Answered step by step

Verified Expert Solution

Question

1 Approved Answer

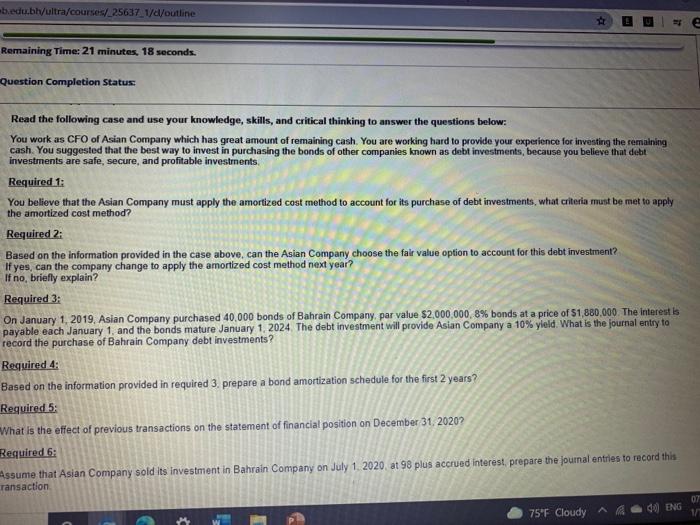

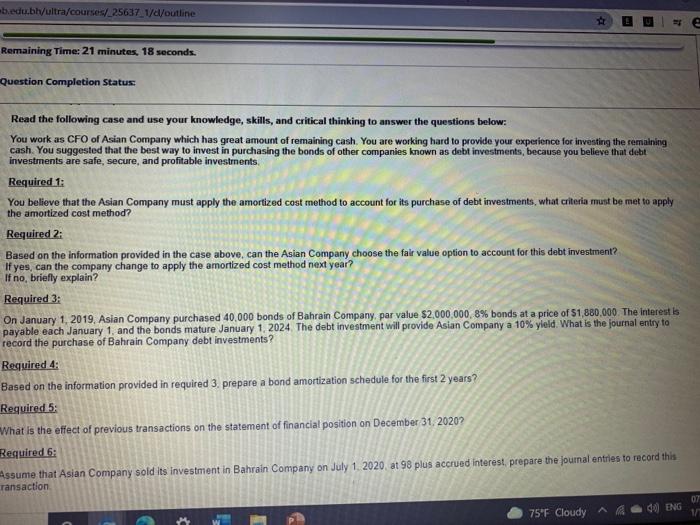

fasstttttt b.edu.bl/ultra/courses/_256371/d/outline = Remaining Time: 21 minutes, 18 seconds. Question Completion Status: Read the following case and use your knowledge, skills, and critical thinking to

fasstttttt

b.edu.bl/ultra/courses/_256371/d/outline = Remaining Time: 21 minutes, 18 seconds. Question Completion Status: Read the following case and use your knowledge, skills, and critical thinking to answer the questions below: You work as CFO of Asian Company which has great amount of remaining cash. You are working hard to provide your experience for investing the remaining cash. You suggested that the best way to invest in purchasing the bonds of other companies known as debt investments, because you believe that debit investments are safe, secure, and profitable investments Required 1: You believe that the Asian Company must apply the amortized cost method to account for its purchase of debt investments, what criteria must be met to apply the amortized cost method? Required 2: Based on the information provided in the case above can the Asian Company choose the fair value option to account for this debt investment? If yes, can the company change to apply the amortized cost method next year? If no briefly explain? Required 3: On January 1, 2019. Asian Company purchased 40.000 bonds of Bahrain Company, par value $2,000,000,8% bonds at a price of S1,880,000 The interest is payable each January 1, and the bonds mature January 1, 2024 The debt investment will provide Asian Company a 10% yield. What is the journal entry to record the purchase of Bahrain Company debt investments ? Required 4: Based on the information provided in required 3.prepare a bond amortization schedule for the first 2 years? Required 5: What is the effect of previous transactions on the statement of financial position on December 31, 2020? Required 6: Assume that Asian Company sold its investment in Bahrain Company on July 1 2020 at 98 plus accrued interest, prepare the journal entries to record this ransaction OT do ENG 75F Cloudy b.edu.bl/ultra/courses/_256371/d/outline = Remaining Time: 21 minutes, 18 seconds. Question Completion Status: Read the following case and use your knowledge, skills, and critical thinking to answer the questions below: You work as CFO of Asian Company which has great amount of remaining cash. You are working hard to provide your experience for investing the remaining cash. You suggested that the best way to invest in purchasing the bonds of other companies known as debt investments, because you believe that debit investments are safe, secure, and profitable investments Required 1: You believe that the Asian Company must apply the amortized cost method to account for its purchase of debt investments, what criteria must be met to apply the amortized cost method? Required 2: Based on the information provided in the case above can the Asian Company choose the fair value option to account for this debt investment? If yes, can the company change to apply the amortized cost method next year? If no briefly explain? Required 3: On January 1, 2019. Asian Company purchased 40.000 bonds of Bahrain Company, par value $2,000,000,8% bonds at a price of S1,880,000 The interest is payable each January 1, and the bonds mature January 1, 2024 The debt investment will provide Asian Company a 10% yield. What is the journal entry to record the purchase of Bahrain Company debt investments ? Required 4: Based on the information provided in required 3.prepare a bond amortization schedule for the first 2 years? Required 5: What is the effect of previous transactions on the statement of financial position on December 31, 2020? Required 6: Assume that Asian Company sold its investment in Bahrain Company on July 1 2020 at 98 plus accrued interest, prepare the journal entries to record this ransaction OT do ENG 75F Cloudy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started