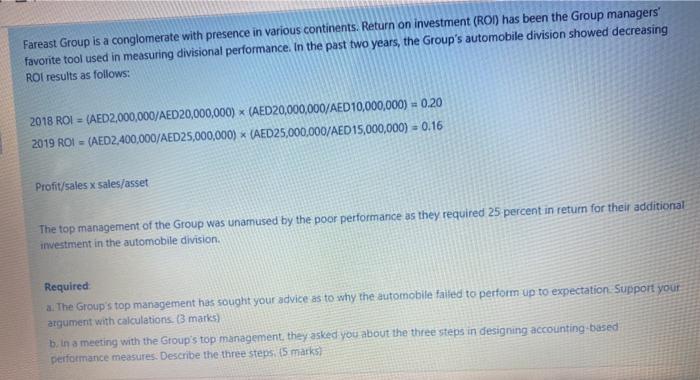

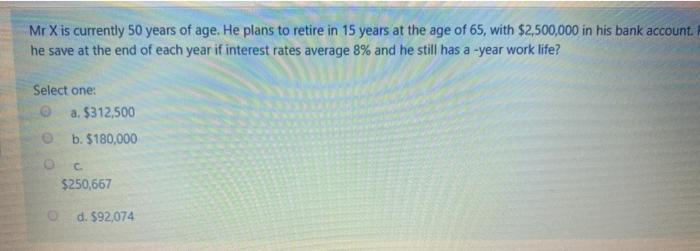

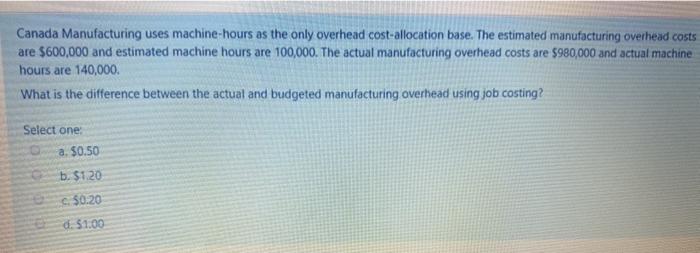

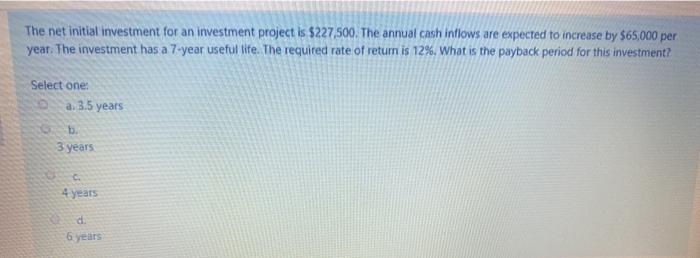

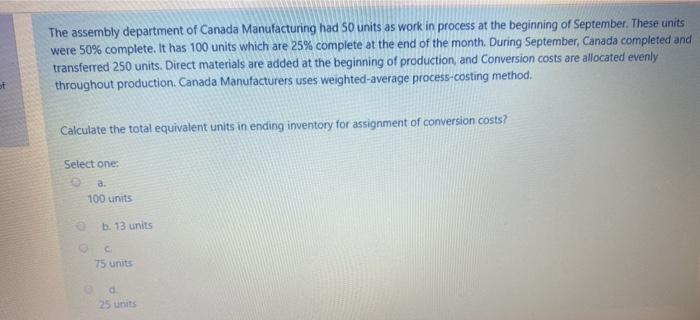

Fareast Group is a conglomerate with presence in various continents. Return on investment (ROI) has been the Group managers favorite tool used in measuring divisional performance. In the past two years, the Group's automobile division showed decreasing ROI results as follows: 2018 ROL = (AED 2,000,000/AED 20,000,000) * (AED 20,000,000/AED10,000,000) = 0.20 2019 ROI = (AED 2,400,000/AED 25,000,000) * (AED25,000,000/AED15,000,000) = 0.16 Profit/sales x sales/asset The top management of the Group was unamused by the poor performance as they required 25 percent in return for their additional investment in the automobile division. Required a. The Group's top management has sought your advice as to why the automobile failed to perform up to expectation Support your argument with calculations. (3 marks) b. In a meeting with the Group's top management they asked you about the three steps in designing accounting-based performance measures. Describe the three steps t5 marks) Mr X is currently 50 years of age. He plans to retire in 15 years at the age of 65, with $2,500,000 in his bank account he save at the end of each year if interest rates average 8% and he still has a -year work life? Select one: a. $312,500 b. $180,000 $250,667 d. $92,074 Canada Manufacturing uses machine-hours as the only overhead cost-allocation base. The estimated manufacturing overhead costs are $600,000 and estimated machine hours are 100,000. The actual manufacturing overhead costs are $980,000 and actual machine hours are 140,000 What is the difference between the actual and budgeted manufacturing overhead using job costing? Select one: a. $0.50 b. $120 s $0.20 d. $1.00 The net initial investment for an investment project is $227,500. The annual cash inflows are expected to increase by $65,000 per year. The investment has a 7-year useful life. The required rate of return is 12%. What is the payback period for this investment? Select one: a. 3.5 years b. 3 years 4 years d 6 years The assembly department of Canada Manufacturing had 50 units as work in process at the beginning of September. These units were 50% complete. It has 100 units which are 25% complete at the end of the month. During September, Canada completed and transferred 250 units. Direct materials are added at the beginning of production, and Conversion costs are allocated evenly throughout production. Canada Manufacturers uses weighted average process-costing method. of Calculate the total equivalent units in ending inventory for assignment of conversion costs? Select one: 100 units b. 13 units 75 units 25 units