Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Farm and Pet Veterinary Clinic in a small town is offering two primary services, farm animal services and pet care services. Providing veterinary care

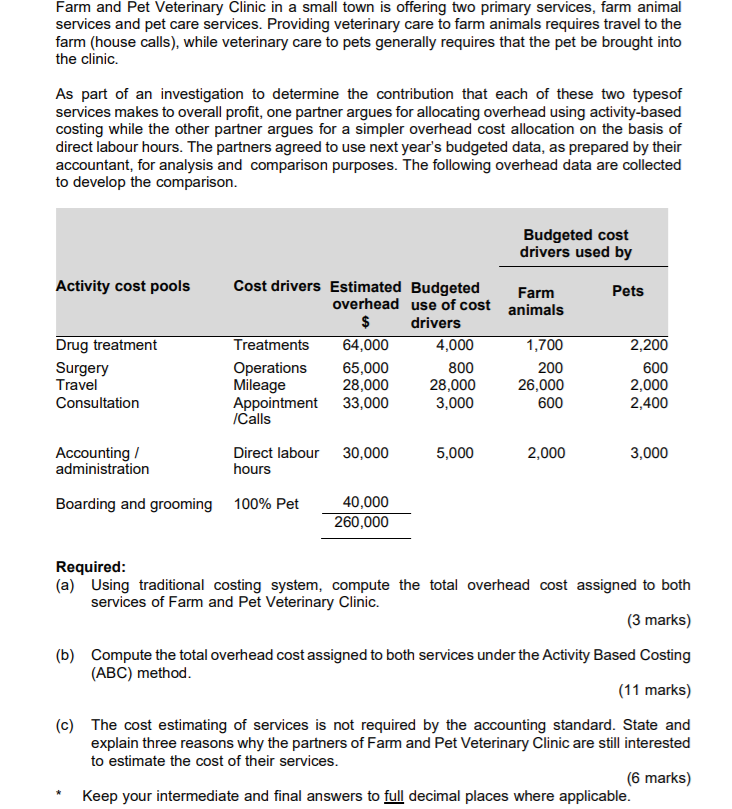

Farm and Pet Veterinary Clinic in a small town is offering two primary services, farm animal services and pet care services. Providing veterinary care to farm animals requires travel to the farm (house calls), while veterinary care to pets generally requires that the pet be brought into the clinic. As part of an investigation to determine the contribution that each of these two typesof services makes to overall profit, one partner argues for allocating overhead using activity-based costing while the other partner argues for a simpler overhead cost allocation on the basis of direct labour hours. The partners agreed to use next year's budgeted data, as prepared by their accountant, for analysis and comparison purposes. The following overhead data are collected to develop the comparison. Budgeted cost drivers used by Activity cost pools Cost drivers Estimated Budgeted Farm Pets overhead use of cost $ animals drivers Drug treatment Treatments 64,000 4,000 1,700 2,200 Surgery Travel Operations Mileage Appointment 33,000 Ialls 65,000 28,000 800 28,000 3,000 200 26,000 600 600 2,000 2,400 Consultation 5,000 Accounting / administration Direct labour 30,000 2,000 3,000 hours Boarding and grooming 100% Pet 40,000 260,000 Required: (a) Using traditional costing system, compute the total overhead cost assigned to both services of Farm and Pet Veterinary Clinic. (3 marks) (b) Compute the total overhead cost assigned to both services under the Activity Based Costing (ABC) method. (11 marks) (c) The cost estimating of services is not required by the accounting standard. State and explain three reasons why the partners of Farm and Pet Veterinary Clinic are still interested to estimate the cost of their services. (6 marks) Keep your intermediate and final answers to full decimal places where applicable. Farm and Pet Veterinary Clinic in a small town is offering two primary services, farm animal services and pet care services. Providing veterinary care to farm animals requires travel to the farm (house calls), while veterinary care to pets generally requires that the pet be brought into the clinic. As part of an investigation to determine the contribution that each of these two typesof services makes to overall profit, one partner argues for allocating overhead using activity-based costing while the other partner argues for a simpler overhead cost allocation on the basis of direct labour hours. The partners agreed to use next year's budgeted data, as prepared by their accountant, for analysis and comparison purposes. The following overhead data are collected to develop the comparison. Budgeted cost drivers used by Activity cost pools Cost drivers Estimated Budgeted Farm Pets overhead use of cost $ animals drivers Drug treatment Treatments 64,000 4,000 1,700 2,200 Surgery Travel Operations Mileage Appointment 33,000 Ialls 65,000 28,000 800 28,000 3,000 200 26,000 600 600 2,000 2,400 Consultation 5,000 Accounting / administration Direct labour 30,000 2,000 3,000 hours Boarding and grooming 100% Pet 40,000 260,000 Required: (a) Using traditional costing system, compute the total overhead cost assigned to both services of Farm and Pet Veterinary Clinic. (3 marks) (b) Compute the total overhead cost assigned to both services under the Activity Based Costing (ABC) method. (11 marks) (c) The cost estimating of services is not required by the accounting standard. State and explain three reasons why the partners of Farm and Pet Veterinary Clinic are still interested to estimate the cost of their services. (6 marks) Keep your intermediate and final answers to full decimal places where applicable.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Working note Predetermined rate overhead rate based on direct labor hours Total Manufacturing Overhe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started