Answered step by step

Verified Expert Solution

Question

1 Approved Answer

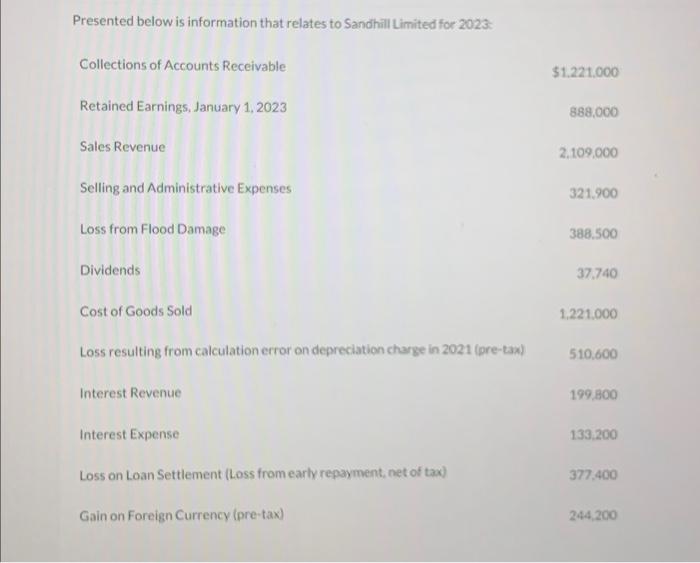

FAST HELP NEEDED! Presented below is information that relates to Sandhill Limited for 2023 : Collections of Accounts Receivable Retained Earnings, January 1, 2023 Sales

FAST HELP NEEDED!

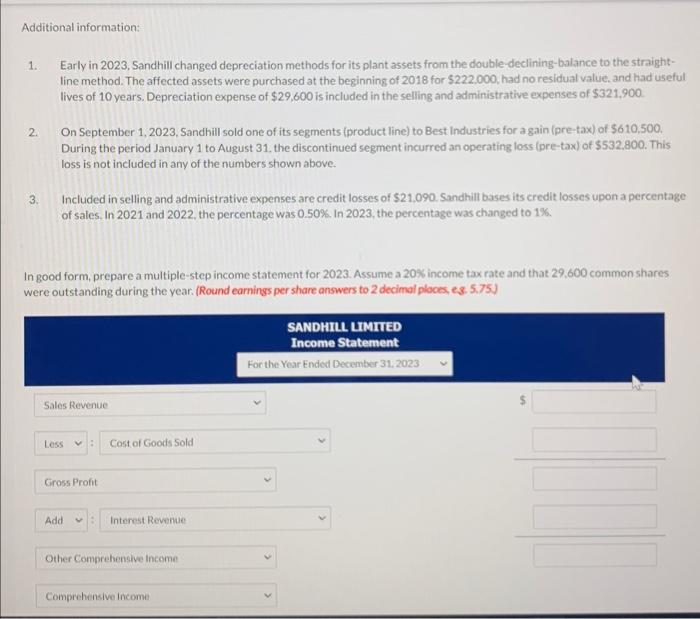

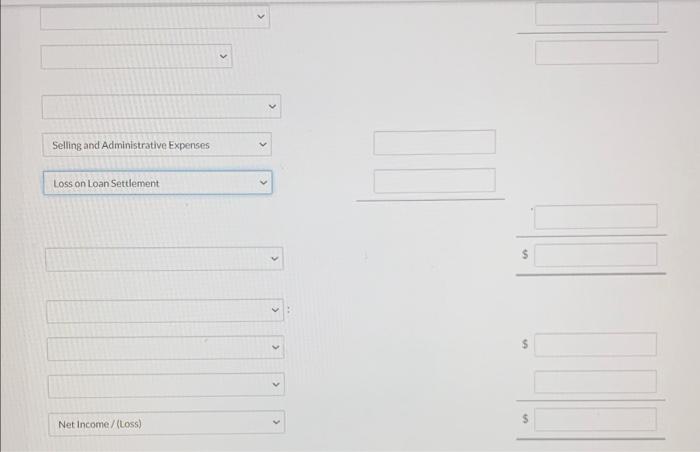

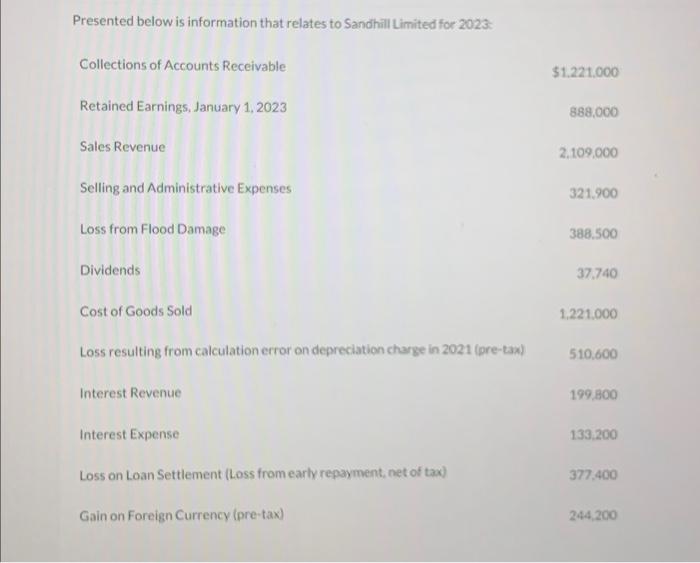

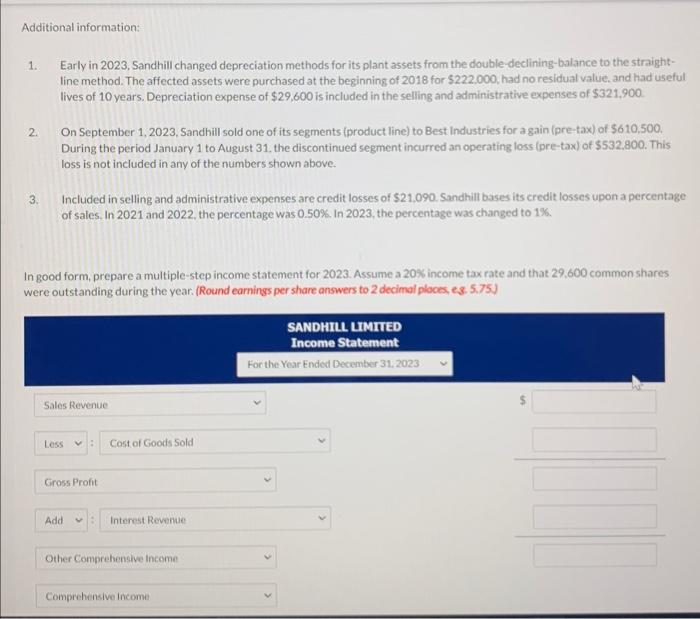

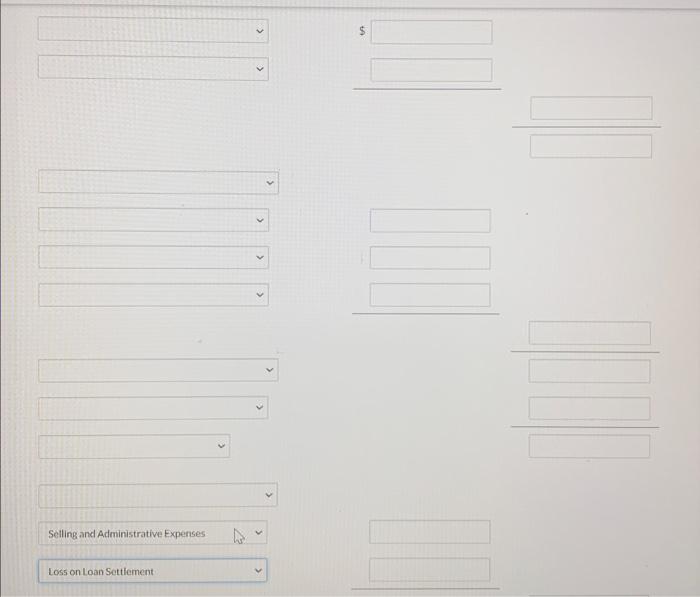

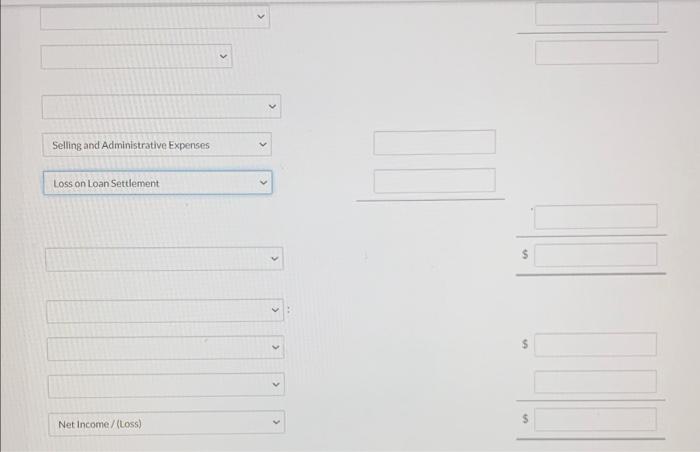

Presented below is information that relates to Sandhill Limited for 2023 : Collections of Accounts Receivable Retained Earnings, January 1, 2023 Sales Revenue Selling and Administrative Expenses Loss from Flood Damage Dividends Cost of Goods Sold Loss resulting from calculation error on depreciation charge in 2021 (pre-taw) Interest Revenue Interest Expense Loss on Loan Settlement (Loss from early repayment, net of tax) Gain on Foreign Currency (pre-tax) $1.221.000 888,000 2,109,000 321,900 388.500 37,740 1.221 .000 510,600 199.800 133.200 377,400 244,200 Additional information: 1. Early in 2023, Sandhill changed depreciation methods for its plant assets from the double-declining-balance to the straightline method. The affected assets were purchased at the beginning of 2018 for $222.000, had no residual value. and had useful lives of 10 years. Depreciation expense of $29,600 is included in the selling and administrative expenses of $321,900. 2. On September 1, 2023, Sandhill sold one of its segments (product line) to Best industries for a gain (pre-tax) of $610,500. During the period January 1 to August 31, the discontinued segment incurred an operating loss (pre-tax) of \$532.800. This loss is not included in any of the numbers shown above. 3. Included in selling and administrative expenses are credit losses of $21.090. Sandhill bases its credit losses upon a percentage of sales. In 2021 and 2022 , the percentage was 0.50%. In 2023 , the percentage was changed to 1%. In good form, prepare a multiple-step income statement for 2023. Assume a 20\% income tax rate and that 29,600 common shares were outstanding during the year. (Round earnings per share answers to 2 decimal ploces, es. 5.75) Selling and Administrative Expenses Loss on Loan Settlement 5 Net income / (Loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started