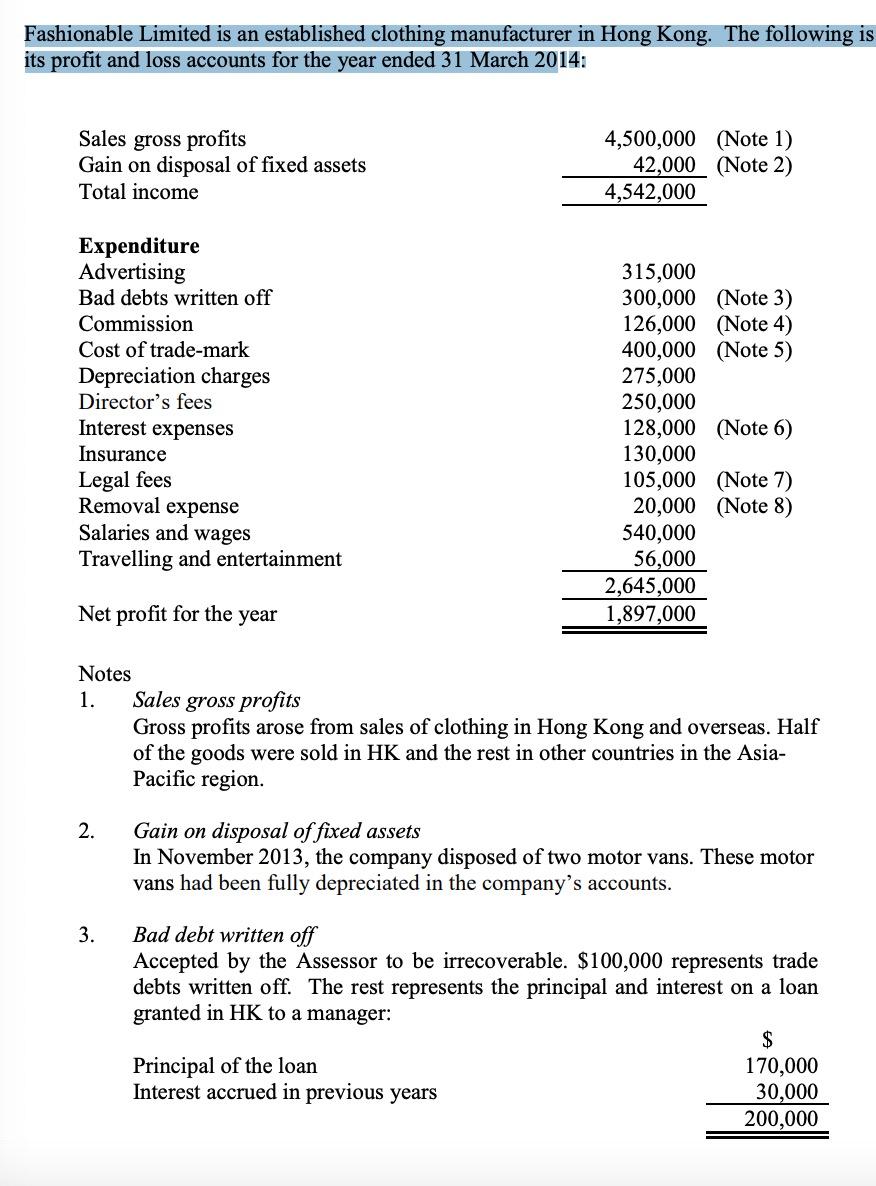

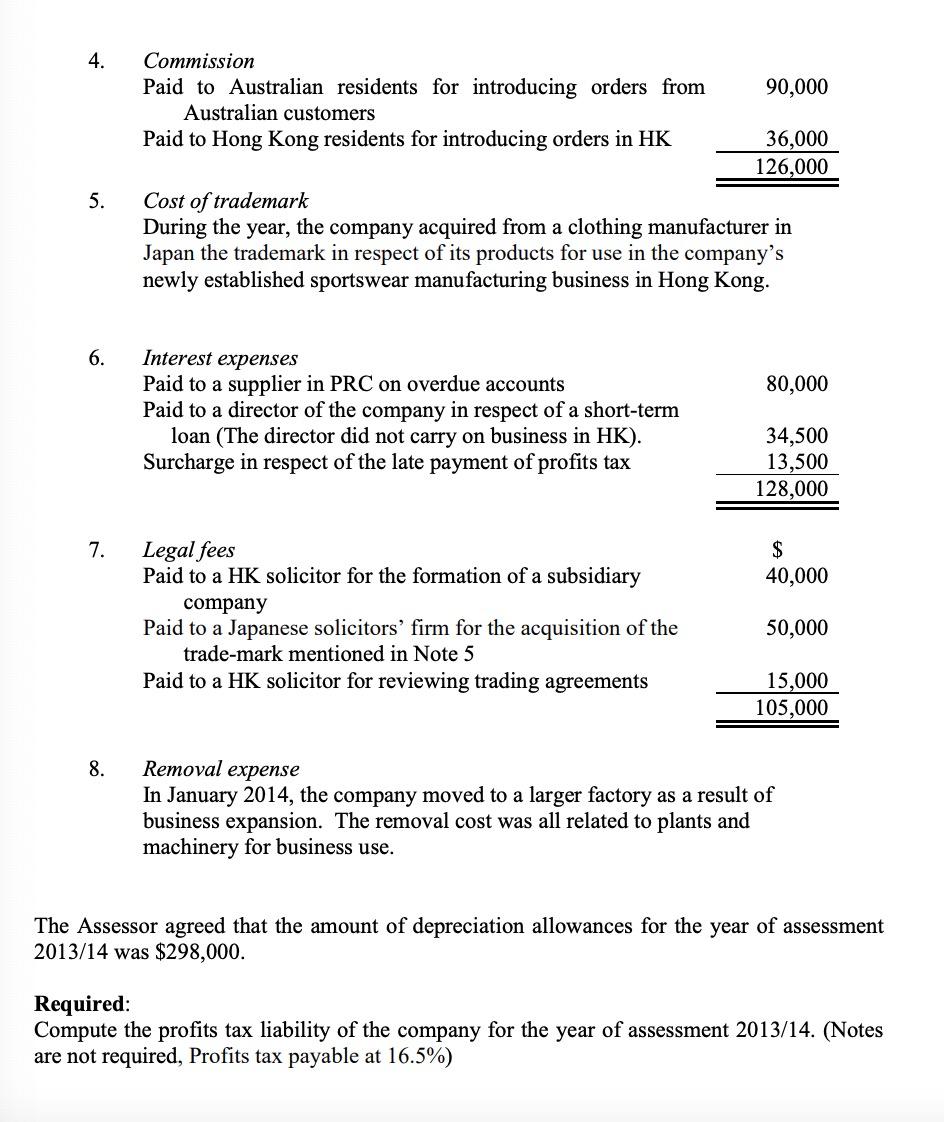

Fashionable Limited is an established clothing manufacturer in Hong Kong. The following is its profit and loss accounts for the year ended 31 March 2014: Sales gross profits Gain on disposal of fixed assets Total income 4,500,000 (Note 1) 42,000 (Note 2) 4,542,000 Expenditure Advertising Bad debts written off Commission Cost of trade-mark Depreciation charges Director's fees Interest expenses Insurance Legal fees Removal expense Salaries and wages Travelling and entertainment 315,000 300,000 (Note 3) 126,000 (Note 4) 400,000 (Note 5) 275,000 250,000 128,000 (Note 6) 130,000 105,000 (Note 7) 20,000 (Note 8) 540,000 56,000 2,645,000 1,897,000 Net profit for the year Notes 1. Sales gross profits Gross profits arose from sales of clothing in Hong Kong and overseas. Half of the goods were sold in HK and the rest in other countries in the Asia- Pacific region. 2. Gain on disposal of fixed assets In November 2013, the company disposed of two motor vans. These motor vans had been fully depreciated in the company's accounts. 3. Bad debt written off Accepted by the Assessor to be irrecoverable. $100,000 represents trade debts written off. The rest represents the principal and interest on a loan granted in HK to a manager: $ Principal of the loan 170,000 Interest accrued in previous years 30,000 200,000 4. Commission Paid to Australian residents for introducing orders from 90,000 Australian customers Paid to Hong Kong residents for introducing orders in HK 36,000 126,000 Cost of trademark During the year, the company acquired from a clothing manufacturer in Japan the trademark in respect of its products for use in the company's newly established sportswear manufacturing business in Hong Kong. 5. 6. 80,000 Interest expenses Paid to a supplier in PRC on overdue accounts Paid to a director of the company in respect of a short-term loan (The director did not carry on business in HK). Surcharge in respect of the late payment of profits tax 34,500 13,500 128,000 7. $ 40,000 Legal fees Paid to a HK solicitor for the formation of a subsidiary company Paid to a Japanese solicitors' firm for the acquisition of the trade-mark mentioned in Note 5 Paid to a HK solicitor for reviewing trading agreements 50,000 15,000 105,000 8. Removal expense In January 2014, the company moved to a larger factory as a result of business expansion. The removal cost was all related to plants and machinery for business use. The Assessor agreed that the amount of depreciation allowances for the year of assessment 2013/14 was $298,000. Required: Compute the profits tax liability of the company for the year of assessment 2013/14. (Notes are not required, Profits tax payable at 16.5%) Fashionable Limited is an established clothing manufacturer in Hong Kong. The following is its profit and loss accounts for the year ended 31 March 2014: Sales gross profits Gain on disposal of fixed assets Total income 4,500,000 (Note 1) 42,000 (Note 2) 4,542,000 Expenditure Advertising Bad debts written off Commission Cost of trade-mark Depreciation charges Director's fees Interest expenses Insurance Legal fees Removal expense Salaries and wages Travelling and entertainment 315,000 300,000 (Note 3) 126,000 (Note 4) 400,000 (Note 5) 275,000 250,000 128,000 (Note 6) 130,000 105,000 (Note 7) 20,000 (Note 8) 540,000 56,000 2,645,000 1,897,000 Net profit for the year Notes 1. Sales gross profits Gross profits arose from sales of clothing in Hong Kong and overseas. Half of the goods were sold in HK and the rest in other countries in the Asia- Pacific region. 2. Gain on disposal of fixed assets In November 2013, the company disposed of two motor vans. These motor vans had been fully depreciated in the company's accounts. 3. Bad debt written off Accepted by the Assessor to be irrecoverable. $100,000 represents trade debts written off. The rest represents the principal and interest on a loan granted in HK to a manager: $ Principal of the loan 170,000 Interest accrued in previous years 30,000 200,000 4. Commission Paid to Australian residents for introducing orders from 90,000 Australian customers Paid to Hong Kong residents for introducing orders in HK 36,000 126,000 Cost of trademark During the year, the company acquired from a clothing manufacturer in Japan the trademark in respect of its products for use in the company's newly established sportswear manufacturing business in Hong Kong. 5. 6. 80,000 Interest expenses Paid to a supplier in PRC on overdue accounts Paid to a director of the company in respect of a short-term loan (The director did not carry on business in HK). Surcharge in respect of the late payment of profits tax 34,500 13,500 128,000 7. $ 40,000 Legal fees Paid to a HK solicitor for the formation of a subsidiary company Paid to a Japanese solicitors' firm for the acquisition of the trade-mark mentioned in Note 5 Paid to a HK solicitor for reviewing trading agreements 50,000 15,000 105,000 8. Removal expense In January 2014, the company moved to a larger factory as a result of business expansion. The removal cost was all related to plants and machinery for business use. The Assessor agreed that the amount of depreciation allowances for the year of assessment 2013/14 was $298,000. Required: Compute the profits tax liability of the company for the year of assessment 2013/14. (Notes are not required, Profits tax payable at 16.5%)