Question

Farmer Donald has grown 5,000 bushels of wheat. Each bushel of wheat costs him 9.00 to grow. On each bushel, he bought a $10

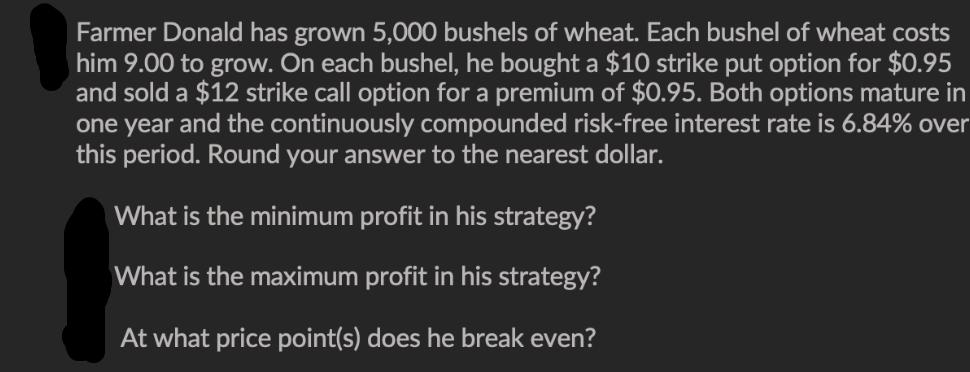

Farmer Donald has grown 5,000 bushels of wheat. Each bushel of wheat costs him 9.00 to grow. On each bushel, he bought a $10 strike put option for $0.95 and sold a $12 strike call option for a premium of $0.95. Both options mature in one year and the continuously compounded risk-free interest rate is 6.84% over this period. Round your answer to the nearest dollar. What is the minimum profit in his strategy? What is the maximum profit in his strategy? At what price point(s) does he break even?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the minimum and maximum profit in Farmer Donalds strategy as well as the breakeven price points we need to consider the outcomes under di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

11th edition

538480289, 978-0538480284

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App