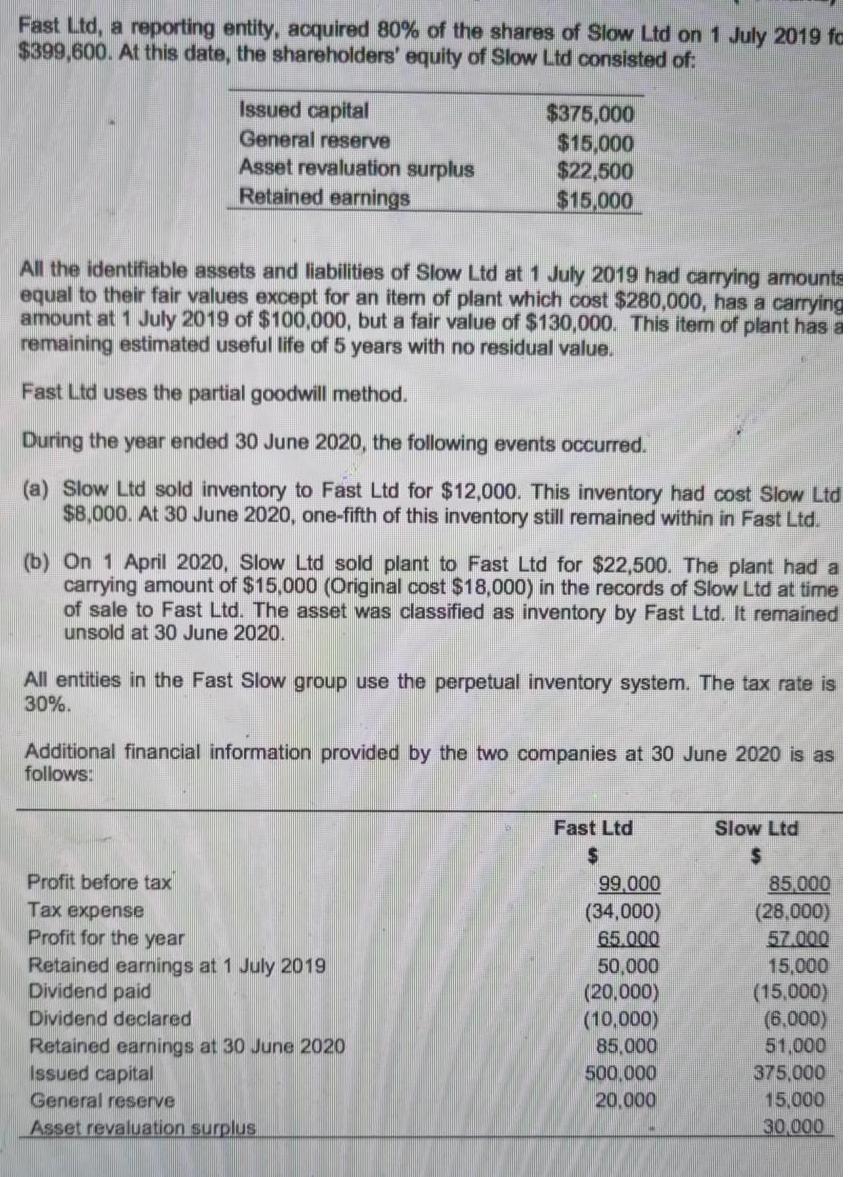

Fast Ltd, a reporting entity, acquired 80% of the shares of Slow Ltd on 1 July 2019 fo $399,600. At this date, the shareholders'

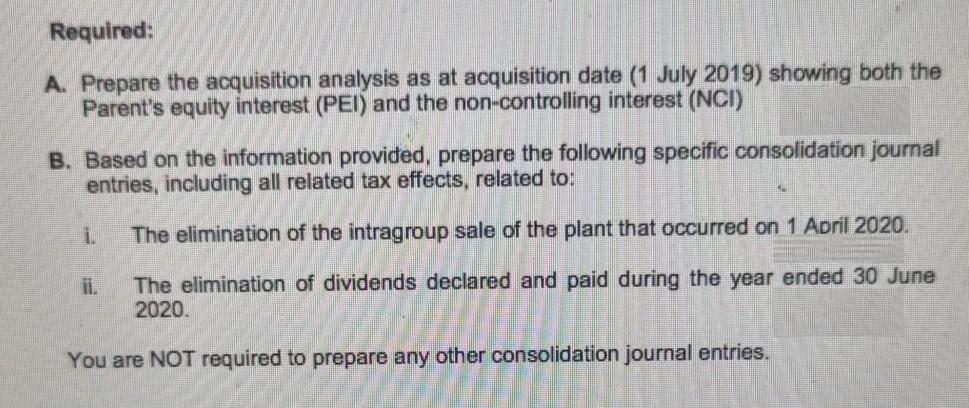

Fast Ltd, a reporting entity, acquired 80% of the shares of Slow Ltd on 1 July 2019 fo $399,600. At this date, the shareholders' equity of Slow Ltd consisted of: Issued capital $375,000 $15,000 $22,500 $15,000 General reserve Asset revaluation surplus Retained earnings All the identifiable assets and liabilities of Slow Ltd at 1 July 2019 had carrying amounts equal to their fair values except for an item of plant which cost $280,000, has a carrying amount at 1 July 2019 of $100,000, but a fair value of $130,000. This item of plant has a remaining estimated useful life of 5 years with no residual value. Fast Ltd uses the partial goodwill method. During the year ended 30 June 2020, the following events occurred. (a) Slow Ltd sold inventory to Fast Ltd for $12,000. This inventory had cost Slow Ltd $8,000. At 30 June 2020, one-fifth of this inventory still remained within in Fast Ltd. (b) On 1 April 2020, Slow Ltd sold plant to Fast Ltd for $22,500. The plant had a carrying amount of $15,000 (Original cost $18,000) in the records of Slow Ltd at time of sale to Fast Ltd. The asset was classified as inventory by Fast Ltd. It remained unsold at 30 June 2020. All entities in the Fast Slow group use the perpetual inventory system. The tax rate is 30%. Additional financial information provided by the two companies at 30 June 2020 is as follows: Fast Ltd Slow Ltd %24 85,000 (28,000) 57.000 15,000 (15,000) (6,000) 51,000 375,000 %24 Profit before tax 99,000 Tax expense Profit for the year Retained earnings at 1 July 2019 Dividend paid Dividend declared (34,000) 65.000 50,000 (20,000) (10,000) 85,000 500,000 Retained earnings at 30 June 2020 Issued capital General reserve 20,000 15,000 Asset revaluation surplus 30,000 Required: A. Prepare the acquisition analysis as at acquisition date (1 July 2019) showing both the Parent's equity interest (PEI) and the non-controlling interest (NCI) B. Based on the information provided, prepare the following specific consolidation journal entries, including all related tax effects, related to: i. The elimination of the intragroup sale of the plant that occurred on 1 Aoril 2020. The elimination of dividends declared and paid during the year ended 30 June 2020. ii. You are NOT required to prepare any other consolidation journal entries.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

solution Acquisition analysis Issued Capital 375000 Genral Reserve 15000 Asset Revaluation surplus 2...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started