Question

Fashion Inc. is a textile manufacturing company located in the United States. It is 2018 and knit ties have swept over all local fashion magazines

Fashion Inc. is a textile manufacturing company located in the United States. It is 2018 and knit ties have swept over all local fashion magazines lately. Fashion Inc. is considering expanding its business to knit ties. After some research and consultation, the following findings have been reached:

(1) The necessary facility (plants and equipment) needed to produce knit ties will cost $3 million.

(2) Once the facility is ready. Fashion Inc. will be able to produce high-quality knit ties for the subsequent three consecutive years.

(3) The $3 million cost can be depreciated using straight-line depreciation over the three years of production to $0.3 million

(4) After the three years' operation, the salvage value of the facility is estimated to be $ 0.3 million.

(5) Fashion Inc. forecasts that sales will be 200,000 units and the price of a knit tie will be $20 per unit. (6) The cost of raw materials for a knit tie is forecasted at $11 per unit.

(7) Fashion Inc. forecasts the total fixed cost is $450,000 per year.

(8) The discount rate of this project is estimated at 8%. The tax rate applicable is constant at 30%.

(9) This project has no impacts on working capital.

Answer the following sub-questions based on the above information

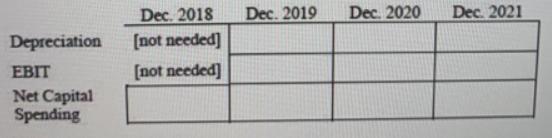

(a) Suppose the facility will be prepared by December 2018 and Fashion Inc. Fashion Inc. expects to engage in the knit tie market for the three years of 2018, 2019, and 2020. What are the EBIT, Depreciation and Net Capital Spending for each year? You can use the following table as guidance.

(b) What is the after-tax salvage value of the facility?

(c) Calculate the cash flows on this project and show them in a timeline table?

(d) Should Fashion Inc. invest in the facility to produce knit ties? Calculate the NPV)

Now the CEO of Fashion Inc. recognizes that the forecasts of the unit sales, cost per unit and fixed cost are subject to some uncertainties. The unit sales, cost per unit and fixed cost could be 110%, 90% or equal to the forecasts given in finding (5)-7).

Dec. 2018 Dec. 2019 Dec. 2020 Dec. 2021 Depreciation [not needed] EBIT [not needed] Net Capital Spending

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started