Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Farmer's Cart is a local produce shop that uses the periodic inventory system. Its fiscal year end is December 31. It began the fiscal

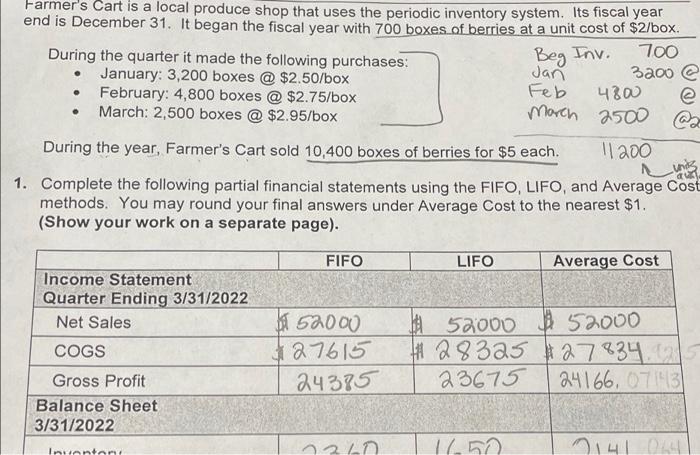

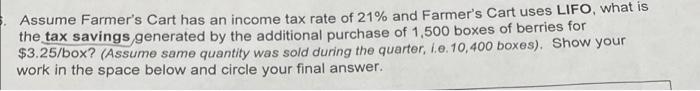

Farmer's Cart is a local produce shop that uses the periodic inventory system. Its fiscal year end is December 31. It began the fiscal year with 700 boxes of berries at a unit cost of $2/box. During the quarter it made the following purchases: January: 3,200 boxes @ $2.50/box February: 4,800 boxes @ $2.75/box March: 2,500 boxes @ $2.95/box 700 3a00 e 4800 Morch 2500 @ Beg Inv. Jan Feb During the year, Farmer's Cart sold 10,400 boxes of berries for $5 each. 1. Complete the following partial financial statements using the FIFO, LIFO, and Average Cost methods. You may round your final answers under Average Cost to the nearest $1. (Show your work on a separate page). FIFO LIFO Average Cost Income Statement Quarter Ending 3/31/2022 5a000 J52000 # 28325 27834. 23675 Net Sales COGS 27615 24385 24166, 07113 Gross Profit Balance Sheet 3/31/2022 1650 D141 041 Inventoni Assume Farmer's Cart has an income tax rate of 21% and Farmer's Cart uses LIFO, what is the tax savings generated by the additional purchase of 1,500 boxes of berries for $3.25/box? (Assume same quantity was sold during the quarter, i.e. 10,400 boxes). Show your work in the space below and circle your final answer.

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

FIFO Beginning Inventory Purchases Cost of Goods Sold Ending Inventory Quantity Cost per unit Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started