recording Uncollectible Receivables Shaded cells have feedback. Review the accounts receivable transactions shown in the general journal on the Fan-Tastic Sports Gear Inc. panel. Answer the following questions. 1. How does the company appear to be handling uncollectible receivables? allowance method direct write-off method percent of sales method analysis receivables method Points: 1/1 2. You have made the following observations during your review of the accounting records. In deciding whether Fan-Tastic Sports Gear Inc. is handling uncollectible receivables appropriately, which of these observations are key factors in your decision? Check all that apply. An analysis of the company's accounts receivable shows more accounts will be uncollectible than last year. Most of the company's sales are on account. The company sells primarily smaller businesses, who are more likely to have cash flow problems. Bad debt is a rising expense. Collection agencies are routinely used. Company sales last year were $3,000,000 and are expected to increase by $360,000 this Points: 1/1 3. After making the observations previously listed in (2), you have recommended that Fan-Tastic Sports Gear Inc. use the allowance method to record bad debt expense. Points: 1/1 Feedback Check My Work What is the dominant method that is applied in the journal entries? 2-3. Review the observations listed in (2). Does GAAP provide guidance? Revised Joumal Entries Shaded cells have feedback 1. Assume that Fan-Tastic Sports Gear Inc. will be using the allowance method this year. Select any items(s) from the following list that should be added to the existing chart of accounts. Check all that apply. Balance of Aging Accounts Total Credit Sales Net Realizable Value of Receivables Allowance for Doubtful Accounts Estimate for Uncollectible Accounts Points: 1/1 2. Finalize the journal entries shown on the Fan-Tastic Sports Gear Inc, panel and make any necessary changes. Refer to the Chart of Accounts for the exact wording of account titles. You may also use any items from the preceding list shown in (1), if needed. How does grading work? ? PAGE 11 JOURNAL Score: 198/236 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 f 1 1 Jan. 17 Sales 9,800.00 2 Accounts Receivable-Healthy Running Inc. 9,800.00 1 3 17 Bad Debt Expense 9,600.00 + + 9,600.00 + 5 10,700.00 t 6 Accounts Receivable-C's Sports Corp. 21 Cash Accounts Receivable-Four Seasons Sportswear Co. Bad Debt Expense Mar. 4 Bad Debt Expense 12,900.00 1 7 2,200.00 2,200.00 1 9 Cash 2,200.00 1 10 2,200.00 f 11 2,200.00 + Mar. 4 Cash Accounts Receivable-Four Seasons Sportswear Co. Mar. 13 Cash Accounts Receivable-Barb's Best Gear 12 5,540.00 t 13 5,540.00 1 14 Mar. 31 20,870,00 + Bad Debt Expense Accounts Receivable Healthy Running Inc. 15 5,250.00 1 16 Accounts Receivable-The Locker Room 4,100.00 1 17 Accounts Receivable-Get Your Gear Inc. 7,050.00 + 17 Accounts Receivable-Get Your Gear Inc. 7,050.00 + 16 2,780.00 + Accounts Receivable-cl's Sports Corp. Accounts Receivable-Ready-2-Go 19 1,690.00 1 Points: 37.75 / 45 Feedback Check My Work 1. Review the different journal entries used in the allowance method. 2. As you look at the original entries, think about the event that the transaction is attempting to record. Note Receivable Shaded cells have feedback. In the trial balance for March, you see that Notes Receivable-Fast Feet Co. has a negative balance of $255, which would seem to indicate that Fast Feet paid too much. Looking back through the journal entries for March, you find that on March 19 the accounting intern recorded receipt of $6,630 in payment of this note receivable. Further investigation reveals that on November 19, 2087, this note receivable was received from Fast Feet Co. for $. . $6.375. You can find no additional information about this note in the accounting records. Assume a 360 day year. Using the preceding information, compute the term and the interest rate of the note receivable from Fast Foet. 1. Term of the note: : 120 days Points: | 1/1 2. Interest rate of the note: 4 X 4 % Points: 0/1 3. Journalize the entry needed to record information about the note receivable from Fast Feet for the year 2017. Assume that the entry on November 19, 2017 is correct. Refer to the Chart of Accounts of exact wording of account titles. Round all amounts to the nearest dollar. How does grading work? PAGE 11 JOURNAL Score: 21/25 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. . CREDIT ASSETS LIABILITIES EQUITY DEBIT 47.25 1 Dec. 31 Interest Receivable f 2 Interest Revenue 47.25 f 4. Joumalize the entry needed to record collection of the note at malurily on March 19, 2018. Assume that the entry on November 19, 2017 is correct. Refer to the Chart of Accounts of exact wording of account titles. Round all amounts to the nearest dollar. How does grading work? PAGE 3 JOURNAL Score: 41/49 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Mar. 19 Cash 46.00 t V 2 Interest Receivable 47.00 + 3 Interest Revenue 88.00 t + Notes Receivable-Fast Feet Co. 45.00 1 Points: 7.53/9 Feedback Check My Work 2. Use the equation for computing interest on a note but solve for the interest rate. . 3. How much interest was earned on this note in 20Y7? ? Final Questions Shaded cells have feedback. Fan-Tastic Sports Gear Inc. recorded $3,000,000 of sales last year and projects sales to increase by $360,000 in the current year. Last year, 80% of sales were on account, with over 300 customer accounts. Bad debt expense . , was $26,187. $ 1. Assume that Fan-Tastic Sports Gear Inc. used the allowance method last year, and the allowance account at the end of the year had a debit balance of $2,240. The company estimated uncollectible accounts expense using the percent of credit sales method and expected 0.75% of credit sales to be uncollectible. What is the amount of the adjusting entry to provide for doubtful accounts on December 31? Round all computations to the nearest dollar. S 2. How much higher (lower) would Fan-Tastic Sports Gear Inc.'s net income have been under the allowance method assumption previously shown in (1) than under the direct write-off method? (Enter "0" if there is no change.) by s 3. Using the allowance method, the net realizable value of the receivables would appear on which financial statement? Points: 0/4 Feedback Check My Work Fan-Tastic Sports Gear Inc. You have just been hired as the accountant for Fan-Tastic Sports Gear Inc., a wholesaler of sporting goods and apparel. The previous accountant left abruptly in late December, 20Y7, and an accounting intern has been drafting the journal entries since January. You are examining the accounting records before finalizing the journal entries for the first quarter of 20Y8. The following journal shows some of the accounts receivable transactions that you are reviewing. PAGE 11 JOURNAL ACCOUNTING EQUATION DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES DATE Jan 17 EQUITY 1 1 Sales 9,600.00 Bad Debt Expense 9,600.00 t 3 17 Bad Debt Expense 9,600.00 1 4 Accounts Receivable-C's Sports Corp. 9,600.00 1 5 21 Cash 10,700.00 1 Bad Debt Expense 2,200.00 7 Accounts Receivable-Four Seasons Sportswear Co. 12,900.00 + 6 Feb. 15 Accounts Receivable Healthy Running Inc. 3,000.00 1 9 500.00 + Bad Debt Expense Sales 10 3,500.00 1 11 Mar. 4 Accounts Receivable-Four Seasons Sportswear Co. 2,200.00 1 12 Bad Debt Expense 2,200.00 t 13 4 Cash 2,200.00 1 14 Bad Debt Expense 2,200.00 1 t 15 13 Cash 5,540.00 1 16 Accounts Receivable-Barb's Best Gear 5,540.00 + 17 20,870.00 + 31 Bad Debt Expense Accounts Receivable-Healthy Running Inc. 18 5,250.00 1 19 Accounts Receivable-The Locker Room 4,100.00 + 20 2,780.00 + 21 Accounts Receivable-C's Sports Corp. Accounts Receivable-Get Your Gear Inc. Accounts Receivable-Ready-2-GO 2 7,050.00 + 22 1,690.00 1 CHART OF ACCOUNTS Fan-Tastic Sports Gear Inc. General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Rent Revenue 612 Interest Revenue EXPENSES 510 Cost of Goods Sold 520 Sales Salaries Expense 121 Accounts Receivable-Healthy Running Inc. 122 Accounts Receivable-The Locker Room - 123 Accounts Receivable-CJ's Sports Corp. 124 Accounts Receivable-Get Your Gear Inc. 125 Accounts Receivable-Four Seasons Sportswear Co. 126 Accounts Receivable-Ready-2-Go 127 Accounts Receivable-Barb's Best Gear 132 Notes Receivable-Fast Feet Co. 136 Interest Receivable 141 Inventory 145 Office Supplies 521 Advertising Expense 522 Depreciation Expense-Store Equipment 523 Delivery Expense 529 Miscellaneous Selling Expense 530 Office Salaries Expense 531 Rent Expense 532 Depreciation Expense-Office Equipment 151 Prepaid Insurance 181 Land 533 Insurance Expense 191 Store Equipment 192 Accumulated Depreciation Store Equipment 193 Office Equipment 194 Accumulated Depreciation Office Equipment 534 Office Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Misc. Administrative Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 212 Unearned Rent 213 Customer Refunds Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 313 Income Summary Recording Uncollectible Receivables Shaded cells have feedback. Review the accounts receivable transactions shown in the general journal on the Fan-Tastic Sports Gear Inc. panel. Answer the following questions. 1. How does the company appear to be handling uncollectible receivables? allowance method direct write-off method percent of sales method analysis receivables method Points: 1/1 2. You have made the following observations during your review of the accounting records. In deciding whether Fan-Tastic Sports Gear Inc. is handling uncollectible receivables appropriately, which of these observations are key factors in your decision? Check all that apply. An analysis of the company's accounts receivable shows more accounts will be uncollectible than last year. Most of the company's sales are on account. The company sells primarily smaller businesses, who are more likely to have cash flow problems. Bad debt is a rising expense. Collection agencies are routinely used. Company sales last year were $3,000,000 and are expected to increase by $360,000 this Points: 1/1 3. After making the observations previously listed in (2), you have recommended that Fan-Tastic Sports Gear Inc. use the allowance method to record bad debt expense. Points: 1/1 Feedback Check My Work What is the dominant method that is applied in the journal entries? 2-3. Review the observations listed in (2). Does GAAP provide guidance? Revised Joumal Entries Shaded cells have feedback 1. Assume that Fan-Tastic Sports Gear Inc. will be using the allowance method this year. Select any items(s) from the following list that should be added to the existing chart of accounts. Check all that apply. Balance of Aging Accounts Total Credit Sales Net Realizable Value of Receivables Allowance for Doubtful Accounts Estimate for Uncollectible Accounts Points: 1/1 2. Finalize the journal entries shown on the Fan-Tastic Sports Gear Inc, panel and make any necessary changes. Refer to the Chart of Accounts for the exact wording of account titles. You may also use any items from the preceding list shown in (1), if needed. How does grading work? ? PAGE 11 JOURNAL Score: 198/236 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 f 1 1 Jan. 17 Sales 9,800.00 2 Accounts Receivable-Healthy Running Inc. 9,800.00 1 3 17 Bad Debt Expense 9,600.00 + + 9,600.00 + 5 10,700.00 t 6 Accounts Receivable-C's Sports Corp. 21 Cash Accounts Receivable-Four Seasons Sportswear Co. Bad Debt Expense Mar. 4 Bad Debt Expense 12,900.00 1 7 2,200.00 2,200.00 1 9 Cash 2,200.00 1 10 2,200.00 f 11 2,200.00 + Mar. 4 Cash Accounts Receivable-Four Seasons Sportswear Co. Mar. 13 Cash Accounts Receivable-Barb's Best Gear 12 5,540.00 t 13 5,540.00 1 14 Mar. 31 20,870,00 + Bad Debt Expense Accounts Receivable Healthy Running Inc. 15 5,250.00 1 16 Accounts Receivable-The Locker Room 4,100.00 1 17 Accounts Receivable-Get Your Gear Inc. 7,050.00 + 17 Accounts Receivable-Get Your Gear Inc. 7,050.00 + 16 2,780.00 + Accounts Receivable-cl's Sports Corp. Accounts Receivable-Ready-2-Go 19 1,690.00 1 Points: 37.75 / 45 Feedback Check My Work 1. Review the different journal entries used in the allowance method. 2. As you look at the original entries, think about the event that the transaction is attempting to record. Note Receivable Shaded cells have feedback. In the trial balance for March, you see that Notes Receivable-Fast Feet Co. has a negative balance of $255, which would seem to indicate that Fast Feet paid too much. Looking back through the journal entries for March, you find that on March 19 the accounting intern recorded receipt of $6,630 in payment of this note receivable. Further investigation reveals that on November 19, 2087, this note receivable was received from Fast Feet Co. for $. . $6.375. You can find no additional information about this note in the accounting records. Assume a 360 day year. Using the preceding information, compute the term and the interest rate of the note receivable from Fast Foet. 1. Term of the note: : 120 days Points: | 1/1 2. Interest rate of the note: 4 X 4 % Points: 0/1 3. Journalize the entry needed to record information about the note receivable from Fast Feet for the year 2017. Assume that the entry on November 19, 2017 is correct. Refer to the Chart of Accounts of exact wording of account titles. Round all amounts to the nearest dollar. How does grading work? PAGE 11 JOURNAL Score: 21/25 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. . CREDIT ASSETS LIABILITIES EQUITY DEBIT 47.25 1 Dec. 31 Interest Receivable f 2 Interest Revenue 47.25 f 4. Joumalize the entry needed to record collection of the note at malurily on March 19, 2018. Assume that the entry on November 19, 2017 is correct. Refer to the Chart of Accounts of exact wording of account titles. Round all amounts to the nearest dollar. How does grading work? PAGE 3 JOURNAL Score: 41/49 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 Mar. 19 Cash 46.00 t V 2 Interest Receivable 47.00 + 3 Interest Revenue 88.00 t + Notes Receivable-Fast Feet Co. 45.00 1 Points: 7.53/9 Feedback Check My Work 2. Use the equation for computing interest on a note but solve for the interest rate. . 3. How much interest was earned on this note in 20Y7? ? Final Questions Shaded cells have feedback. Fan-Tastic Sports Gear Inc. recorded $3,000,000 of sales last year and projects sales to increase by $360,000 in the current year. Last year, 80% of sales were on account, with over 300 customer accounts. Bad debt expense . , was $26,187. $ 1. Assume that Fan-Tastic Sports Gear Inc. used the allowance method last year, and the allowance account at the end of the year had a debit balance of $2,240. The company estimated uncollectible accounts expense using the percent of credit sales method and expected 0.75% of credit sales to be uncollectible. What is the amount of the adjusting entry to provide for doubtful accounts on December 31? Round all computations to the nearest dollar. S 2. How much higher (lower) would Fan-Tastic Sports Gear Inc.'s net income have been under the allowance method assumption previously shown in (1) than under the direct write-off method? (Enter "0" if there is no change.) by s 3. Using the allowance method, the net realizable value of the receivables would appear on which financial statement? Points: 0/4 Feedback Check My Work