Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Farmland Enterprises, Inc., headquartered in Des Moines, Iowa, is a major supplier of seed corn in the Midwest. The firm has a capital structure

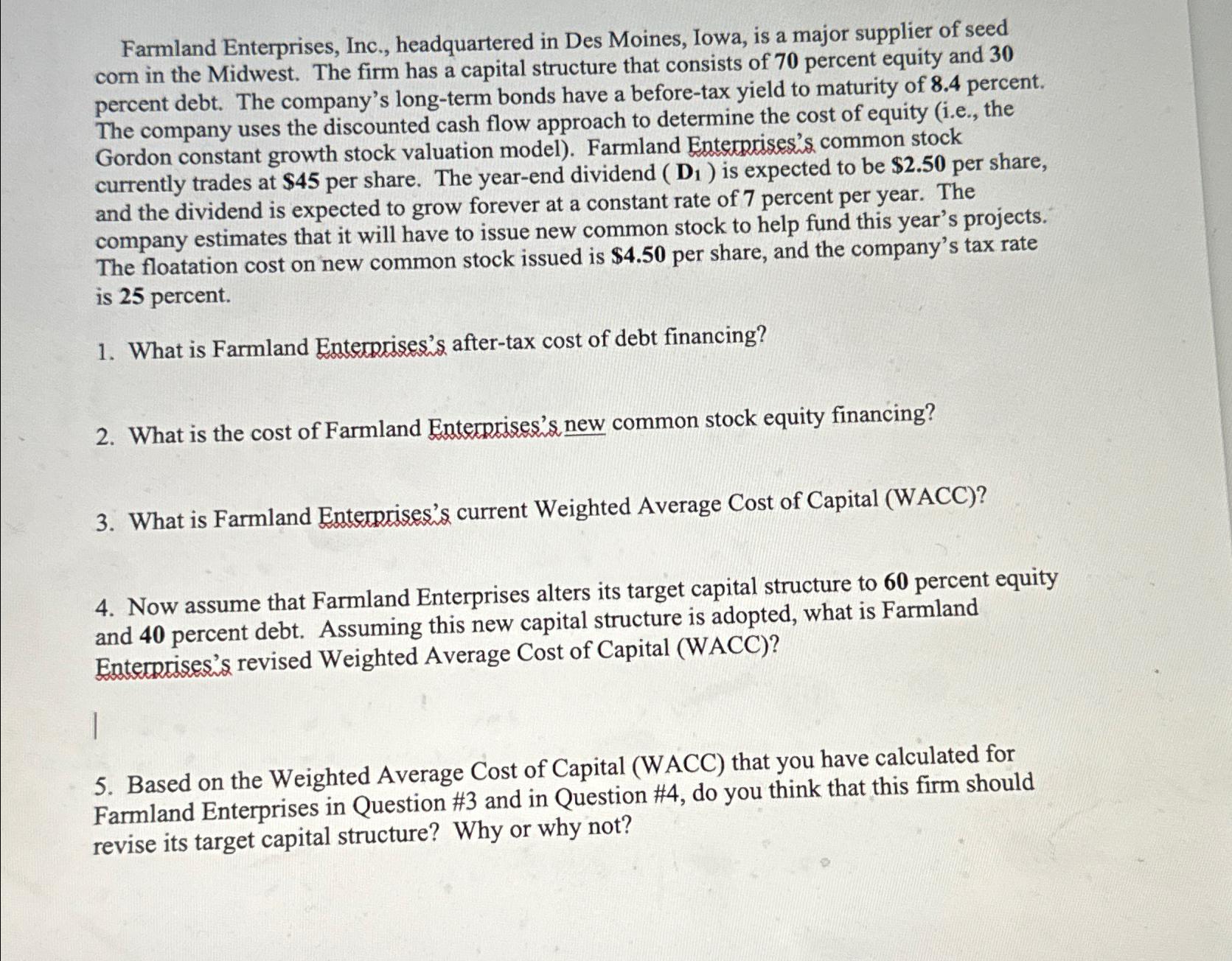

Farmland Enterprises, Inc., headquartered in Des Moines, Iowa, is a major supplier of seed corn in the Midwest. The firm has a capital structure that consists of 70 percent equity and 30 percent debt. The company's long-term bonds have a before-tax yield to maturity of 8.4 percent. The company uses the discounted cash flow approach to determine the cost of equity (i.e., the Gordon constant growth stock valuation model). Farmland Enterprises's common stock currently trades at $45 per share. The year-end dividend (D1) is expected to be $2.50 per share, and the dividend is expected to grow forever at a constant rate of 7 percent per year. The company estimates that it will have to issue new common stock to help fund this year's projects. The floatation cost on new common stock issued is $4.50 per share, and the company's tax rate is 25 percent. 1. What is Farmland Enterprises's after-tax cost of debt financing? 2. What is the cost of Farmland Enterprises's new common stock equity financing? 3. What is Farmland Enterprises's current Weighted Average Cost of Capital (WACC)? 4. Now assume that Farmland Enterprises alters its target capital structure to 60 percent equity and 40 percent debt. Assuming this new capital structure is adopted, what is Farmland Enterprises's revised Weighted Average Cost of Capital (WACC)? 5. Based on the Weighted Average Cost of Capital (WACC) that you have calculated for Farmland Enterprises in Question #3 and in Question #4, do you think that this firm should revise its target capital structure? Why or why not?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions I will calculate the various components of Farmland Enterprisess cost of capital and then use those values to determine the weighted average cost of capital WACC Lets go throu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e4fb47b321_958320.pdf

180 KBs PDF File

663e4fb47b321_958320.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started