Answered step by step

Verified Expert Solution

Question

1 Approved Answer

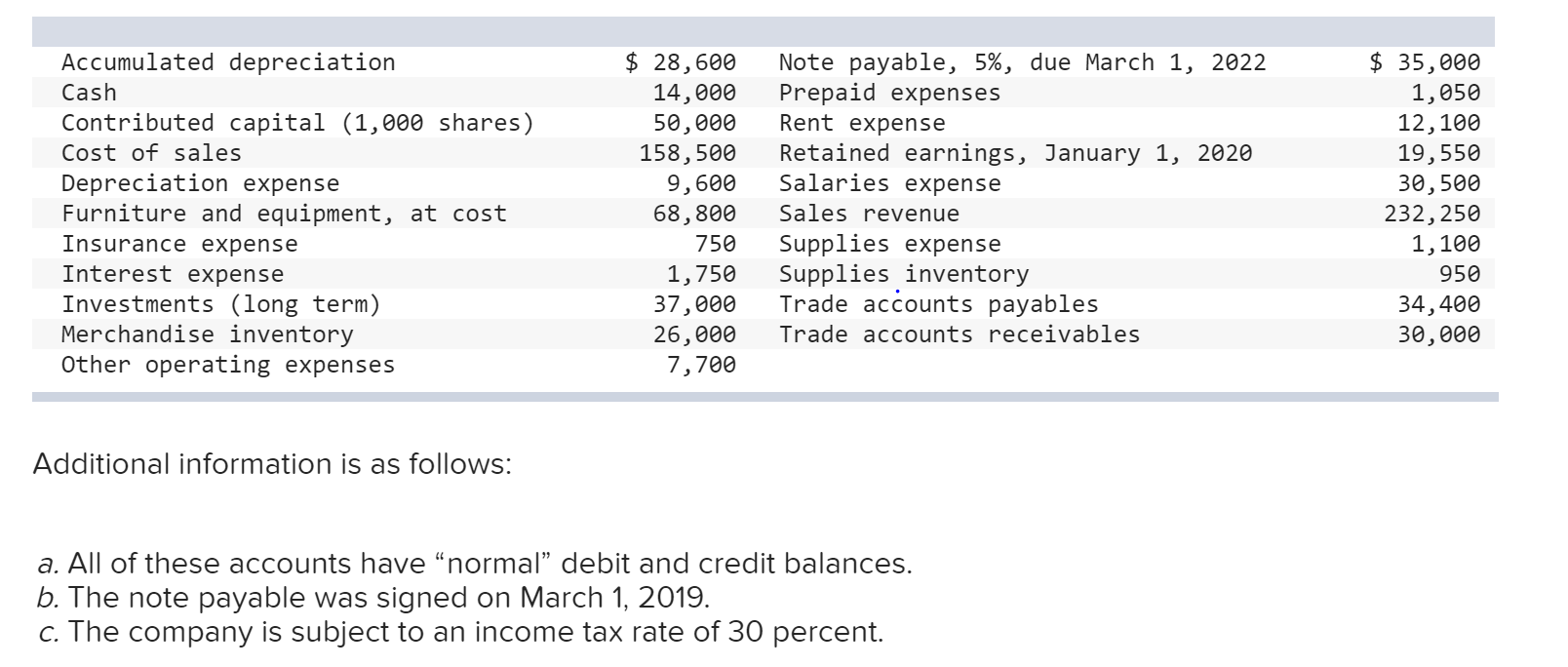

Fashion World Inc. reported the following accounts and balances in its unadjusted trial balance as at December 31, 2020 (in thousands of Canadian dollars). Note

Fashion World Inc. reported the following accounts and balances in its unadjusted trial balance as at December 31, 2020 (in thousands of Canadian dollars). Note that the accounts are listed in alphabetical order

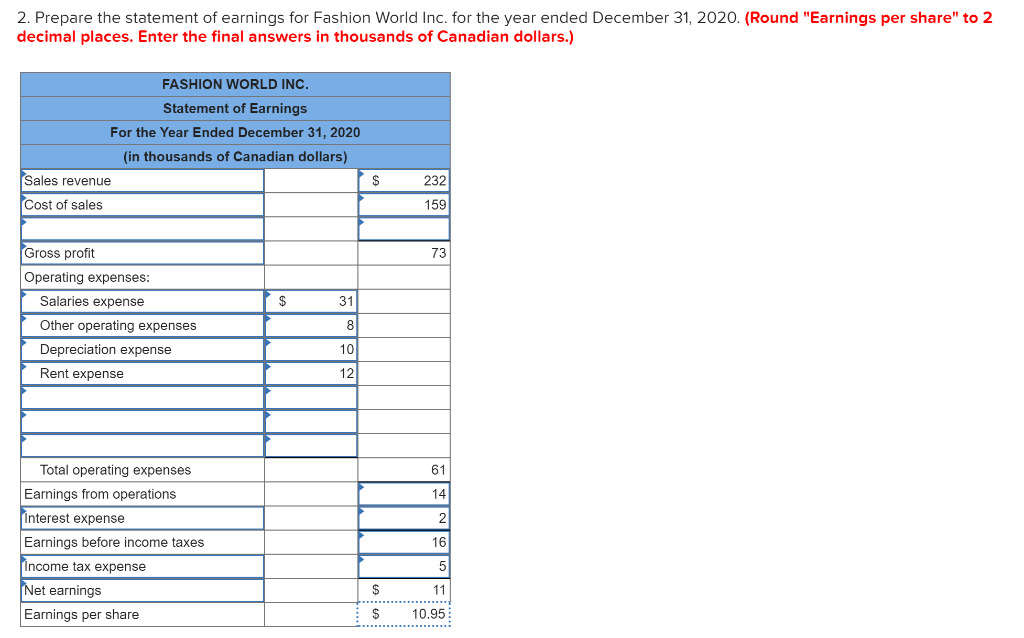

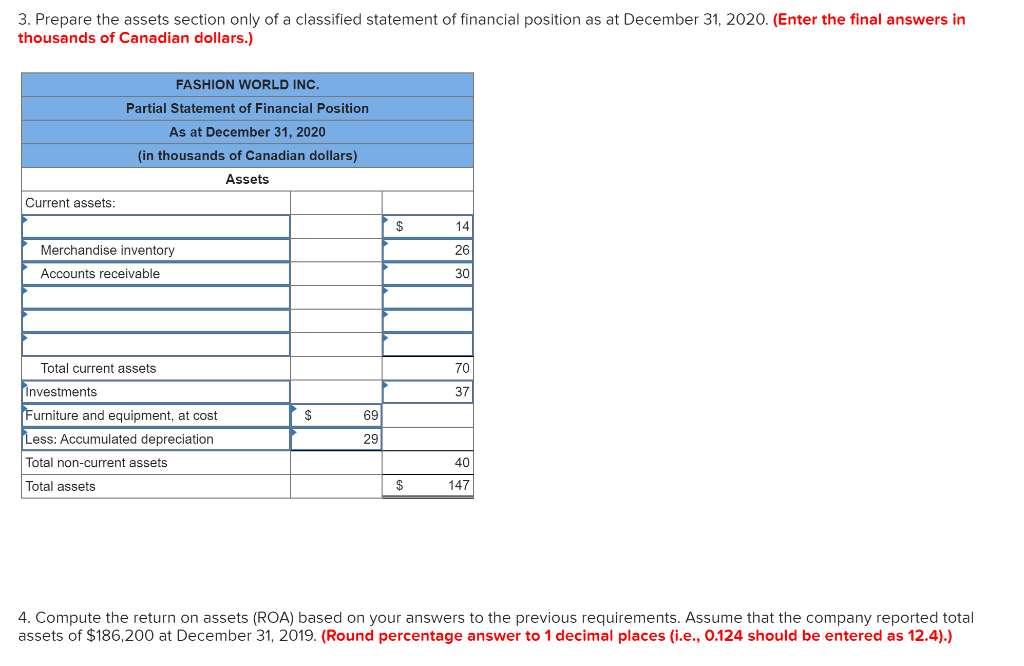

This is what I have so far. I try to submit it and it says it is incomplete. Any feedback would be great! (When I enter the decimals they just round to the nearest whole number).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started