Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fareeha is a sole trader who is setting up 'Fareeha Muslimah Collection' (FMC) to sell decent attire purchased from a local factory at RM40

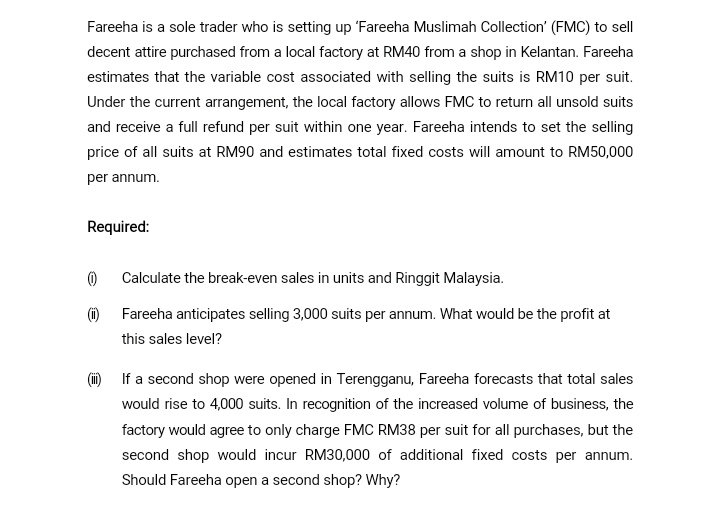

Fareeha is a sole trader who is setting up 'Fareeha Muslimah Collection' (FMC) to sell decent attire purchased from a local factory at RM40 from a shop in Kelantan. Fareeha estimates that the variable cost associated with selling the suits is RM10 per suit. Under the current arrangement, the local factory allows FMC to return all unsold suits and receive a full refund per suit within one year. Fareeha intends to set the selling price of all suits at RM90 and estimates total fixed costs will amount to RM50,000 per annum. Required: (0) (ii) Calculate the break-even sales in units and Ringgit Malaysia. Fareeha anticipates selling 3,000 suits per annum. What would be the profit at this sales level? (ii) If a second shop were opened in Terengganu, Fareeha forecasts that total sales would rise to 4,000 suits. In recognition of the increased volume of business, the factory would agree to only charge FMC RM38 per suit for all purchases, but the second shop would incur RM30,000 of additional fixed costs per annum. Should Fareeha open a second shop? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the breakeven sales in units and Ringgit Malaysia we can use the formula Breakev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started