Answered step by step

Verified Expert Solution

Question

1 Approved Answer

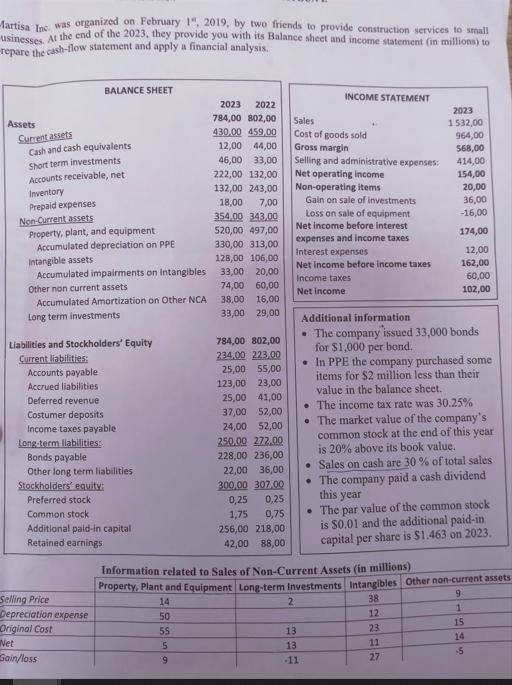

fartisa Inc. was organized on February 1, 2019, by two friends to provide construction services to small usinesses. At the end of the 2023,

fartisa Inc. was organized on February 1, 2019, by two friends to provide construction services to small usinesses. At the end of the 2023, they provide you with its Balance sheet and income statement (in millions) to repare the cash-flow statement and apply a financial analysis. Assets Current assets BALANCE SHEET Cash and cash equivalents: 46,00 33,00 222,00 132,00 132,00 243,00 18,00 7,00 354,00 343,00 520,00 497,00 330,00 313,00 Intangible assets 128,00 106,00 Accumulated impairments on Intangibles 33,00 20,00 74,00 60,00 38,00 16,00 33,00 29,00 Short term investments Accounts receivable, net Inventory Prepaid expenses Non-Current assets Property, plant, nt Accumulated depreciation on PPE Other non current assets Accumulated Amortization on Other NCA Long term investments Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Deferred revenue Costumer deposits Income taxes payable Long-term liabilities: Bonds payable Other long term liabilities Stockholders' equity: Preferred stock Common stock Additional paid-in capital Retained earnings Selling Price Depreciation expense Original Cost Net Gain/loss 2023 2022 784,00 802,00 430.00 459,00 12,00 44,00 5 9 784,00 802,00 234.00 223.00 25,00 55,00 123,00 23,00 25,00 41,00 37,00 52,00 24,00 52,00 250,00 272.00 228,00 236,00 22,00 36,00 300,00 307,00 0,25 0,25 1,75 0,75 256,00 218,00 42,00 88,00 Sales Cost of goods sold INCOME STATEMENT Gross margin Selling and administrative expenses: Net operating income Non-operating items 2 Gain on sale of investments Loss on sale of equipment Net income before interest expenses and income taxes Interest expenses Net income before income taxes Income taxes Net income 13 13 -11 2023 1532,00 964,00 Information related to Sales of Non-Current Assets (in millions) Property, Plant and Equipment Long-term Investments Intangibles Other non-current assets 14 38 9 1 50 55 12 23 568,00 414,00 11 27 154,00 20,00 36,00 -16,00 174,00 12,00 162,00 Additional information The company issued 33,000 bonds for $1,000 per bond. In PPE the company purchased some items for $2 million less than their value in the balance sheet. The income tax rate was 30.25% The market value of the company's common stock at the end of this year is 20% above its book value. Sales on cash are 30 % of total sales The company paid a cash dividend this year . The par value of the common stock is $0.01 and the additional paid-in capital per share is $1.463 on 2023. 60,00 102,00 15 14 -5 Required: Cash flow statement and Price-Earnings ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started