Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Farmer Ned is trying to decide whether he should rebuild the engine on his current combine or whether he should invest in a new combine

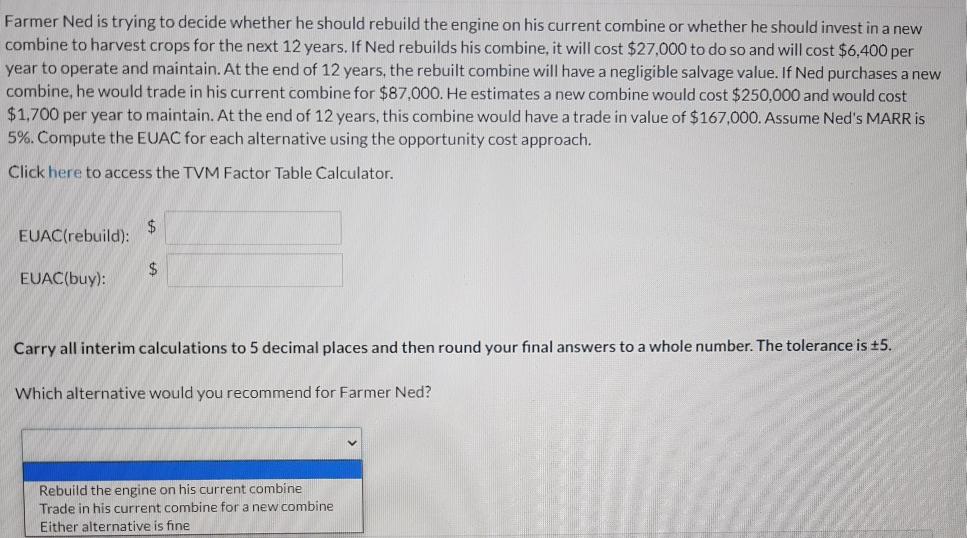

Farmer Ned is trying to decide whether he should rebuild the engine on his current combine or whether he should invest in a new combine to harvest crops for the next 12 years. If Ned rebuilds his combine, it will cost $27,000 to do so and will cost $6,400 per year to operate and maintain. At the end of 12 years, the rebuilt combine will have a negligible salvage value. If Ned purchases a new combine, he would trade in his current combine for $87,000. He estimates a new combine would cost $250,000 and would cost $1,700 per year to maintain. At the end of 12 years, this combine would have a trade in value of $167,000. Assume Ned's MARR is 5%. Compute the EUAC for each alternative using the opportunity cost approach. Click here to access the TVM Factor Table Calculator. $ EUAC(rebuild): $ EUAC(buy): Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +5. Which alternative would you recommend for Farmer Ned? Rebuild the engine on his current combine Trade in his current combine for a new combine Either alternative is fine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started