Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fast TradingLtd, an expanding company is considering the replacement of its existing machine which is obsolete and unable to meet the rapidly rising demand

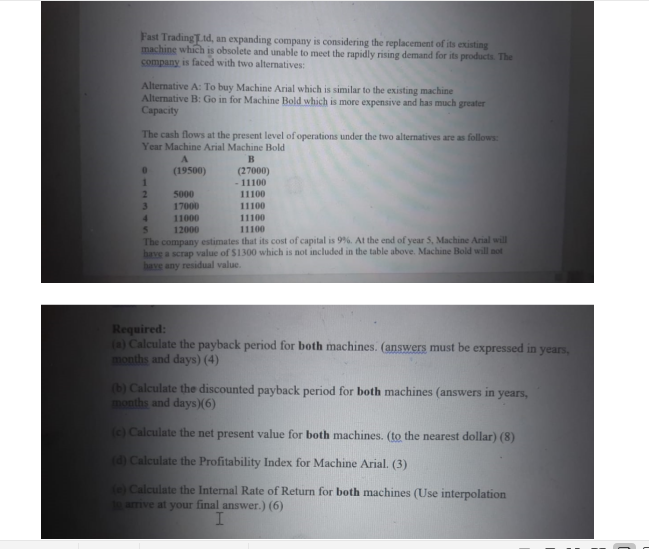

Fast TradingLtd, an expanding company is considering the replacement of its existing machine which is obsolete and unable to meet the rapidly rising demand for its products. The Company is faced with two alternatives: Alternative A: To buy Machine Arial which is similar to the existing machine Alternative B: Go in for Machine Bold which is more expensive and has much greater Capacity The cash flows at the present level of operations under the two alternatives are as follows: Year Machine Arial Machine Bold A. (19500) (27000) 1. 11100 2. 5000 11100 3. 17000 11100 4. 11000 11100 12000 11100 The company estimates that its cost of capital is 9%. At the end of year 5, Machine Arial will bave a scrap value of $1300 which is not included in the table above. Machine Bold will not bave any residual value. Required: (a) Calculate the payback period for both machines. (answers must be expressed in years, months and days) (4) (b) Calculate the discounted payback period for both machines (answers in years, months and days)(6) (c) Calculate the net present value for both machines. (to the nearest dollar) (8) rd) Calculate the Profitability Index for Machine Arial. (3) fe) Calculate the Internal Rate of Return for both machines (Use interpolation to arrive at your final answer.) (6) I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ybk erid It refers the time required t reu the initil investment whih des nt nsider the time vlue f ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started