Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fashions Ltd has a chain of women's clothing boutiques. It focuses on fashionable everyday clothing at a midrange price. Its shops are in local

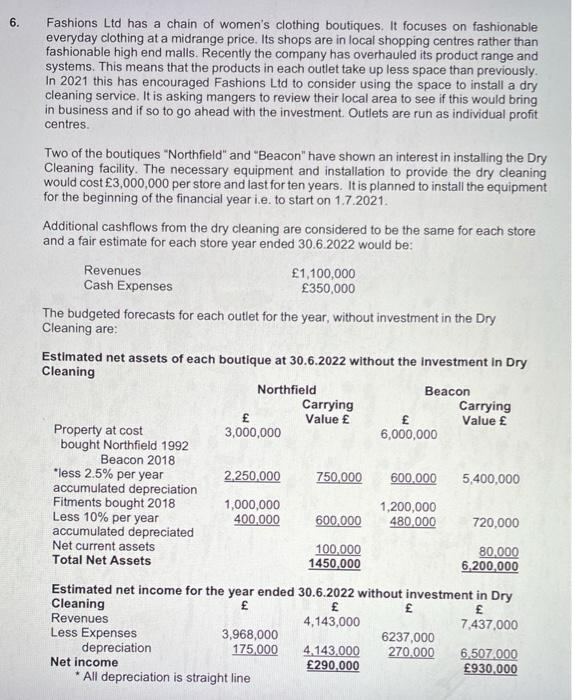

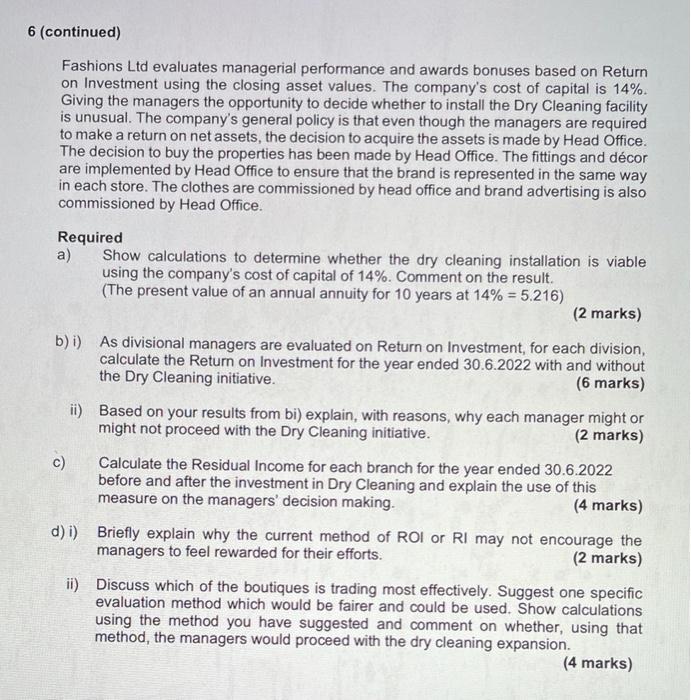

Fashions Ltd has a chain of women's clothing boutiques. It focuses on fashionable everyday clothing at a midrange price. Its shops are in local shopping centres rather than fashionable high end malls. Recently the company has overhauled its product range and systems. This means that the products in each outlet take up less space than previously. In 2021 this has encouraged Fashions Ltd to consider using the space to install a dry cleaning service. It is asking mangers to review their local area to see if this would bring in business and if so to go ahead with the investment. Outlets are run as individual profit centres. 6. Two of the boutiques "Northfield" and "Beacon" have shown an interest in installing the Dry Cleaning facility. The necessary equipment and installation to provide the dry cleaning would cost 3,000,000 per store and last for ten years. It is planned to install the equipment for the beginning of the financial year i.e. to start on 1.7.2021. Additional cashflows from the dry cleaning are considered to be the same for each store and a fair estimate for each store year ended 30.6.2022 would be: Revenues 1,100,000 350,000 Cash Expenses The budgeted forecasts for each outlet for the year, without investment in the Dry Cleaning are: Estimated net assets of each boutique at 30.6.2022 without the Investment in Dry Cleaning Northfield eacon Carrying Value Carrying Value Property at cost bought Northfield 1992 Beacon 2018 *less 2.5% per year accumulated depreciation Fitments bought 2018 Less 10% per year accumulated depreciated Net current assets 3,000,000 6,000,000 2,250,000 750,000 600,000 5,400,000 1,000,000 400,000 1,200,000 480,000 600,000 720,000 100,000 1450,000 80,000 Total Net Assets 6,200,000 Estimated net income for the year ended 30.6.2022 without investment in Dry Cleaning Revenues Less Expenses depreciation Net income All depreciation is straight line 4,143,000 7,437,000 3,968,000 175,000 6237,000 270.000 4.143.000 290,000 6.507,000 930,000 6 (continued) Fashions Ltd evaluates managerial performance and awards bonuses based on Return on Investment using the closing asset values. The company's cost of capital is 14%. Giving the managers the opportunity to decide whether to install the Dry Cleaning facility is unusual. The company's general policy is that even though the managers are required to make a return on net assets, the decision to acquire the assets is made by Head Office. The decision to buy the properties has been made by Head Office. The fittings and dcor are implemented by Head Office to ensure that the brand is represented in the same way in each store. The clothes are commissioned by head office and brand advertising is also commissioned by Head Office. Required a) Show calculations to determine whether the dry cleaning installation is viable using the company's cost of capital of 14%. Comment on the result. (The present value of an annual annuity for 10 years at 14% = 5.216) (2 marks) b) i) As divisional managers are evaluated on Return on Investment, for each division, calculate the Return on Investment for the year ended 30.6.2022 with and without the Dry Cleaning initiative. (6 marks) ii) Based on your results from bi) explain, with reasons, why each manager might or might not proceed with the Dry Cleaning initiative. (2 marks) c) Calculate the Residual Income for each branch for the year ended 30.6.2022 before and after the investment in Dry Cleaning and explain the use of this measure on the managers' decision making. (4 marks) d) i) Briefly explain why the current method of ROI or RI may not encourage the managers to feel rewarded for their efforts. (2 marks) ii) Discuss which of the boutiques is trading most effectively. Suggest one specific evaluation method which would be fairer and could be used. Show calculations using the method you have suggested and comment on whether, using that method, the managers would proceed with the dry cleaning expansion. (4 marks)

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The solution to part a For the project to be viable the present value of inflows should be greater than the present value of outputs PV of outputs 300...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started