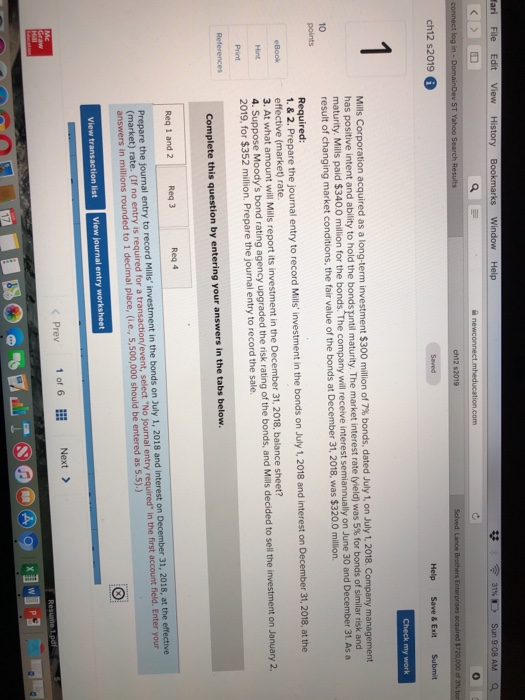

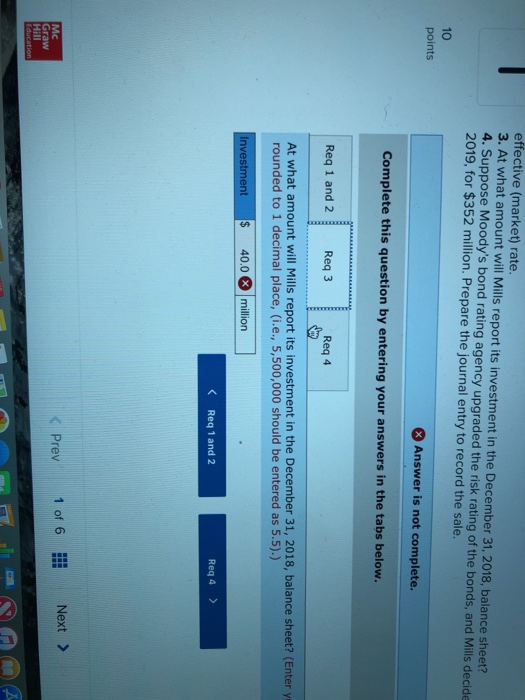

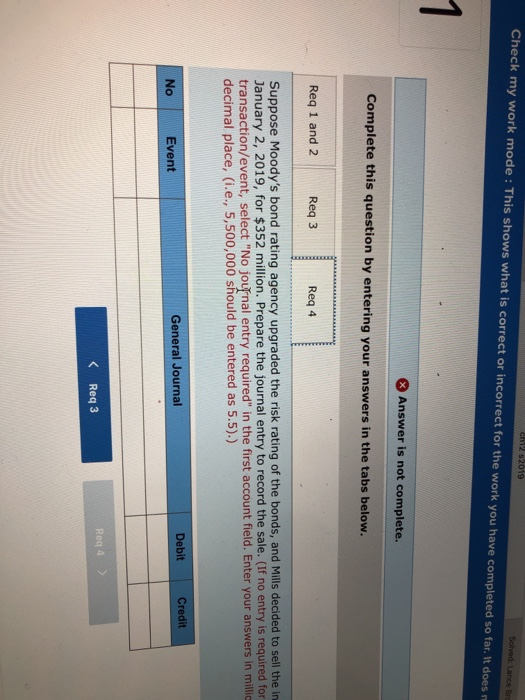

fari File Edit View History Boo Window Help 31% L- Sun 9 08 AM a ST ch12 s2019 6 Help Save& ExitSubmit Mills Corporation acquired as a long-term investment $300 million of 7% bonds has positive maturity. Mills paid $340.0 million for the bonds. The c result of changing market conditions, the fair value of the bonds at December 31, 2018, was $320.0 million. , dated July 1, on July 1, 2018, Company management intent and ability to hold the til maturity. The market interest rate (yield) was 5% for bonds ofsimilar risk and will receive interest semiannually on June 30 and December 31. As a 10 Required 1. & 2. Prepare the journal entry to record Mills investment in the bonds on July 1, 2018 and interest on December 31, 2018, at the effective (market) rate 3. At what amount will Mills report its investment in the December 31, 2018, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2019, for $352 million. Prepare the journal entry to record the sale. Complete this question by entering your answers in the tabs below. Req 4 Req 1 and 2 Req 3 Prepare the journal entry to record Mills' investment in the bonds on July 1, 2018 and interest on December 31, 2018, at the (market) rate. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).) Prev 1 of 6i Next> effective (market) rate 3. At what amount will Mills report its investment in the December 31, 2018, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decide 2019, for $352 million. Prepare the journal entry to record the sale. 10 points Answer is not complete. omplete this question by entering your answers in the tabs below Req 1 and 2 Req 3 Req 4 At what amount will Mills report its investment in the December 31, 2018, balance sheet? (Enter y rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5.) Investment 40.0million Req 1 and 2 Req4 > 1 of 6 Next > Prev Mc Hill Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does rn & Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the in January 2, 2019, for $352 million. Prepare the journal entry to record the sale. (If no entry is required for transaction/event, select "No journal entry required" in the first account field. Enter your answers in millic decimal place, (i.e., 5,500,000 should be entered as 5.5.) Debit Credit No Event General Journal Req 4 > Req3